Tencent-Backed Esports Livestreamer Files for $500 Million U.S. IPO

Livestreaming platform DouYu International Holdings Ltd. has filed for an initial public offering (IPO) of up to $500 million in the U.S. as it seeks extra funding for a bid to dominate China’s world-leading esports market.

With a name that literally means “fighting fish” in Chinese, DouYu claims it was China’s biggest esports platform by average total monthly active users (MAUs) in the fourth quarter of last year, with an average of 153.5 million users signing in each month to compete in or watch video game competitions, according to its prospectus.

The company's mobile and PC apps provide a platform for gamers to livestream games as they play, often providing commentary along the way and drawing big crowds online.

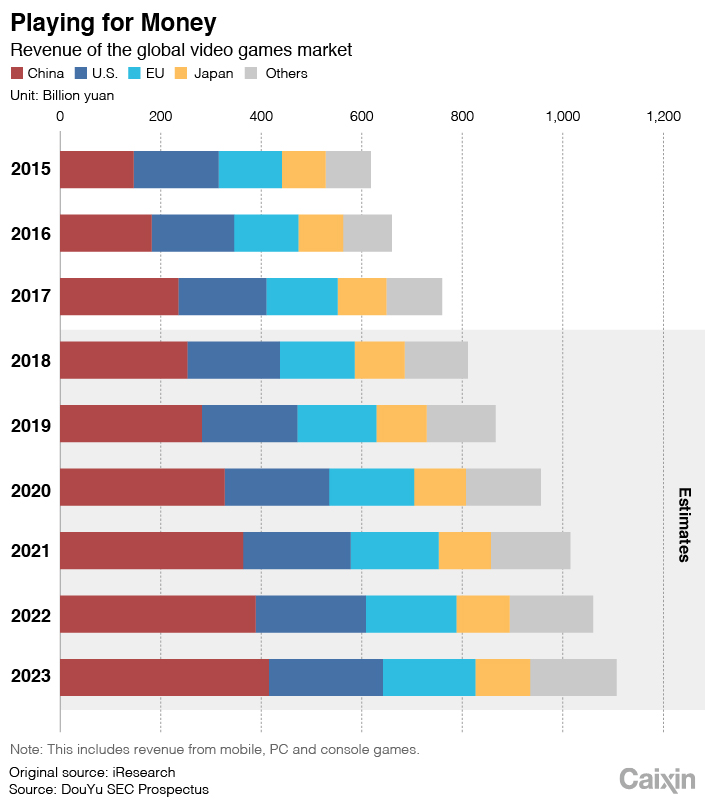

But China’s esports market is a fierce battleground. It was worth 112.8 billion yuan ($16.8 billion) last year, around 7.1 times that of the U.S. market, according to consultancy iResearch. In going public, DouYu is following its chief rival Huya Inc., or “tiger’s teeth,” onto the New York Stock Exchange, where the latter raised $180 million in May.

The value of China’s esports market has more than tripled since 2015 and is expected to more than double from its 2018 level to 247.8 billion yuan by 2023. MAUs are expected to increase to 400 million from 255 million in the same period.

In an intriguing twist, social media and gaming giant Tencent Holdings Ltd. is backing both companies. It is DouYu’s biggest shareholder, holding a 40.1% stake through a wholly-owned subsidiary, while it is the second-biggest shareholder in Huya, according to the livestreamer’s own prospectus filed last year.

|

Tencent appears to be backing DouYu at least partially because it sees it as a useful platform on which to advertise its other products. Tencent paid 27.48 million yuan in advertising fees to the company last year, according to DouYu’s filing.

Yet Tencent’s involvement with multiple leading livestreaming companies has alarmed some industry watchers, with Wang Zhikai, founder of a livestreaming talent agency, warning last month that the industry has entered a “Tencent-led oligopoly state.”

DouYu said in its prospectus that proceeds from the IPO will be invested in content as well as research and development, with some possibly used for acquisitions. Pricing terms have not been disclosed, although Morgan Stanley, J.P. Morgan Securities and Merrill Lynch will underwrite the deal.

Contact reporter David Kirton (davidkirton@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas