Microlenders Choose Flight Over Fight

As stringent rules sweep the microloan sector in China, flight is the only option for some lenders.

Even before Dec. 1, when China’s central bank and banking regulator unveiled a slew of new policies to curb the explosive growth of unsecured, small short-term loans, some listed companies had already shelved their plans to expand into microloans. After the tighter rules became official, existing lenders are weighing a shift to other businesses such as installment payment and supply-chain financing. Meanwhile, a collection agency said it has received a lot more requests to pursue debts and at higher prices, suggesting some microlenders might be wrapping up ahead of an eventual exit.

“The regulatory clean-up will take time because companies cannot immediately transition to new businesses … and smaller microloan companies who have nothing to lose will try to find innovative ways to get around regulations,” said Fang Song, chairman of the Guangzhou Internet Finance Association and a political advisor to the Guangzhou government.

The new policies, announced by the People’s Bank of China (PBOC) and China Banking Regulatory Commission (CBRC), covered not only microlenders but also peer-to-peer (P2P) platforms that extend small loans. New measures include a statutory limit of 36% on the so-called annual percentage rate (APR) — the total interest rate and fees they charge, as well as a ban on unlicensed platforms.

The PBOC and the CBRC said earlier that the rapid development of the cash-loan industry has created problems such as overlending, repeated borrowing, improper debt collection, abnormally high interest rates, as well as privacy violations. Concerns were escalated following high-profile initial public offerings of several major Chinese micro- and P2P lenders in the U.S.. Moreover, there were reports that some of these microloans were channeled to the property market, contributing to the soaring home prices.

Natural next steps

To bigger microlenders, tighter regulations may not be the end of the world. They have the resources — such as access to funding, cost structure and staffing – to develop new business focus, while absorbing the shock from lower profitability during the transition.

Qudian Inc. is a case in point.

Caixin learned that the company is considering doing more installment payment services. The company said earlier that it is part of its long-term strategy. In the last quarter, a fifth of revenues, or close to 40% of net income, came from lending to consumers who decided to pay in installments for big-ticket purchases.

“The margin on facilitating these actual purchases is significantly higher than the margin on pure cash loans,” an executive from a microlending platform told Caixin.

In fact, installment payments, or sometimes called “scenario-based installment services” in China, has garnered blessing from regulators, mainly because these transactions are easily tracked.

Some microlenders are also looking into new opportunities in consumer loans or supply-chain financing, which targets small and midsize enterprises (SMEs), Fang said.

As long as the loans have legitimate uses, they are likely to stay, and that also explains why some of these firms are switching to consumer loans, a lawyer working at an internet finance company told Caixin.

“The intention of regulators is to turn short-term unsecured loans into a responsible segment of the financial sector,” said Huang Yiping, an adviser to the central bank's monetary policy committee and a professor of Peking University.

Two executives from a bad-debt collection agency said requests from microlenders, especially the small ones, have surged over the past week, and that some of them even doubled the fees for successful debt recovery.

This could be a sign suggesting some lenders are throwing in the towel, one of them said.

“From the cost perspective, small lenders are facing higher pressures from customer acquisition and debt collection, after the 36%-cap on the interest rate plus commission fee becomes effective,” the executive said.

“They might consider whether to exit or live with a lower profitability as a compliant player,” he said.

Investors take flight too

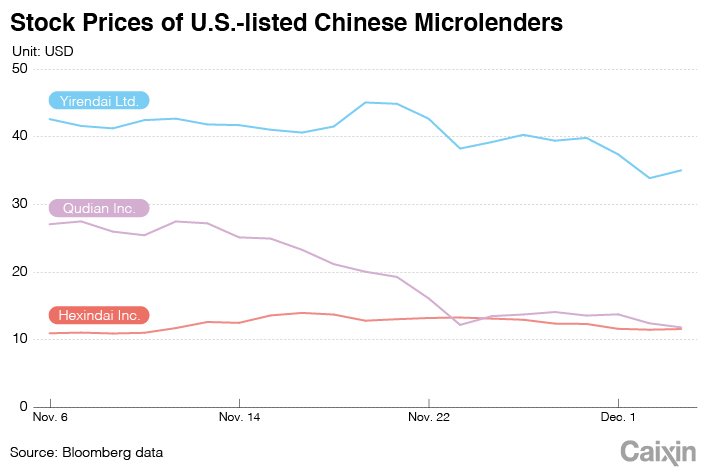

The new policies have sent U.S.-listed Chinese microlenders as well as P2P platforms sharply lower.

Their share prices tumbled on Dec. 1, with China Rapid Finance dropping by 18.9% in a single session. Through the end of Wednesday, China Rapid Finance had already lost 28%, while five other lenders — Ppdai, Qudian, Yirendai, Hexindai and Jianpu Technology, a subsidiary of Rong360 — fell between 6.9% and 16%. Qudian, which shed 18.6% over the past week, had also vowed to bolster its share price by expanding its share-repurchase program to $300 million from $100 million on Friday.

|

A senior executive at a major U.S.-listed Chinese microlender said he welcomed the new regulatory framework, which will leave more room for companies that are compliant with the rules, helping the firm consolidate its leadership position in the market.

Hexindai, another P2P lender listed on the Nasdaq since October, said in an earnings conference call Tuesday that it has long been complying with the requirements. Earlier, Chief Financial Officer Johnson Zhang told Caixin: “We only target middle-income groups who already have credit records in the banking system, and have a demand for consumption upgrade.”

Did regulators miss the big picture?

Fang said the vertiginous growth of microloans has been fueled by a “tremendous demand from an underserved segment of the market.”

A more stringent regulatory framework on microloans should be accompanied by a broader strategy of financial inclusion, Fang said.

“When I worked in retail banking, we had a saying that we only ate the sweetest part of the sugar cane, meaning that we served the 20% highest-income clients. That leaves 80% others for whom banks are not providing sufficient credit services,” he said.

Wang Jian, a senior banking analyst in Guotai Junan Securities Co. added: “In a financial market … a key thing is to guide the gray market toward licensed and fully compliant operations, and not to brush them all out of the picture.”

Meanwhile, banks eagerly shifting from corporate to retail lending may find new opportunities.

“China’s regulation of internet-based consumer finance is credit positive for banks,” said Nicholas Zhu, senior banking analyst with Moody’s Investors Service.

“Larger banks are likely to benefit most because their brand recognition is more attractive to customers as the regulation reforms the sector,” Zhu said.

The story has been updated to reflect the share-price change of mircolenders.

Contact reporters Leng Cheng (chengleng@caixin.com) and Liu Xiao (liuxiao@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas