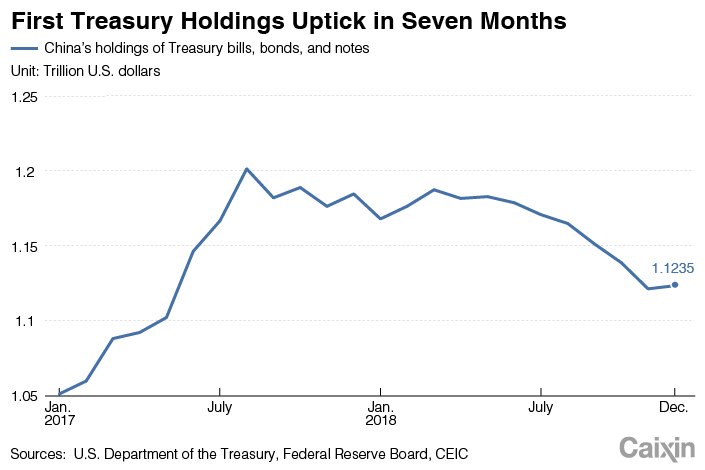

Chart of the Day: China’s U.S. Treasury Hoard Stops Shrinking

China’s holdings of U.S. Treasurys climbed for the first time in seven months in December, up $2.1 billion from the month before, amid a temporary trade truce between the world’s two largest economies.

|

China increased its holdings of U.S. Treasury bills, bonds, and notes to $1.1235 trillion in December, up from November’s $1.121 trillion, according to data released by the U.S. Treasury Department on Friday. China has been cutting its Treasury hoard since May, reducing holdings by total of $61.7 billion as of November, according to Caixin calculations based on official data.

China is the largest foreign holder of U.S. debt, accounting for about 17.9% of total foreign debt holdings and 5.1% of total U.S. debt in December. The second-largest foreign holder, Japan, added to its Treasury assets by $5.7 billion from a month earlier to around $1.04 trillion at the end of December, according to the Treasury Department.

During a meeting in Argentina in December, Presidents Donald Trump and Xi Jinping agreed to a temporary truce in the trade war. The U.S. promised not to impose any additional tariffs for 90 days, ending on March 1, as the two sides work toward a deal.

Contact Reporter Charlotte Yang (yutingyang@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas