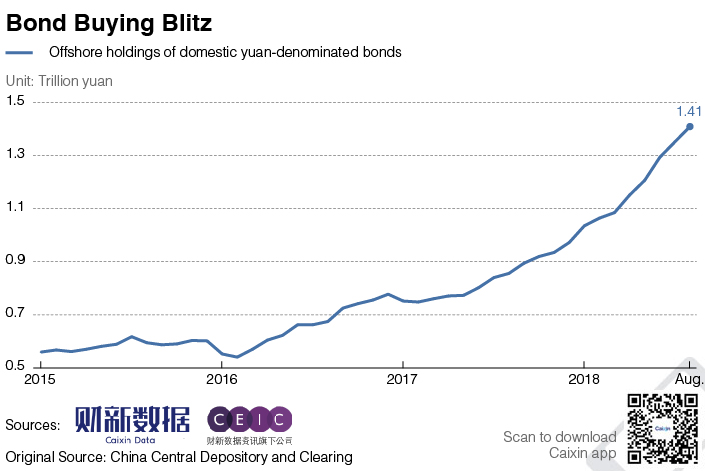

Chart of the Day: Overseas Buyers Picking Up More Yuan-Denominated Bonds

Offshore holdings of domestic yuan-denominated bonds increased for the 18th straight month in August, hitting 1.41 trillion yuan ($206.27 billion), according to China Central Depository and Clearing Co. Ltd. (CCDC), one of the country’s clearing houses.

|

Graphic: Gao Baiyu/Caixin |

Foreign institutions strengthened their yuan-denominated bonds positions by 58 billion yuan in August from a month earlier, according to Caixin calculations based on CCDC data.

Banking regulators have introduced a raft of measures to lure offshore money to invest in China’s bond market. On Aug. 30, China’s cabinet announced that foreign institutions will be exempt for the next three years from paying corporate income tax and value-added tax on interest from Chinese bonds.

Last year, regulators instituted a bond connect program that allows eligible investors to trade and settle mainland bonds through a Hong Kong-based custodian and clearing service.

Contact reporter Charlotte Yang (yutingyang@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas