In Depth: China’s Biggest Private Broadband Provider Wants to Stop Providing Broadband

Dr. Peng Telecom & Media Group Co. Ltd. may not be as well-known as China’s big three carriers, but it is one of the few significant private players in a market completely dominated by state-owned giants.

Dr. Peng is the largest private broadband provider — but doesn’t plan to be for long. As the company has seen its market share squeezed and its profits plummet, it is looking to transform itself from a network provider to a provider of services to the big state-owned networks — such as maintenance, installation and customer care.

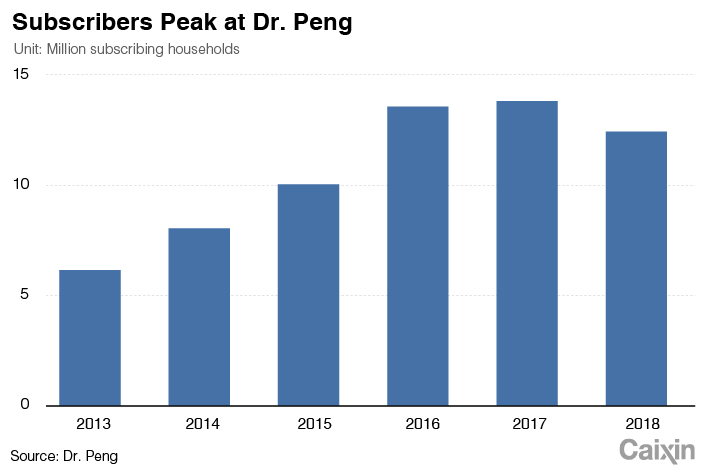

The company plans to sell its 12.5 million residential broadband subscriptions to the big three, a company source told Caixin. The person asked not to be named as the plan hasn’t been made public yet.

The retreat signals another smaller player is being squeezed out of the field by the big three — China Mobile, China Telecom and China Unicom — which since last year have offered cheap packages that bundle together mobile data, broadband and television.

Transformation is nothing new to Dr. Peng, which was founded in 1985 in Chengdu, capital of Southwest China’s Sichuan province, as a steel manufacturer. In 2007, it decided to dispose of its unprofitable steel business and get into telecommunications by buying Beijing-based telecom services provider Teletron Telecom for 770 million yuan ($111.42 million).

|

In 2012, Dr. Peng became the country’s largest private broadband operator when it spent 1.8 billion yuan to take over Beijing-based rival Great Wall Broadband Network Service Co. Ltd.

Today, Dr. Peng is China’s the fourth-largest telecommunications operator by revenue, according to credit ratings agency Moody’s.

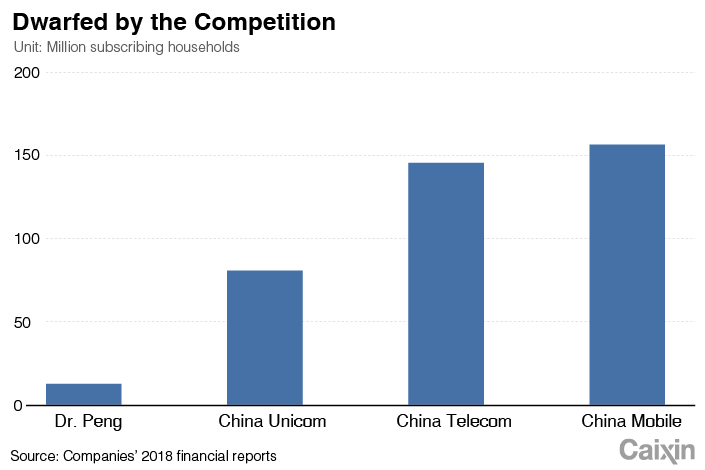

The big three and Dr. Peng currently command a total broadband user base of 400 million households — over 90% of the country’s 430 million households.

The downfall

China Mobile has played a big role in Dr. Peng’s decision to pivot, market watchers said.

