Stocks Rally as Securities Regulator Promises to Meddle Less in Trading

Chinese stocks rallied on Wednesday after the country’s securities regulator promised to reduce intervention in trading and renewed a vow to encourage share buybacks and long-term investment in the market.

The benchmark Shanghai Composite Index closed up 1.35% at 2,602.78, extending a gain on Tuesday that reversed falls seen over the previous two trading days.

During early trading hours on Tuesday when stocks were trending down, the China Securities Regulatory Commission (CSRC) posted a statement on its official social media account saying that it will “optimize trading oversight.”

The authorities will “reduce unnecessary interventions in the trading link to help the market form clear expectations on regulation and give investors the chance to trade in a fair way,” it said.

That means the regulators in the future are likely to drop the dramatic approaches they now employ to meddle in investors’ decisions to buy or sell stocks, such as ordering them by phone to withdraw their instructions to brokers, sources told Caixin.

Currently “investors would be warned if they request to buy large amounts of shares because the consensus among the regulators is that risks arise from price increases,” a source close to the country’s stock exchange operators told Caixin.

An executive in charge of regulatory compliance at a public fund also said that the authorities currently put all large deals on notice and often choose to suspend a securities account if they decide its transactions are “abnormal.”

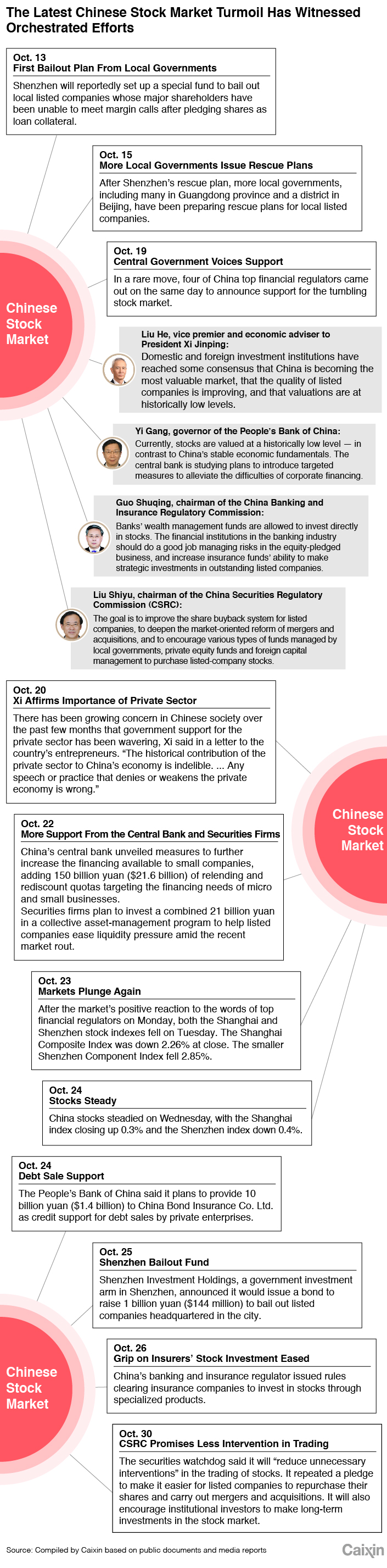

The statement was the latest in a slew of steps the government has taken in recent weeks to defuse a liquidity crisis faced by numerous listed companies whose shares have been pledged by their major shareholders as collateral for loans. But the timing of the move is extremely unusual because China’s financial regulators usually choose to publish announcements outside trading hours to avoid causing big swings in the market.

Investors responded positively to the CSRC statement, with the benchmark Shanghai Composite Index quickly recovering from a loss of 0.65% to rise by more than 1% soon after the official message was sent. The index was up 1.02% at close on Tuesday.

The CSRC also repeated a pledge to make it easier for listed companies to repurchase their shares and carry out mergers and acquisitions to shore up prices. It added it will encourage institutional investors including insurers, asset managers and securities investment funds to make long-term investments in the stock market.

The securities watchdog deleted the statement Tuesday afternoon before publishing a revised version on its website 20 minutes later, in which it corrected a misspelling of the name of the State Council Financial Stability and Development Committee in the original statement. The committee is a powerful body headed by Vice Premier Liu He.

|

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas