Update: Inflation in China Jumps to Eight-Year High as Pork Prices Keep Soaring

Consumer inflation in China soared to an eight-year high in November, official data showed Tuesday, as pork prices continued to climb amid an ongoing supply shortage caused by a nationwide outbreak of African swine fever that has decimated hog stocks.

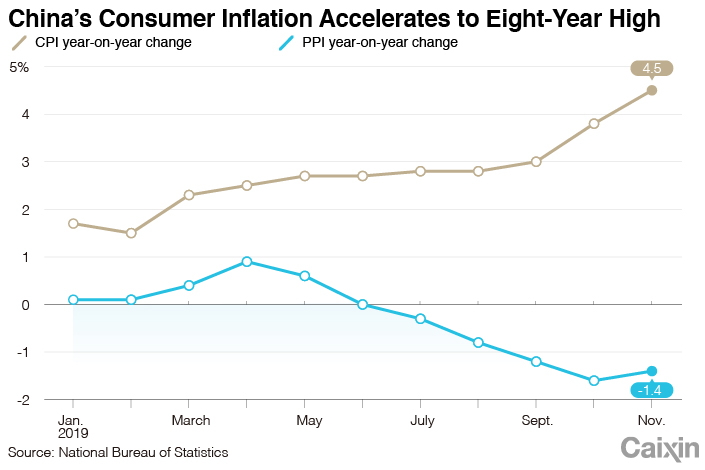

The consumer price index (CPI), which measures the prices of a basket of consumer goods and services, rose 4.5% (link in Chinese) year-on-year in November, the biggest jump since October 2011, data released by the National Bureau of Statistics (NBS) show. That compared with a 3.8% gain in October and was higher than the median estimate of 4.4% growth (link in Chinese) in a Caixin survey of economists.

|

Pork is China’s most widely consumed meat, and an outbreak of African Swine Fever that began in the middle of 2018 has wiped out much of the country’s domestic supply of hogs. In October, the number of live pigs plunged 41.4% year-on-year, according to data (link in Chinese) from the Ministry of Agriculture and Rural Affairs.

The worst of the surge in pork prices may now be over. On a month-on-month basis, they rose by 3.8% in November compared with a 20.1% jump in October. In November, the number of live pigs rose 2% month-on-month, the first increase in a year, the Ministry of Agriculture said (link in Chinese) on Monday. These are signs that swine fever “is now being brought under control,” economists from research firm Capital Economics said in a note. “It may take a little longer before pork prices start to drop back, but consumer price inflation should peak before long as a result.”

|

Apart from food, there is little pressure on other prices. Core CPI — which excludes the more-volatile food and energy prices and which economists say better reflects long-term inflation trends — rose by a more modest 1.4% year-on-year in November, edging down from 1.5% in October, and showing the weakest increase in more than three years.

The producer price index (PPI), which tracks changes in the prices of goods circulated among manufacturers and mining companies, fell 1.4% year-on-year in November, NBS data showed (link in Chinese). It was a slight recovery from a 1.6% decline the previous month and in line with the median estimate of economists in Caixin’s survey.

Some economists expect the decline in the PPI to narrow further in December on the back of a low base effect comparison with the year earlier when global oil prices fell sharply and have now recovered. China is the world’s top importer of the commodity. Nomura’s economists forecast the drop will be just 0.4% in December.

Capital Economics said that the continued decline in the PPI coupled with the likely easing of food inflation could “strengthen the case for further monetary easing.”

Policymakers have said repeatedly that the central bank will not unleash a flood of liquidity to stimulate the economy although they have pledged to strengthen counter-cyclical adjustments, policies aimed at supporting or stimulating the economy in a downturn. A meeting of the Politburo, the Communist Party’s top decision-making body, on Friday reiterated that the government should adopt “counter-cyclical adjustment tools” as part of its policy framework.

Contact reporter Tang Ziyi (ziyitang@caixin.com)

Caixin Global has officially launched Caixin CEIC Mobile, a mobile-only version of a world-class platform for macroeconomic and microeconomic data.

From now on, all users can enjoy a one-month free trial on the Caixin App through December 2019. If you’re using our App, click here. If you haven’t downloaded the App, click here.

- PODCAST

- MOST POPULAR