Exclusive: Key Personnel Moves Among China’s Biggest Bad-Debt Managers

China’s most profitable distressed-asset manager will soon appoint a new chief, likely triggering a chain of personnel moves among major financial giants, Caixin has learned.

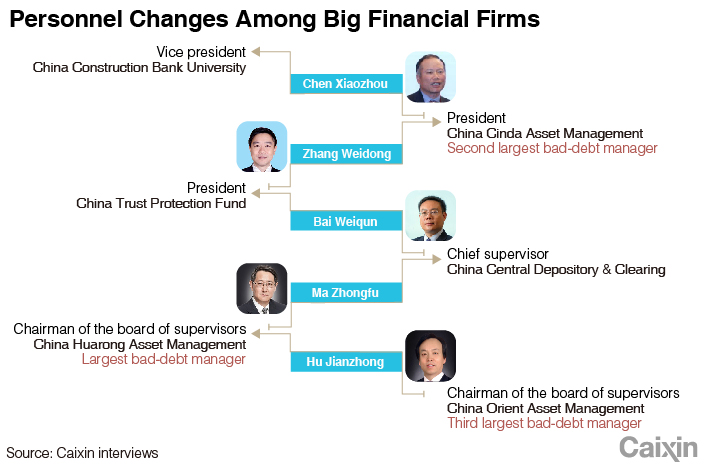

Hong Kong-listed China Cinda Asset Management Co. Ltd. will nominate veteran financier Zhang Weidong as its new president to replace Chen Xiaozhou, sources with knowledge of the matter said. The company already appointed Zhang as its deputy Communist Party chief on Monday, they said.

The appointment marks the latest key managerial change in an industry that has come under intensified scrutiny in the wake of a corruption case at the country’s largest bad-debt manager.

Zhang, 52, is currently president of China Trust Protection Fund Co. Ltd., the state-backed bailout fund for trust firms, which he joined in 2015. Between 1999 and 2016, Zhang worked at state-owned Cinda for 17 years, eventually rising to the high-level positions of board secretary and assistant to the president.

Chen, 57, will become a vice president of the China Construction Bank University, a corporate university set up in December by China Construction Bank Corp., one of the country’s four biggest state-owned commercial lenders.

Of the nation’s four major state-run bad-debt managers, Cinda is the second largest by assets after China Huarong Asset Management Co. Ltd. All of the “Big Four” were initially set up by the Ministry of Finance in 1999 to deal with four major state-owned banks’ bad debts.

Cinda’s profits used to come second as well, but have outpaced Huarong’s since last year. In the wake of a scandal has left former chairman Lai Xiaomin facing criminal charges, Hong Kong-listed Huarong’s net profit collapsed 94.3% year-on-year to 1.5 billion yuan ($212 million) in 2018, well below Cinda’s 11.9 billion yuan.

Read more

In Depth: Bad Business at a ‘Bad Bank’

Personnel merry-go-round

The personnel change at Cinda is likely to set off moves in other state-run financial firms, including at other big bad-debt managers. This showcases a tactic that the Chinese government commonly uses — rotating experienced financiers between a number of state-owned institutions to help them better understand different sectors.

Bai Weiqun, chief supervisor of bond clearing house China Central Depository & Clearing Co. Ltd., will take over Zhang’s post as president of China Trust Protection Fund, people with knowledge of the matter told Caixin.

|

Bai’s position at the clearing house will be occupied by Ma Zhongfu, they said. Ma used to be Huarong’s second-in-command, playing a key role in assisting Huarong Chairman Wang Zhanfeng in dealing with risks accumulated during Lai’s tenure. Ma resigned on Monday as chairman of Huarong’s board of supervisors.

Ma’s position at Huarong will be filled by Hu Jianzhong, currently chairman of the board of supervisors at China Orient Asset Management Co. Ltd., the third largest bad-debt manager, the sources said.

Since Lai was put under investigation in April 2018, the leadership of the “Big Four” have reflected on the aggressive expansions they undertook regardless of potential risks, sources close to the companies said. Over the years, these asset management companies have all grown into financial holding groups that engage in a wide range of financial services, including banking, securities and trust businesses.

Lai’s case is typical of China’s sweeping anti-graft campaign in the financial sector in recent years. Investigators found that he had 270 million yuan worth of cash stashed at home, and 300 million yuan saved in bank accounts under his mother’s name, Caixin previously revealed. In February, Lai was charged with corruption, bribery and bigamy.

The fallout of the scandal has not faded. In the first half of this year, Huarong’s net profit of 2.8 billion yuan was still well below Cinda’s 9.5 billion yuan, according to their interim reports. At the end of June, Huarong and Cinda respectively had 1.7 trillion yuan and 1.5 trillion yuan in total assets.

A previous version of this story inaccurately described China Trust Protection Fund's relationship with the state. It is a state-backed bailout fund.

Contact reporter Lin Jinbing (jinbinglin@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas