In Depth: After Conquering the Bargain Basement, Pinduoduo Sets Sights on Big Cities

In the year since its New York IPO, budget e-commerce company Pinduoduo Inc. has been working overtime to shake its image as a small-town specialist selling to bargain-hungry plain folks. The company hopes to draw in wealthier big-city dwellers as well, fueling growing whispers that it could finally pose the first real challenge in years to industry titans Alibaba and JD.com.

Just this week the company passed a milestone by overtaking search veteran and internet stalwart Baidu Inc. to become China’s fifth largest internet company. It achieved that position thanks to a 30% gain in its stock following the release of its latest turbo-charged quarterly results last week.

At its current price of $34, Pinduoduo’s stock has nearly doubled from its New York IPO price in July last year.

Founded in 2015, Pinduoduo made its name using a “team purchase” model that combines social elements with traditional shopping. It offers consumers steep discounts if they invite friends and relatives to form a “team” to shop. The model quickly helped it gain large followings in smaller cities that were neglected by Alibaba Group Holding Ltd. and JD.com Inc.

But that is rapidly changing. As of June, orders from top cities like Beijing, Shanghai and Wuhan made up 48% of Pinduoduo’s total transactions, up from just 37% in January, founder and CEO Zheng Huang said in a call after announcing his company’s latest results last week.

Those results showed that Pinduoduo’s revenue surged 169% to 7.3 billion yuan ($1 billion) from a year earlier, while its net loss narrowed sharply to 1 billion yuan from 6.5 billion yuan over the same period.

|

Pinduoduo’s strong move into larger cities followed the launch of its “10-billion-yuan subsidy program” that, according to the name, subsidized users to the tune of up to $140 million during a shopping festival running on the first 18 days of June.

The company’s upbeat noises may be hype, analysts said. But they also show the company is serious about shedding its long-held association with cheap products and wants to target bigger cities and wealthier buyers.

“It is a ‘natural move’ that now Pinduoduo is focusing more on bigger cities, after it already established a stronghold in less developed areas,” said Zhao Ge, a Shenzhen-based analyst at Futu Securities.

Well received

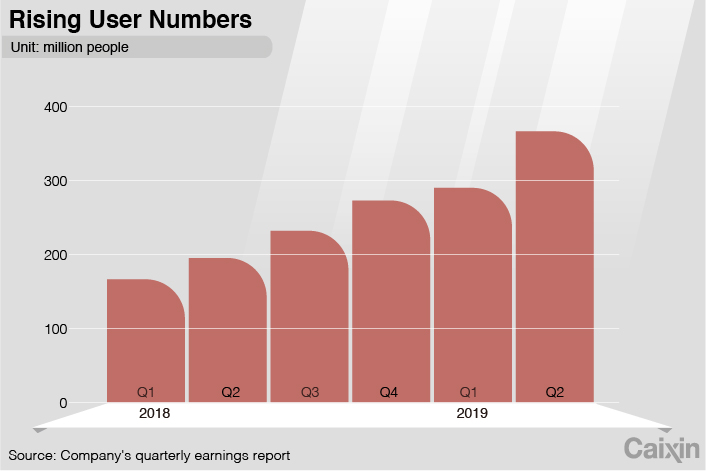

Its massive subsidy campaigns, often in partnership with established brands like Apple and Sony, are quickly winning fans. For the three months through June, Pinduoduo's number of average monthly active users rose 88% to 366 million. Though it didn’t offer a breakdown of geography, analysts believe most are from major cities, often called tier-1 and tier-2 cities.

Average spending by active buyers also improved significantly. In the 12 months through June, the average active buyer on Pinduoduo spent 1,467.5 yuan – nearly double the amount from a year earlier, according to the company’s second quarter’s earnings report.

|

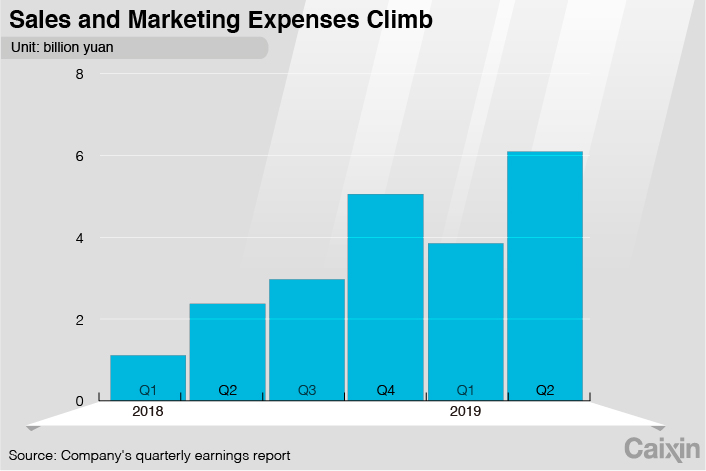

The company’s marketing expenses also more than doubled during the quarter to 6.1 billion yuan, partly due to promotions like the 10 billion yuan subsidy campaign. But returns from such aggressive spending are clearly outweighing the expenses. Pinduoduo’s expense-to-revenue ratio came in at 83.7% in the third quarter, down from as high as 107.6% in the first quarter of this year.

The greater return on spending may be a major factor behind the hugely positive response to the company’s latest earnings, as investors buy into Pinduoduo’s expansion strategy despite its loss-making status.

Forced exclusivity

As the company encroaches on its bigger rivals, however, it is expected to see further pushback from sector behemoth Alibaba, the undisputed leader with 58% of China’s e-commerce market. But Pinduoduo’s dramatic rise to seize 5.2% as of early this year is rapidly altering the e-commerce landscape.

Pinduoduo’s CEO has said the industry is troubled by “force exclusivity,” whereby some larger players hobble smaller rivals by forcing big brands to choose between themselves and the smaller players. That issue exploded into public view in June, when one of China’s leading microwave manufacturers Galanz accused Alibaba of demanding it choose between Alibaba and Pinduoduo.

|

That obstacle could be a major one, since Pinduoduo’s biggest challenge to winning bigger city customers is its lack of branded merchants, said Shawn Yang, a Shenzhen-based analyst with Blue Lotus Capital. “Given Alibaba’s tightening grip on such merchants, it is unclear how Pinduoduo could make a breakthrough anytime soon,” he said.

Yang said even though Pinduoduo could continue leveraging its low-end expertise to tie up with smaller merchants, the smaller value of such deals could limit its growth in terms of total sales value.

Less logistical worries

The increasing rivalry with Alibaba has also been playing out in logistics – a key area where e-commerce companies compete fiercely to provide the fastest and most customer-friendly product delivery. As of June, Pinduoduo said it has persuaded nearly all of its third-party courier partners to use its in-house electronic logistics tracking system.

Electronic logistics tracking systems are a key nexus connecting merchants, couriers and shoppers, controlling the vast flow of information and data in the e-commerce business. For years, Pinduoduo has relied on Alibaba’s Cainiao, an early leader in the area, which has relationships with nearly all major delivery companies.

But its reliance on Cainiao has also exposed Pinduoduo’s business transaction data to Alibaba. For that reason, its switch from the system was more an act of defense to protect its own customer data, said Cao Lei, a Hangzhou-based analyst at Electronic Commerce Research Center.

But whereas Alibaba can force merchants to choose, it would have more difficulty using such strong-arm tactics in logistics, Cao said. That’s because its huge order volume would easily allow Pinduoduo to find other partners even if all of its current ones were ordered to cut ties by Alibaba.

Contact reporter Mo Yelin (yelinmo@caixin.com)