LG Chem Casts Lot With Chinese Cobalt Producer

South Korean chemical firm LG Chem Ltd. has agreed to set up two joint ventures with a Chinese cobalt producer to supply key components for electric car batteries.

LG Chem’s move comes at a time when the Chinese government is pushing to make electric vehicles (EVs) a much larger part of the domestic automotive industry, helping China become the world’s largest EV market last year. In the first 11 months of 2017, EV sales in China reached nearly 480,000 vehicles, accounting for about half of global output, according to data firm BBD.

The two joint ventures, located in eastern China’s Zhejiang and Jiangsu provinces, will have a combined registered capital of $444 million, of which LG Chem and a subsidiary of its Chinese partner Zhejiang Huayou Cobalt Co. Ltd. will each put up half, according to a Huayou filing to the Shanghai Stock Exchange on Wednesday.

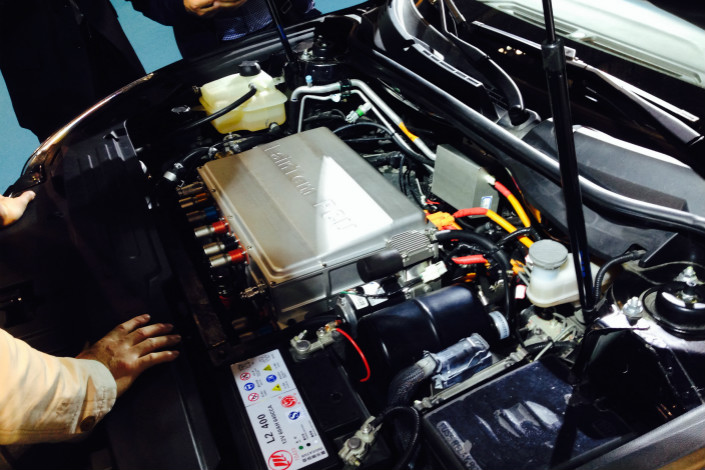

The new companies will manufacture and sell anode components that make up the positive electrode of EV batteries. The components are mainly made of cobalt, nickel, manganese and lithium.

LG Chem will provide technology and training, while Huayou will be responsible for raw materials, obtaining government certification and seeking a tax break.

Since 2010, China’s central and local authorities have been handing out generous subsidies to support EV manufacturing so that consumers can buy the vehicles at reduced prices, in part to combat air pollution. Electric car sales in China rose 45% year-on-year in the first 10 months of 2017, according to official statistics.

But the red-hot industry might soon cool, as the government plans to phase out EV subsidies by 2020. The government started reducing subsidies this year with cuts of more than 30%.

Apart from the phasing out of subsidies, battery component suppliers may face other risks, including rising prices for raw materials such as cobalt and lithium, Huayou warned in its filing.

Contact reporter Coco Feng (renkefeng@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas