Update: Export Growth Hits Seven-Month High Despite Trade War

* China’s exports rose by 14.5% year-on-year in September, an acceleration from the previous month, while growth in imports declined to 14.3%

* Economists predict the robust performance of exports will cool in the fourth quarter when more costly U.S. tariffs start to bite and the momentum of the global economy weakens

(Beijing) — China’s exports jumped robustly in September despite the escalating trade war with the U.S., while import growth continued to slow from the previous month, pointing to subdued domestic demand, official data showed Friday.

The country exported $226.69 billion in goods last month, up 14.5% from a year ago, according to figures released by the General Administration of Customs. The rate accelerated from a pace of 9.1% in August and was the fastest since February. It was way ahead of the median forecast of an 8.2% gain from a Bloomberg News poll of economists.

Imports by China increased 14.3% year-on-year in September to $195.0 billion, easing from a growth rate of 19.9% in the previous month and 26.9% in July.

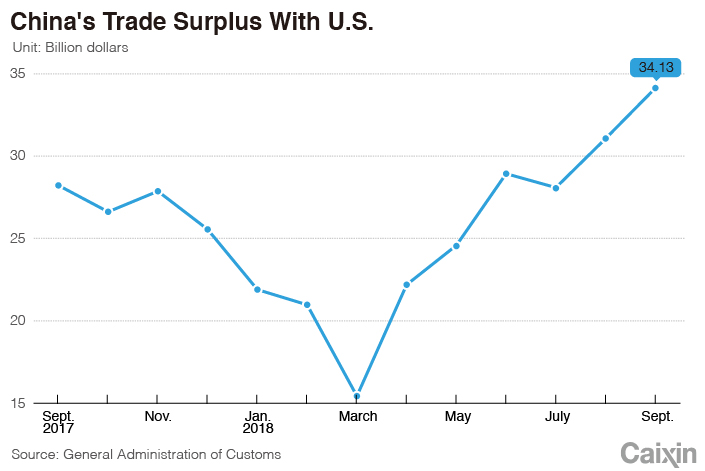

Accelerating overseas shipments and softening imports left the world’s biggest goods exporter with a trade surplus of $31.69 billion last month, up from $26.65 billion in August.

|

Analysts attributed September’s surprisingly strong exports to a rush by exporters to deliver before higher U.S. tariffs took effect amid intensifying bilateral trade tensions, a weakening Chinese currency, and a pickup in shipments to the EU and Japan.

“Exports could be frontloaded in anticipation of more tariff hikes from the U.S.,” analysts with financial consulting firm Macquarie Capital Ltd. said in a report on Friday. The different timing of the iPhone release, which was in September this year and in October last year, added around 1.5 percentage points to China’s export growth last month, they said.

Export rush

Washington has imposed additional duties on a total of $250 billion worth of Chinese products, which accounts for roughly half of China’s annual exports to the country. Beijing has responded with retaliatory measures on imports from the U.S, defying President Donald Trump’s warning that such a move will trigger levies on all Chinese goods exports to his country.

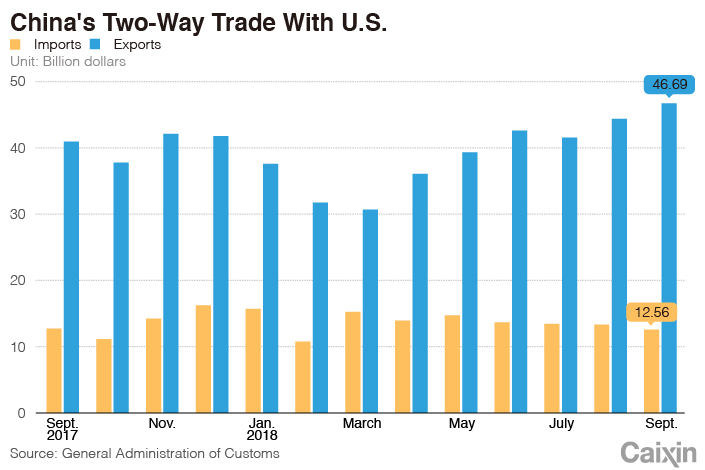

China’s exports to the U.S. have continued to increase on a monthly basis since April, when trade tensions spiked upon Washington’s unveiling of the list of the first batch of Chinese goods to be subject to additional tariffs after an investigation into Beijing’s alleged unfair policies. In September, sales to the U.S. hit an all-time high of $46.69 billion, up 5.2% from August. Year-on-year, it grew at an even faster pace of 14%.

However, imports from the U.S. have been declining month-on-month since June. They fell to $12.56 billion last month, down 5.7% from August and 1.3% less than a year ago, as Chinese importers shift away from U.S. products after Beijing imposed tariffs on them.

|

Exports to the EU, China’s second-largest overseas market, soared 17.4% in September from a year ago, more than double the rate in the previous month. Year-on-year growth in shipments to Japan also accelerated to 14.4% last month from merely 3.7% in August.

The pickup could have been helped by the depreciation of the yuan, which has weakened more than 9% against the dollar over the past six months as the trade dispute with the U.S. flared up.

But economists widely predict the robust performance of the world’s second-largest economy’s exports will cool in the fourth quarter when more costly U.S. tariffs start to bite and as the momentum of the global economy weakens.

“The trade-oriented industries are still vulnerable to further escalation of tariff war,” analysts with HSBC Global Research said in a note.

The U.S. is ratcheting up the rate of additional tariffs on $200 billion of Chinese products to 25% starting the beginning of next year from 10% currently. This would be another blow to bilateral trade relations “unless we see a meaningful breakthrough in trade talks over the next few months,” they said.

Trump and Chinese President Xi Jinping plan to meet at the late-November Group of 20 meeting of leading rich and developing nations in Buenos Aires, the Wall Street Journal reported Thursday, raising hopes that a break in the trade negotiations impasse might be on the horizon.

Domestic woes

The increase in China’s imports of major commodities, such as iron ore and crude oil, weakened markedly last month from August both in value and volume terms.

“The slowdown in overall imports is consistent with other signs that China’s domestic economy has started to slow,” said Louis Kuijs with research firm Oxford Economics.

The Chinese government has taken a series of measures to boost domestic demand amid increasing signs of a slowdown fueled by a crackdown on local government debt that has hit investment, and a campaign to rein in home prices. The central bank this week cut the amount of cash that lenders are required to keep in reserve for the fourth time this year to inject liquidity into the financial system to encourage lending. Policymakers have also fine-tuned the pace of a campaign to deleverage the financial sector.

It has also told local governments to speed up the sale of special-purpose bonds to fund construction of infrastructure such as toll roads and subways as well as the rebuilding of run-down urban neighborhoods.

Yi Gang, governor of the People’s Bank of China, in an exclusive interview with Caixin on Thursday said that the focus of monetary policymaking will now be shifted to the domestic economy only, indicating the growing importance of maintaining growth on the official agenda.

Nonetheless, the slowdown in the country’s purchases of foreign products suggested recent government efforts to boost infrastructure investment to drive domestic demand and support growth have “yet to gain much traction” while credit expansion has remained sluggish, said Julian Evans-Pritchard, an analyst with research firm Capital Economics.

“With policy easing unlikely to put a floor beneath domestic economic activity until the middle of next year, import growth is set to slow further,” he said.

Contact reporter Fran Wang (fangwang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas