In Depth: Stricter Regulations Push China’s Money Market Funds Into Major Makeover

When given a choice, investors prefer a sure thing. For China’s multitrillion-yuan money market fund industry, that has become a problem.

For the last few years, the money market fund industry has been going through a bitter transition — shifting away from conventional funds with a guaranteed value to those whose worth changes based on the fluctuating value of the assets they are invested in.

On Aug. 19, the shareholders of a conventional money market fund run by Shenzhen-based First Seafront Fund Management Co. Ltd. voted to shut it down and take their money back, becoming the second such fund to do so this year. The first closure also happened last month, when a fund operated by Bank of Communications Schroder Fund Management Co. Ltd. decide to close.

According to China’s regulations, a money market fund that has less than 200 shareholders or a net worth of less than 50 million yuan ($7.2 million) for 60 straight days, can be shut down. Under that requirement, a total of 37 funds are at risk of dissolution, according to the second quarter reports of companies than run money market funds.

The closures follow regulatory moves to aggressively reform the industry after the central government released new asset management regulations in April 2018. The regulations indicated that a consensus had been reached — the conventional money market fund, with its guaranteed value and returns, posed a threat to market stability.

|

Past the peak

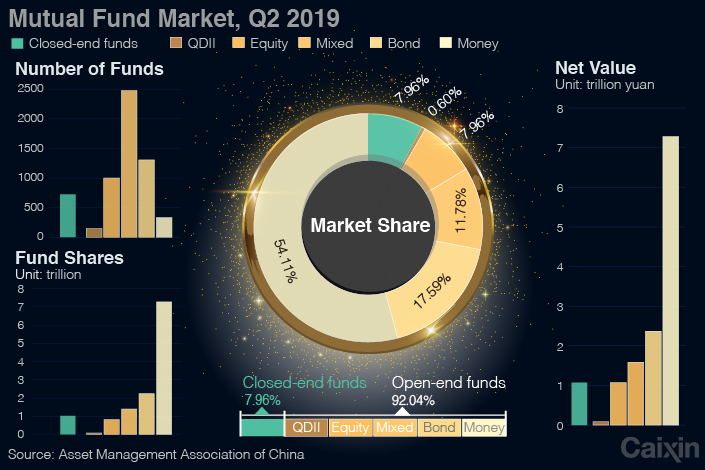

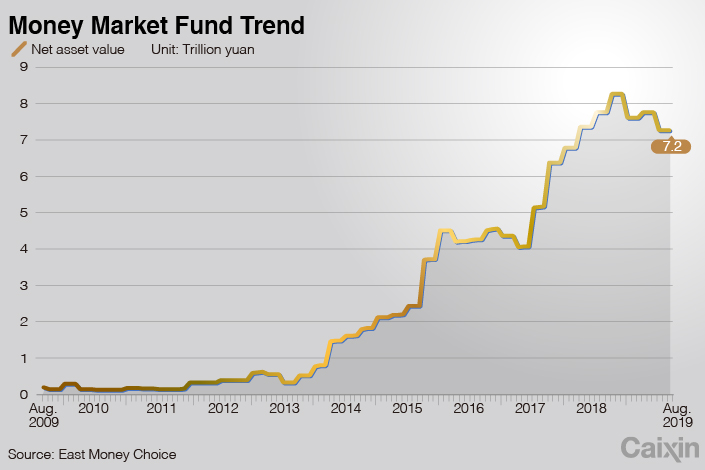

The domestic market for such funds has been shrinking since 2016. As of the second quarter of this year, it has slumped to 7.28 trillion yuan, down by 1 trillion yuan from an earlier peak of 8.2 trillion yuan. Furthermore, the money market funds’ share of the broader mutual fund market is also down, falling from 62% in the second quarter of 2018 to 54% a year later.

The market’s retreat followed a three-year surge in which Yu’e Bao, the money market fund run by a Tianhong, a fund manager controlled by Ant Financial Services Group, ballooned into the world’s largest money market fund.

But by the end of 2016 as liquidity began to dry up, money market funds began to face the growing risk of their investors cashing out en masse. To contain that risk, financial regulators, including the People’s Bank of China (PBOC) and the China Securities Regulatory Commission (CSRC), tightened oversight over the industry.

It’s unclear whether conventional money market funds will be subject to the new asset management rules, which require a cleanup of opaque assets before 2020. However, the direction of the reform is already set: Going forward, the value of money market funds will be calculated based on their floating net-asset value (NVA), meaning their value must be based on the underlying worth of the assets they invest in. The U.S. has required the same of money markets fund there since October 2016, and the EU since last year.

An inspector at a Shenzhen-based fund sees this as the beginning of the end.

|

Pilot funds

CSRC has approved six pilot funds whose value will be calculated based on NVA. On Aug. 28, ahead of a preset schedule, Penghua Fund concluded its six-day fundraising round, bringing in more than 20 billion yuan — the cap placed on fundraising in the pilot program

That’s quite a haul considering that less than two weeks earlier, the first NAV fund, distributed by Harvest Fund Management, raised just 210 million yuan from two investors, one of which was Harvest itself.

A source in the mutual fund industry said that Harvest was clearly treating the fund as a way to try out the pilot program as its lone outside investor only invested the minimum amount of 200 million yuan.”

Another 25 money market NAV funds are currently waiting for CSRC approval.

In April, the CSRC issued guidelines for NAV funds that allowed institutional investors to subscribe to the pilot funds. Individual investors were excluded.

However, NAV funds currently aren’t as appealing as conventional money market funds precisely because their value can fluctuate, along with the fact they don’t yield as much as their predecessors, Citic Securities’ researchers said. In the long run, however, NAV funds could fill in part of the gap in the market left by the retreating conventional funds.

Grasping for investors

Although the shift to NAV has already begun, only a few fund firms have been allowed to launch funds under the pilot program. Since August 2017, the CSRC has declined to approve any new conventional money market funds. Because the existing 331 conventional funds are shrinking, fund managers have been testing out new ways to attract investors, such as by allowing them to withdraw money from the fund on the same day they put it in.

Some fund managers have also increased how frequently they distribute the fund’s income to investors. Two firms, Truvalue Asset Management Co. Ltd. and Huatai Securities Co. Ltd., have begun distributing income to investors every day, as opposed to doing it monthly, like it did under its previous policy. For its investors, Ant Financial’s Yu’e Bao abandoned the individual subscription cap and the daily purchasing limit.

These efforts may be in vain, however. In terms of returns, money market funds won’t be able to compete with banks’ wealth management products, said the source in the mutual fund industry.

A way out

The majority of investors in China’s money market funds are individuals. For example, more than 99% of Yu’e Bao investors are individuals, while only 0.03% are institutional buyers.

For money market funds to survive, they need to make a clear distinction between the preferences of individuals and institutions, said Zhong Zhengsheng, chief economist at CEBM Group, a subsidiary of Caixin Media.

“From the American experience, we know that individual investors are not sensitive to the rate of return, but have a low tolerance for risk. So they invest in money market funds as way to supplement their bank savings,” he said. “(In contrast) institutional investors are very sensitive to the rate of return, but are fine with higher risks. Thus money market funds in the future can be a tool for them to manage their cash.

Zhong suggests that China’s money market funds could shift to target institutional investors. U.S. money market funds underwent a similar transition, he said, and China could follow in its footsteps.

Contact reporter Lu Zhenhua (zhenhualu@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

- PODCAST

- MOST POPULAR