Money-Losing Letting Agency Raises Only Half of What It Wanted in U.S. IPO

Money-losing letting agency Q&K International Group Ltd. has raised $45.9 million in its initial public offering (IPO) on the Nasdaq, less than half of its original fundraising target.

Q&K sold 2.7 million American depositary shares (ADSs) at $17 each, the low end of its indicative price range. On Wednesday, the company closed up 2.47% at $18.80, following a 3.8% rise during its first trading day on Tuesday.

The Shanghai-based company originally planned to raise as much as $100 million by offering 5.2 million ADSs last month, before it downsized its fundraising target last week, according to a company prospectus filed to the U.S. Securities and Exchange Commission.

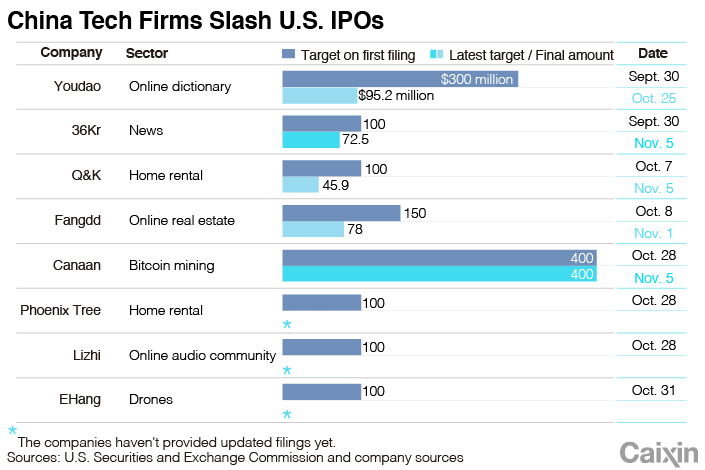

Q&K’s trading debut comes as a wave of Chinese companies slashed their IPO targets amid lukewarm investor sentiment. Institutional investors in the U.S. were cautious about Q&K’s IPO, CEO Jin Guangjie said.

Youdao — a unit of Nasdaq-listed Chinese internet company NetEase Inc. — raised $95.2 million in its New York debut on Oct. 25, after the online dictionary said in a September prospectus that it planned to raise as much as $300 million.

Tech news website 36Kr has also cut its IPO target, giving a figure of $72.5 million in its latest prospectus released on Tuesday, compared with its target of $100 million in September.

|

Almost all of the companies that have cut their IPO targets have reported losses recently, which may indicate that investors are losing patience with money-losing firms.

Q&K booked 373.2 million yuan ($53.21 million) of net losses in the nine months to June, an increase of 15.2% year-on-year. Youdao posted a net loss of 168 million yuan in the first half of this year, twice the figure from the year before.

Founded in 2012, Q&K leases apartments from their owners and then sublets the properties through its website and app.

Q&K said it had 91,234 available rental units across six Chinese cities as of the end of 2018, indicating rapid growth from the 940 Shanghai units it had at the end of 2012.

Q&K’s is the first Chinese residential rental company to list in the U.S. Local rival Phoenix Tree has filed for its U.S. IPO last month, and is looking to raise about $100 million.

Contact reporter Tang Ziyi (ziyitang@caixin.com)

- PODCAST

- MOST POPULAR