Consumer Inflation Cools, Fanning Expectations for Monetary Easing

* China’s consumer price index rises 2.1% in March

* The producer price index, which reflects changes in the prices of factory goods, increases 3.1% in March

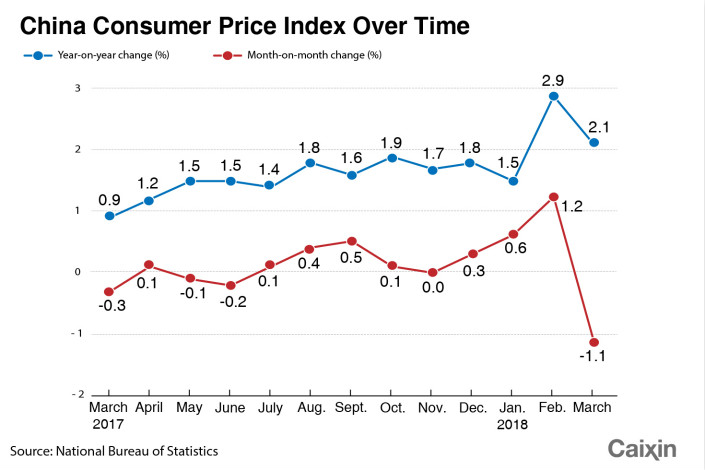

Consumer inflation slipped to 2.1% in March from a four-year high in February, while producer price inflation fell for the fifth straight month, government data showed Wednesday.

The cooling inflationary pressure bolstered market expectations for the central bank to ease monetary policy this year, especially if economic growth slows.

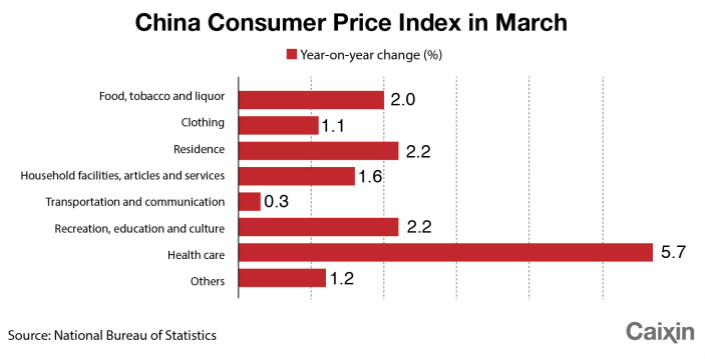

The consumer price index (CPI), which tracks the prices of a basket of consumer goods and services, rose 2.1% year-on-year in March, 0.8 percentage points below the previous month’s reading, according to data from the National Bureau of Statistics. The decline was driven largely by slower growth in food prices.

On a month-on-month basis, the headline CPI declined 1.1% in March, as the week-long Lunar New Year holiday fell in February this year. Seasonal declines in food, tourism and transport prices mainly accounted for the drop.

|

Wendy Chen and Lisheng Wang, economists at Nomura International (Hong Kong) Ltd., expect a mild pickup in the CPI through this year, likely driven by high food and services prices, as well as the pass-through impact of high producer and property prices.

The producer price index (PPI), another closely watched figure that reflects changes in the prices of factory goods, increased 3.1% in March, further easing from February’s 3.7%, marking its lowest level since November 2016.

Nomura’s Chen and Wang expect the PPI to drop lower in the second half of this year due to weakening investment demand, the cooling property market and rising financing costs. Meanwhile, they expect a minor rebound in the second quarter as the base was low last year, according to their analyst note.

Evans-Pritchard with Capital Economics holds a more aggressive view, predicting that the PPI might slide into negative territory by the end of this year. “(The) inflation data are consistent with our view that cooling price pressures will open the door to monetary easing this year,” he said in a note, expecting China’s central bank to guide market interest rates lower this year in response to a cooling economy.

|

An RRR cut this year would be done to ensure stable liquidity conditions and avoid a sharp drop in loan and aggregate financing growth, the analysts said.

China’s central government has set the annual CPI growth target at around 3% this year and refrained from setting a target for PPI as usual.

Contact reporter Lin Jinbing (jinbinglin@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas