Movers and Shakers: Debt-Ridden Investment Giant Promotes Thai Group Ringer

| World of Finance

China Minsheng Investment Group Corp. Ltd. (CMIG) appointed Yang Xiaoping (杨小平), a vice chairman of Bangkok-based Charoen Pokphand Group Co. Ltd., (CP Group) as its co-chairman on Monday.

CMIG, one of China’s largest private investment conglomerates, has started to sell off assets amid a debt crisis to the tune of 233 billion yuan ($34.4 billion). As the company looks for new shareholders, CP Group — Thailand’s biggest private company — could help, people familiar with the matter have told Caixin, Here’s a deep-dive on CMIG’s troubles.

Yang has served on the boards of several Chinese companies — such as Ping An Insurance (Group) Co. of China Ltd. — of which CP Group has been a major shareholder. He’s been on CMIG’s board since it was established in 2014. CMIG’s current chair, Li Huaizhen (李怀珍) replaced Dong Wenbiao (董文标) in October.

| Companies Roundup

|

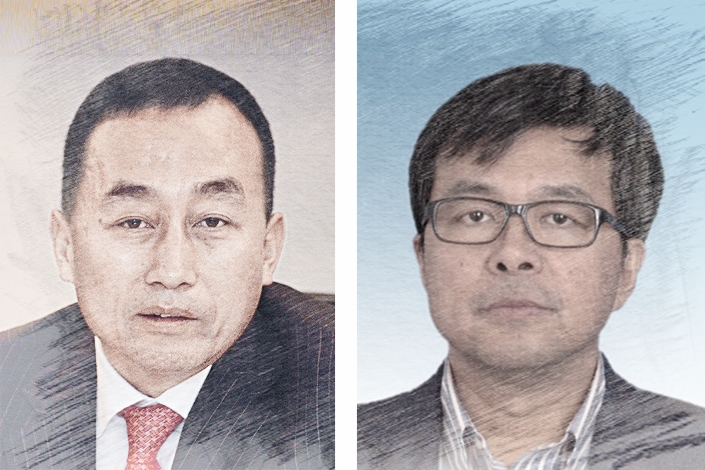

Wu Xiangdong (left) and Hu Yongqing |

Property developers fight for talent: Hong Kong-listed China Resources Land Ltd. said Wu Xiangdong (吴向东) had resigned as executive director, to be replaced by Tang Yong (唐勇). Wu left the company for rival developer China Fortune Land Development Co. Ltd. (CFLD), sources told Caixin. In December, China Resources Land’s CFO, Yu Jian (俞建), also joined CFLD.

CNPC corruption case: Hu Yongqing (胡永庆), deputy manager at the planning department of China National Petroleum Corp. (CNPC) — one of the world’s largest energy conglomerates — is under investigation for “serious violations of law and duty,” a euphemism for corruption, Chinese authorities said Tuesday. Hu, 50, has been the department’s deputy manager since 2011.

Energy moves in western China: Wu Xiuzhang (吴秀章), formerly deputy general manager at China Datang Corp. Ltd., one of China’s “Big Five” state-owned power companies, has been appointed a vice chair of western China’s landlocked Ningxia Hui Autonomous Region. That’s equivalent to a vice governorship of the provincial-level region. Many of China’s provinces have seen top leadership posts given to former upper management at state firms, particularly from the financial sector, in recent months.

| Corruption Casebook

Bad bank boss’s bigamy charges: Lai Xiaomin (赖小民), the former boss of China Huarong Asset Management Co. Ltd., a notorious “bad bank,” or distressed asset manager, was formally charged with corruption, bribery and bigamy, the Supreme People’s Procuratorate announced Friday. Lai was arrested in November, and reportedly had 3 tons of cash stashed at home and a bank account, under his mother’s name, that held 300 million yuan.

Contact reporter Ke Baili (bailike@caixin.com)

Read more about Caixin’s Movers and Shakers.

If you think we’re missing important moves, or if you have any other comments on this newsletter, please let us know.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas