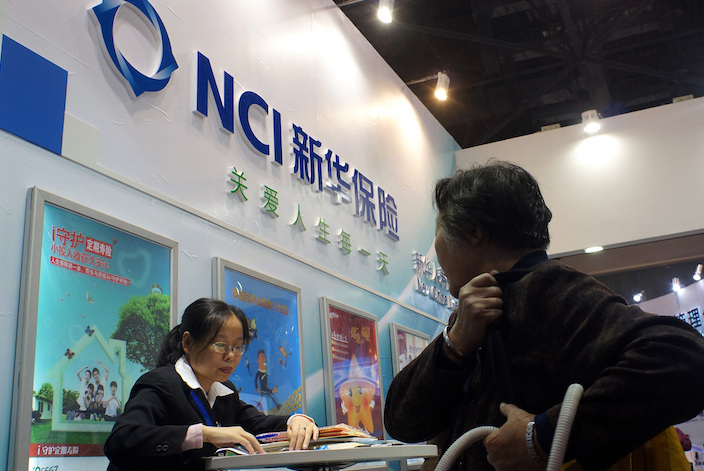

New China Life Fined for Deceiving Customers

China’s banking and insurance regulator Thursday issued a slew of penalty orders to seven insurers, including a 1.1 million yuan ($158,600) fine for one of the country’s largest life insurers.

New China Life Insurance Co. Ltd. was fined for deceiving policyholders and other violations involving 2 billion yuan of life insurance policies, the China Banking and Insurance Regulatory Commission (CBIRC) said.

Ten company executives, including two vice presidents, were fined a total of 1.17 million yuan ($169,000) or received administrative punishment for their roles in the violations, the CBIRC said.

It was one of the toughest penalties imposed by the CBIRC since its establishment in March through the combination of the previously separate banking and insurance regulatory bodies.

The new regulatory body has stepped up scrutiny of the insurance industry, which has enjoyed years of freewheeling growth but has been plagued with risks of lax oversight.

In July and August, the CBIRC levied a total of 34.5 million yuan of fines on 31 insurers and 50 intermediary companies for violating regulations, according to the financial newspaper Securities Daily.

According to a CBIRC statement, New China Life was found deceiving policyholders by exaggerating insurance coverage and providing inconsistent provisions and inadequate explanations of potential risks. In addition, the insurer was also accused of falsifying information provided to the regulator and violating industry pricing rules, according to the statement.

Six other insurers also received CBIRC penalty orders on the same day, including Anxin Property & Casualty Insurance Co. Ltd., China Post Life Insurance Co. Ltd., TK.cn Insurance Co. Ltd., Ancheng Property & Casualty Insurance Co. Ltd and Urtrust Insurance Co. Ltd.

The companies were accused of violations in product marketing, information disclosure, regulatory registration and connected-party transactions.

The regulator ordered the six companies to rectify their operations within a certain period and punish executives responsible for the violations. Ancheng Property & Casualty, which was accused of failing to disclose information about connected-party transactions, was banned from any financial dealings with connected parties for six months, according to the CBIRC statement.

Since the beginning of last year, financial regulators have issued a flurry of new regulations to crack down on irregularities and risky business dealings in the insurance sector, including the issuance of short-term life policies. Premiums raised from such policies are often used to fund risky acquisitions and asset-buying sprees.

Amid the tightened oversight, insurance premium incomes fell industrywide 3.33% to 2.24 trillion yuan in the first half this year, according to the CBIRC. Premium incomes of life insurance companies dropped 8.5% to 1.69 trillion yuan, while property insurance premiums rose 14% to 544.2 billion yuan.

But for the first nine months this year, New China Life posted 11.3% premium growth from the same period last year to 100 billion yuan, the company said in its financial report earlier this week.

Contact reporter Han Wei (weihan@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas