Beauty-App Maker Meitu Says It Lost Less Money in 2019

Chinese beauty-app maker Meitu Inc. expects its losses for 2019 to shrink sharply on the previous year, as the company pushes to monetize a large user base and grow revenue from advertising.

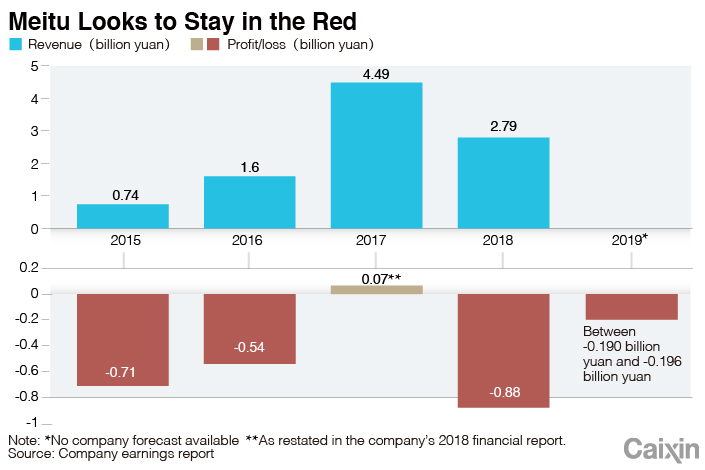

Meitu expects to lose between 190 million yuan ($27 million) and 196 million yuan for the year ending December, down 77.3% to 76.6%, the Hong Kong-listed company said in a note this week. It reported a loss of 879 million yuan in 2018.

The company didn’t touch on the year’s revenue in the note, which made the projection based on core online advertising revenue growth, as well as efforts to cut sales and marketing costs. It noted the actual results may be different as the accounts have not yet been audited.

Founded in 2008, Meitu owns a series of mobile apps, including Meitu Xiuxiu, a hugely popular photo-enhancing tool which claims more than 100 million monthly active users. The company boasted more than 308 million monthly active users across its mobile offerings as of June, including 112 million outside China.

|

Meitu once generated most of its revenue from selling smartphones. But it sold its core hardware business to smartphone heavyweight Xiaomi Inc. in 2018, and has since ramped up efforts to monetize its large user base as part of its strategy to transform into a social media company.

For the first half of 2019, Meitu made 99.7% of its 464 million yuan in revenue from the so-called “internet business,” a monumental jump from only 6.6% at the end of 2016, when it reported the year’s revenues at 1.6 billion yuan.

Aside from advertising, the company has drawn more revenue from premium subscriptions, including through an augmented-reality based advertising platform which partners with bricks and mortar retail stores to let consumers “try on” products virtually.

Meitu said in the note that revenue from subscription fees had seen strong growth in 2019, though it did not provide figures.

After listing in Hong Kong in 2016 with a share price of HK$8.5 ($1.09), Meitu has seen its stock value wither more than 80%, reflecting investors’ concerns about its money-losing status. On Thursday, Meitu closed at HK$1.62, down slightly by 1.2%.

Contact reporter Mo Yelin (yelinmo@caixin.com)

- PODCAST

- MOST POPULAR