In 2018, it overtook China Telecom as the nation’s largest broadband provider, with 157 million households. China Telecom had 146 million at the time and Unicom had 80.9 million.

|

China Mobile, the world’s largest carrier by subscribers, was given a broadband license in late 2013. It soon acquired the broadband assets of China Tietong Telecommunications Corp. for 32 billion yuan, absorbing the latter’s network infrastructure and 47,000 of its employees. Tietong had been one of six carriers operating in China before the sector went through a round of consolidation.

With this acquisition, China Mobile leapt to the forefront, as its broadband service was priced cheaper than its rivals and bundled with phone, mobile data and online television services — its major sources of revenue. In this way, its business was distinct from the other state-owned behemoths, which counted on broadband as their core source of revenue.

Read More

China Unicom to Offer Commercial 5G Services in 7 Cities

The impact on Dr. Peng was monumental. In 2018, Dr. Peng’s revenue growth slowed for only the second time since 2010 — sales were down 16% from a year earlier to 6.9 billion yuan. Net profit plunged 49% to 380 million yuan.

Subscriber numbers also dwindled. They were down by 10% in 2018, against 2% growth in 2017 and 35% growth in 2016.

Now the question remains: will another transformation save the company?

Second transformation

Dr. Peng wants to make the most of its nearly 13 million broadband households. One plan is to sell this lucrative asset to one of the big three, the company source said. As part of this kind of deal, the company would look to become a service provider to that company.

At least one partnership has already taken shape.

In Shanghai, China Telecom signed a deal with a unit of Dr. Peng in March to set up a joint venture that will operate broadband networks and services. They didn’t offer more details.

|

Workers install fiber optic cables for broadband in the northwestern city of Xi’an in December 2014. Photo: VCG |

“Dr. Peng has to navigate its game plan properly,” said another company source who has participated in the negotiations with China Telecom. “It has to safeguard its most important asset — its broadband clients. If it were to transfer them to the rivals (the big three), it has to ensure it was going to be a definite ‘win win.’”

A Dr. Peng spokesperson in April told Caixin that it’s interested in partnerships with state-owned carriers, and that China Unicom has also expressed interest. The person declined to elaborate.

If Dr. Peng succeeds in becoming a major services provider, market watchers said, it will be going toe-to-toe with China Communications Services Corp. Ltd.

That Hong Kong-listed services provider was set up in 2006, and counts the big three among its backers. In 2018, it raked in 41.3 billion yuan in sales from China Telecom, with another 28.4 billion yuan coming in from China Mobile, China Unicom and China Tower Corp. Ltd., a conglomerate that manages the big three’s network infrastructure.

Dr. Peng is also beefing up its cloud computing and database business. The company operated 15 data centers across China including in Wuhan and Shenzhen as of 2018.

However, despite entering the data business as early in 2009, the unit’s revenue was up just 10% last year, accounting 17.5% of company’s total revenue. Broadband remains Dr. Peng’s most important business, accounting for more than 70% of gross profits, according to Moody’s.

An analyst who closely follows China Mobile said the telecom giant had been eyeing a data center and broadband partnership with Dr. Peng around 2015, but the deal didn’t materialize because Dr. Peng wanted to pursue its own path. “Now as its market share is plunging, Dr. Peng isn’t negotiating from a position of strength,” the person added.

So far, analysts appear unconvinced of the company’s growth potential.

Moody's Investors Service this month downgraded Dr. Peng’s credit rating on increasing uncertainty over its ongoing business transformation amid the fast-changing industry landscape.

“Dr. Peng Telecom’s revenue and cash flow have deteriorated materially in the past 12-18 months amid intense competition among broadband internet access operators in China,” said Moody’s analyst Danny Chan in a note on May 10.

While its installation and maintenance services have started to contribute to revenue, they offer lower profit margins than broadband provision. Dr. Peng’s “business transformation will therefore entail execution risk and pose some risk to the company's revenue and cash flow,” Chan said.

Contact reporter Jason Tan (jasontan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas