Update: Rising Exports Drive China’s Trade Surplus Wider

* China’s goods exports rose 9.1% year-on-year to $217.6 billion in January, while imports slipped 1.5% to $178.4 billion, with the overall trade surplus more than doubling from a year earlier

* The timing of the Lunar New Year holiday, which fell at the start of February, played an important role in boosting last month’s exports, an analyst said

(Beijing) — China’s trade surplus more than doubled in January, driven by stronger exports, government data showed Thursday, as businesses rushed to fill orders before the Lunar New Year’s holiday at the beginning of February.

China’s goods exports rose 9.1% year-on-year to $217.6 billion in January, according to data released by the General Administration of Customs. The growth beat a median forecast for a 3.3% decline in a Bloomberg News poll of economists.

Imports slipped to $178.4 billion last month, down 1.5% year-on-year, recovering from a 7.6% decline in December. January’s figure beat economists’ projection of a 10.2% loss. China’s overall trade surplus ballooned to $39.2 billion, more than double January 2018’s surplus of $18.4 billion.

The timing of the holiday played an important role in boosting last month’s exports, according to Julian Evans-Pritchard, an analyst with research firm Capital Economics. “Chinese New Year fell earlier in February this year, which means that more of the pre-holiday rush to fulfill orders will have fallen into January, boosting year-on-year export growth,” he said in a note.

After seasonally adjusting the data, Evans-Pritchard said exports and imports both picked up, but remained weaker than a few months ago. He expected both to fall, citing cooling domestic demand and easing commodity price growth.

Louis Kuijs, head of Asia economics at Oxford Economics, also expects export growth to lose a step. “We expect overall economic growth to remain under pressure in the coming months from slowing exports and weak sentiment before finding a floor around the second quarter in response to the growth-supporting measures,” he said in a note.

China’s economy grew 6.6% last year amid sluggish domestic and foreign demand, marking the slowest annual expansion since 1990, official data showed. To stimulate the economy, policymakers have carried out several pro-growth policies including tax cuts, infrastructure construction projects and favorable policies to encourage lending to small and private firms.

“This suggests that U.S. tariffs have started to become a more meaningful drag on exports,” Pritchard wrote.

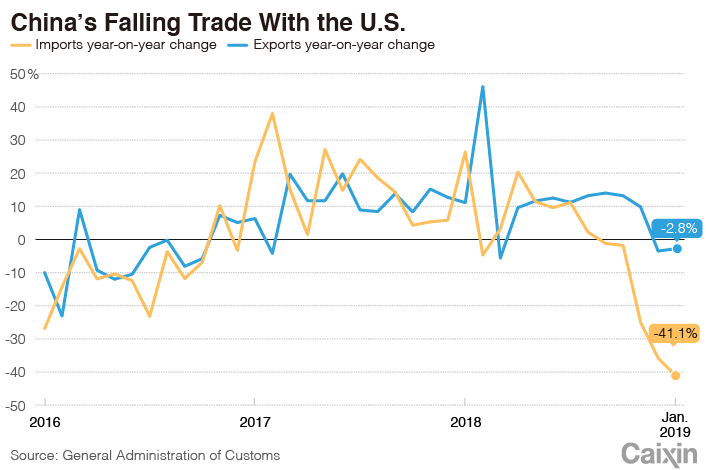

China’s exports to the U.S. exceed its imports from the rival economy by $27.3 billion in January, continuing to narrow from the record-high of $34.1 billion in November. Shipments to the U.S. declined in January for the second straight month to $36.5 billion, down 2.8% from a year earlier, while imports from the U.S. declined at a record pace of 41.1% to $9.2 billion.

|

“Destination-wise, exports to the U.S. continued to fall on a year ago, likely in no small part due to the impact of U.S. tariffs imposed in the third quarter last year,” Kuijs said in the note.

The U.S. President Donald Trump is considering extending the March 1 deadline that he had set for more than doubling tariffs on $200 billion of Chinese goods. Top officials from China and the U.S. are scheduled to meet in Beijing on Thursday and Friday to resolve the trade conflict.

“Despite frequent trade talks at senior levels, many uncertainties linger over the ongoing U.S.-China trade dispute and do not bode well for the export outlook,” said economists with Nomura in a note. Moreover, weakening external demand and the global tech down-cycle appear to be exerting additional downward pressure on China’s export growth.

Contact reporter Liu Jiefei (jiefeiliu@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas