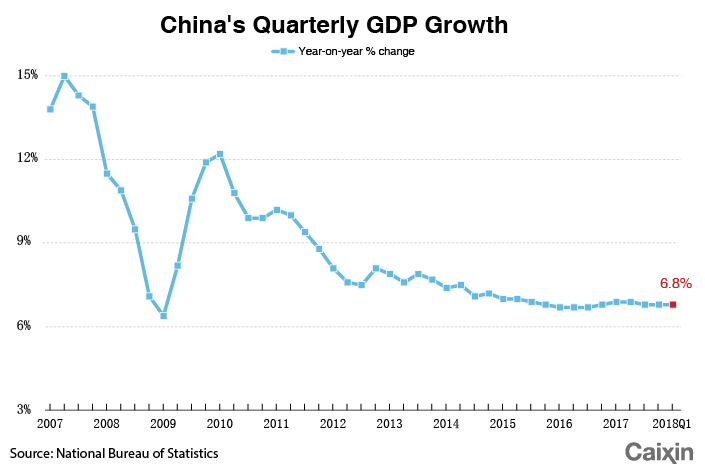

Update: First Quarter Economic Growth Stable at 6.8%

*China’s gross domestic product beats median forecast of economists of 6.7%

*Real estate investment rises 10.4% year-on-year, helping to bolster economy

(Beijing) — China’s economy grew 6.8% year-on-year in the first three months of the year, unchanged from the rate seen in the last two quarters of 2017, official data showed Tuesday, as accelerating property investment and consumer spending underpinned the economy.

The growth rate of gross domestic product (GDP) was slightly higher than the median estimate of 6.7% in a Bloomberg News survey of economists, defying expectations of a marginal slowdown.

However, on a seasonally adjusted quarter-on-quarter basis, China’s GDP growth in the first quarter slowed to 1.4% from 1.6% in the previous quarter, decelerating for the second straight quarter, official data showed.

“March activity data was a mixed bag,” HSBC Global Research analyst Julia Wang said in a research note, referring to the weak growth of industrial output and fixed-asset investment along with the strong growth of retail sales.

|

| GDP Graphic |

Property outperforms

China’s value-added industrial output, which measures production at factories, mines and the utilities sector, rose 6% year-on-year in March, according to data released by the National Bureau of Statistics (NBS). The monthly increase in industrial output has not been this low since August.

Fixed-asset investment excluding rural households, a key driver of domestic demand, rose by 7.5% year-on-year in the first quarter, NBS data showed, moderating from a rise of 7.9% in the January-February period. Private investment jumped 8.9% year-on-year in the first quarter, the highest reading since an annual growth rate of 10.1% for 2015.

Investment in property development was one bright spot. It picked up marginally in the first quarter compared with the first two months of the year, rising by 10.4% year-on-year. The reading has not been this high since the first two months of 2015, according to NBS data.

Some analysts have cautioned that the real conditions in the property market may not be as upbeat as suggested by the rise in real estate investment figures recorded by the government. That is mainly because developers usually make their payments a few months after signing land purchase contracts, meaning the high investment data actually reflect the demand and business confidence of the past rather than the present.

Others held a less-pessimistic view. HSBC’s Wang said there is little reason to be overly pessimistic given that land supply policies are turning more proactive and property prices are stabilizing.

Infrastructure investment, which is mainly driven by local government spending and includes the construction of roads, railways and other public facilities, but excludes electricity, heating, gas and water supply, rose 13% year-on-year in the first quarter, NBS figures showed. It marked the slowest increase in data going back to April 2014, according to Bloomberg data.

Analysts have expected infrastructure investment growth to continue to ease due to tightening control over local governments’ financing.

When it comes to manufacturing investment, high-tech industries have outperformed the average. NBS data showed the production of industrial robots and new-energy vehicles surged nearly 30% and 140% respectively in the first quarter. This points to a trend that China is shifting from low-value-added manufacturing to high-tech production, said Iris Pang, an economist with ING Bank NV.

Robust consumption

Retail sales, which include spending by households, government departments and businesses, rose 10.1% year-on-year last month, the fastest increase since November.

Consumption growth contributed 77.8% to GDP growth in the first quarter, much higher than 58.8% for the whole of last year, NBS data showed.

“We underestimated the purchasing power of consumers,” ING Bank’s Pang said in a research note.

The retail sales data paints a blooming consumption picture, which also implies that wage growth was decent and employment was steady, she said.

Income of urban and rural residents grew 8.8% year-on-year in the first quarter; the surveyed unemployment rate in urban areas, an indicator that includes migrants’ jobless status, rose slightly to 5.1% in March from February’s 5%, NBS data showed.

A sign of continued expansion momentum in the economy, the size of the rural migrant workforce, increased by 1.1%, or 1.88 million, to 174.4 million in the first quarter from the same period last year, NBS spokesman Xing Zhihong said at a news briefing (link in Chinese) on Tuesday.

Uncertainties remain in the trade sector due to tensions between China and the U.S.

Generally speaking, stable GDP growth in the first quarter will provide a cushion to a likely moderation in the second half of the year amid the country’s intensive reform efforts, said Betty Wang and David Qu, economists with Australia and New Zealand Banking Group.

China’s latest efforts to crack down on “shadow banking” and direct credit back to the real economy will likely help alleviate its debt pressure and mitigate risks, they said.

China is aiming for the economy to grow around 6.5% in 2018, the same as the target set for 2017, with its official projection leaving out the phrase “higher if possible in practice” that was contained in last year’s goal. This omission implies the government is willing to tolerate a slower pace of economic expansion.

This story has been corrected to state that China’s quarter-on-quarter GDP growth for the first three months of 2018 decelerated for the second straight quarter.

Contact reporter Lin Jinbing (jinbinglin@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas