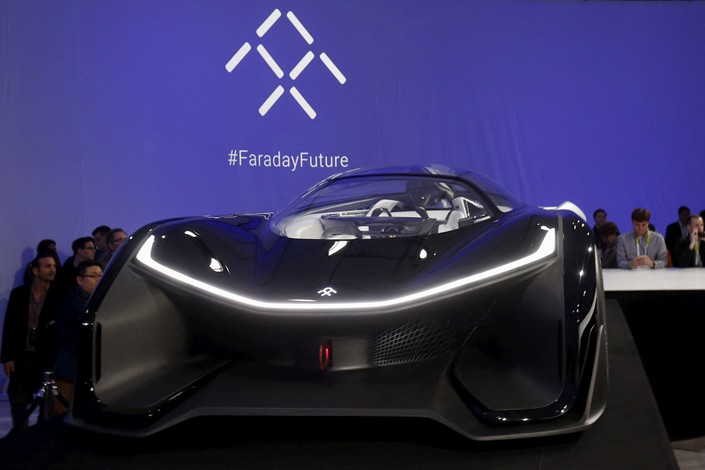

Faraday, Evergrande Both Claim Win in Dispute Over Upstart Carmaker’s Funding

Automaker Faraday Future and real estate giant Evergrande Group have each declared victory in an arbitration case over whether the latter complied with the terms of its investment agreement with the cash-strapped upstart.

Because the Hong Kong arbitrators have yet to publicly announce their decision, it remains unclear which company is the winner in the case that could curtail Evergrande’s influence over Faraday despite its $800 million investment in the carmaker. Regardless, the case still needs to go through final arbitration.

In a social media statement Thursday, the U.S.-based Faraday — led by blacklisted Chinese entrepreneur Yueting Jia — said it had won “a decisive victory” and that “Evergrande can no longer prevent (Faraday) from seeking funding through other channels.”

Evergrande had a different take on the result of the emergency arbitration. In its own announcement Thursday, the real estate company said that arbitrators had not taken away its right to veto any of Faraday’s plans to seek outside funding.

However, Evergrande did acknowledge that arbitrators ruled that Faraday could proceed with up to $500 million in financing as long as the new funding doesn’t lower Faraday’s valuation. Evergrande also noted that the recent decision was not the final word on the matter because the case still needs to go through final arbitration.

The two companies began working together late last year, when Evergrande Health Industry Group Ltd., the real estate company’s health care unit, agreed to invest a total of $2 billion over three years in exchange for a 45% stake in Smart King Ltd., the company that owns Faraday.

Evergrande said it had invested $800 million in 2018 and would complete the deal with additional installments of $600 million in both 2019 and 2020.

However, the pair’s close relationship turned into a high-profile “war of words” earlier the month when a dispute broke out over the terms of a supplemental agreement that required Evergrande to inject the second installment of capital ahead of schedule because Faraday had already spent the $800 million it received this year.

Evergrande said in a previous statement it was “manipulated” and “forced” into signing the agreement, which said it had to pay $700 million in advance.

For its part, Faraday accused Evergrande of deliberately delaying paying its promised investment and trying to “gain control and ownership” over Faraday’s China business and all of the automaker’s intellectual property.

An inside source at Faraday told Caixin that Evergrande agreed to pay $300 million by Aug. 1, another $200 million by the end of 2018, and another $200 million by the end of 2019.

However, the source said that under the terms of the supplemental agreement, Faraday had to give up ownership of its China business and Jia had to step down from Smart King’s board.

By Aug. 1, however, Faraday hadn’t received the additional funding, according to the source.

In its statement, Evergrande said only that the $700 million was contingent on Faraday meeting its “payment conditions.”

Earlier this week, Faraday said it has had to lay off employees and cut salaries, blaming Evergrande for pushing it into a “cash crunch.”

The Faraday-Evergrande tie-up is widely seen as representing the ambition of China’s third-largest real estate company by sales to diversify into the auto industry now that the country’s real estate sector is cooling.

Faraday Future founder and CEO Jia has been grappling with legal troubles since late last year when he was blacklisted as a debt defaulter for failing to repay enormous debts related to LeEco, the onetime star Chinese tech company that he founded.

Contact reporter Mo Yelin (yelinmo@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas