China Pledges to Cut Financial Risks at State Enterprises in Wake of Unipec Losses

*Controlling risks from state-owned enterprises’ investments will be one of the main jobs of the sector’s supervisor this year, it said in a Wednesday statement

*Specifically, it would ensure that companies trade only in derivatives for hedging purposes, and do not engage in speculation

(Beijing) — China’s central government has vowed to better contain risks from the financial businesses of state-owned enterprises (SOEs) after the trading unit of the country’s largest oil refiner suffered significant losses recently.

Heading off risks from SOEs’ investments will be one of this year’s key tasks for the State-owned Assets Supervision and Administration Commission (SASAC), the commission said in a statement Wednesday.

Specifically, SASAC plans to clamp down this year on SOEs’ new financial investments. It also wants to ensure that the companies only trade in derivatives, such as futures, for hedging purposes, not speculation, according to the Economic Information Daily, a newspaper backed by the state-owned Xinhua News Agency.

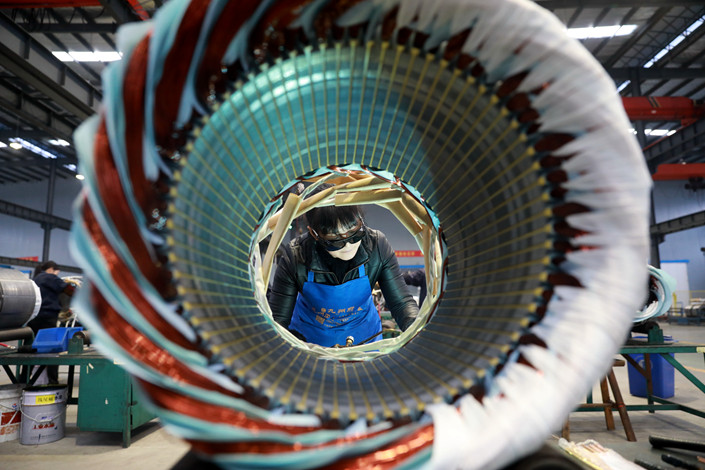

This month, China Petroleum & Chemical Corp., better known as Sinopec, acknowledged that its wholly-owned trading unit Unipec had suffered losses trading oil following a plunge in crude prices. It did not disclose the extent of the losses. Unipec sources said at the time that an investigation was underway into the risk management flaws in the company’s hedging operations.

Unipec trades about 2.2 billion barrels of oil every year, 60% of which are imported into China, according to the company. That accounts for about 43% of China’s total annual crude oil imports.

The confirmation of Unipec’s losses has rattled investors. Sinopec’s shares in Hong Kong and Shanghai plunged after it acknowledged the losses in a filing to the Hong Kong Stock Exchange in January.

SASAC also said it would “explore launching a classified management and registration system for SOEs’ financial business and fund investments,” as well as “a risk control mechanism for both parent companies and their financial subsidiaries.”

SASAC also announced other priorities for SOEs this year such as stepping up efforts to promote technological innovation and high-quality growth, guiding the companies to focus on their core businesses and deepen supply-side reform, pushing for improvements in corporate governance and management, and enhancing the efficiency of regulation to tackle key problems.

Contact reporter Leng Cheng (chengleng@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas