Chart of the Day: Wave of Bond Defaults Continues in 2019

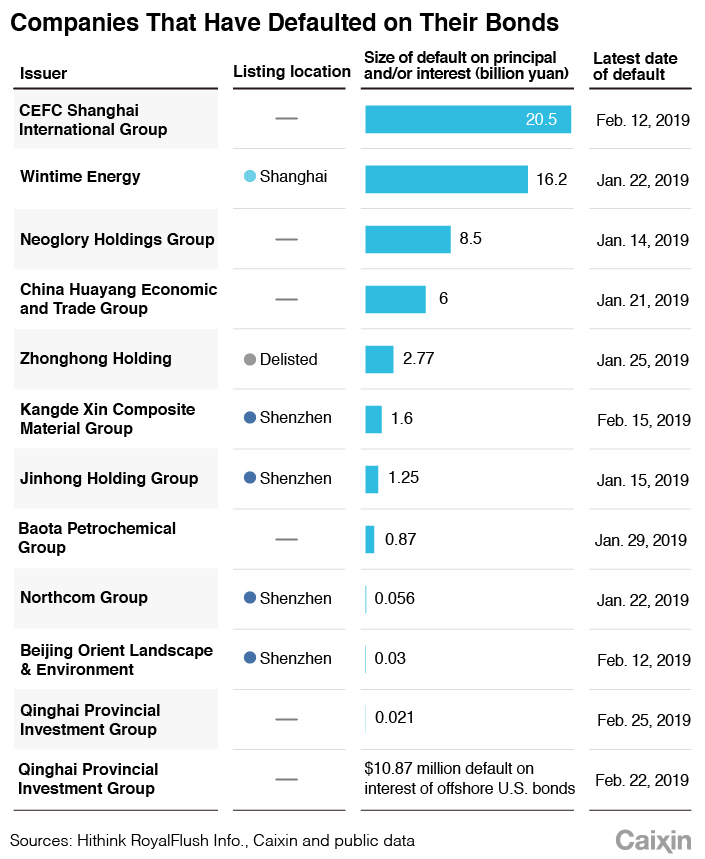

So far this year, at least 15 privately owned companies — five of which are listed and one that has delisted — have defaulted on 19 bond payments worth tens of billions of yuan, according to Caixin’s calculations based on data from financial data provider Hithink RoyalFlush Info.

It’s not just the private sector that’s been struggling to repay debt. State-owned Qinghai Provincial Investment Group Co. Ltd. last month missed an interest payment on $300 million of offshore U.S. dollar-denominated bonds, the first such default in more than 20 years, but later managed to repay part of the debt. The enterprise, based in the underdeveloped interior province of Qinghai, also made a late payment on a domestic note due the same month. Hithink did not give the exact number of state-owned firms that have defaulted this year.

Coal miner Wintime Energy Co. Ltd., one of China’s biggest defaulters, has failed to repay some of its debt 14 times, with its total size of its defaults amounting to about 16.2 billion yuan ($2.4 billion).

Another large debt defaulter is retailer Neoglory Holdings Group Co. Ltd., which missed payments on an exchange-traded bond, bringing its total defaults on eight bond issuances to about 8.5 billion yuan.

In 2018, China saw a wave of defaults on corporate bonds that fueled concerns about Chinese companies’ finances.

|

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas