Caixin Insight: A Second Land Miracle?

Welcome to the newest issue of the Caixin Insight newsletter, which provides more in-depth and incisive views each week on what’s happening in the world’s second-biggest economy as it gets back on its feet after Covid-19.

We are in the calm before the storm waiting for the Two Sessions to start late next week. CPI and PPI both fell more than economists anticipated, local governments are responding to Covid-19 flare-ups in Shulan and Wuhan with mass testing, and the car industry finally saw sales improve slightly after nearly two years of continuous decline. But the most interesting things to consider are more foundational: land reform and signals of broader stimulus to come.

Inflation

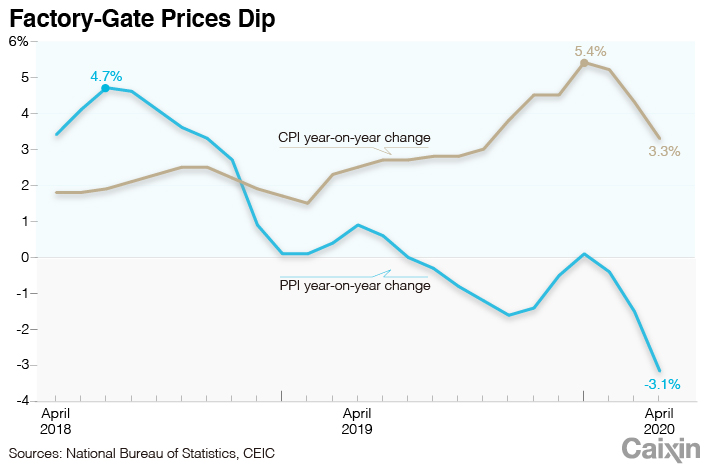

China’s headline Consumer Price Index (CPI) and producer price index (PPI) inflation both continued their fall in April, due largely to pork and oil.

CPI rose 3.3% year-on-year (link in Chinese) last month, the National Bureau of Statistics (NBS) said, as businesses resumed production. The April reading was the lowest in seven months and marked the third straight month of deceleration, and lower than the median estimate of 3.6% growth by economists surveyed by Caixin.

Pork remained the primary driver, with prices surging by 96.9% YoY as China continued grappling with lingering fallout from a prolonged and devastating outbreak of African swine fever. However, that reading was down from 116.4% growth in March.

The producer price index fell 3.1% year-on-year (link in Chinese) in April, data from the National Bureau of Statistics showed. The rate of decline accelerated for the third month in a row. The April reading was steeper than the median estimate of a 2.7% drop (link in Chinese) from a Caixin survey of economists.

China’s factory gate prices fell at their steepest pace in four years in April, as industrial demand continued to weaken amid the worldwide coronavirus pandemic.

|

Mass Virus Testing Will Be the New Normal

Although China has largely brought the Covid-19 pandemic under control, regional flare-ups continue to menace the country and highlight the difficulty of reopening and restarting its economy. On May 10, Shulan, a county-level city home to 600,000 people in Northeast China’s Jilin province, went back under lockdown, after a cluster of a dozen cases appeared in recent days.

Proven to be an effective way to contain the virus, large scale testing is one way help to prevent more Shulan-style local flare-ups. There have been rumors in recent days saying Wuhan will test its entire population (over 11 million people) over the next 10 days, but this is not quite the case.

Instead, each district will submit a detailed plan, with staggered testing schedules prioritizing high-risk areas to be completed over the course of the month.

Regardless, such mass testing is quite ambitious and a remarkable shift in strategy that will put lab capacity to the test. Furthermore, lab capacity and supply of testing kits across China is uneven, so the strategy cannot work in regions with insufficient test kit supply, which may struggle more than others to fully reopen their economies, adding to downside risks.

Automakers call for stimulus as sales rebound

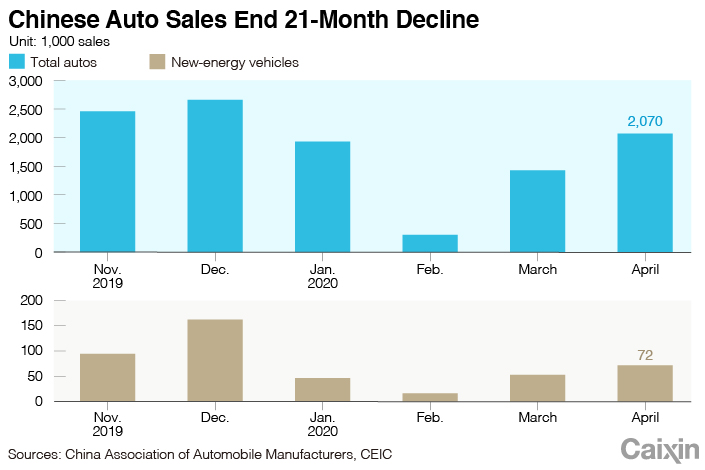

China’s automobile sales rebounded in April, ending a 21-month decline, according to data released May 11 by the China Association of Automobile Manufacturers (CAAM). New Energy Vehicle (NEV) sales did not fare so well, however, with a 26.5% year-on-year slump in sales to 72,000 last month.

|

The rebound hasn’t stopped the industry from crying for more help as we discussed last week. CAAM asked for a cut to the tax on new car purchases on April 10, but it appears to have fallen on deaf ears. Once an effective stimulus for Chinese auto buyers, such cuts no longer have the impact they once did.

Back in 2009, Chinese authorities halved the tax to 5% for cars with 1.6 liter engines or below, and raised it to 7.5% the next year before bringing it back to the original 10%. An auto sales boom followed, with 85.6% more cars sold in the fourth quarter of 2009 compared with the same period the prior year. But when policymakers ran the same play in 2015-2017, the purchasing frenzy dissipated as soon as the cuts ended.

These past experiences showed that such stimulus will overdraw future purchases, risking a deep slump later. Wang Qing, a researcher at the State Council’s Development Research Center, predicted the tax cut could overdraw purchases for two years, so it is understandable that policymakers hesitate to play that trick again.

China’s Land Miracle: Round Two

China’s land system is among both the most important and least well-understood aspects of its economic system. As we noted in our April 22 brief, transitioning out of China’s land-driven development model is the single most challenging aspect of the country’s economic reform, according to premiere land reform researcher Liu Shouying.

We’ve been watching the issue closely, and Liu on Monday published an extensive lecture (link in Chinese) on why China’s “land miracle” ended in 2013, and how we are now seeing the beginning of a new transformation.

If you read Chinese, we highly recommend reading all 6,000 characters of it, but for those who can’t, Liu makes three predictions about what we’re going to see next:

• continuation of existing macro trends, both in terms of Chinese growth and the process of urban-rural development

• favorable timing for land reform: the existing land system was the “engine” for the last round of economic transformation, and marketizing it will drive the next round

• unifying urban and rural construction land markets

• deepening market-oriented allocation of industrial land, and digestion of land in inefficient industrial parks

• encouraging inventory of construction land

• shifting mode from managerial planning to spatial planning

• promotion of urban-rural integration: breaking down long-standing duality of China’s cities and countryside

• equal rights for rural and urban residents (i.e. dissociate hukou from social services)

• optimize spatial pattern and halt decay of villages

• improve cities’ carrying capacity

Liu argues that these changes will revamp the whole system of agricultural land conversion, similar to the 1998 land-driven structural transformation. Their ability to drive Xi’s signature rural revitalization initiative and economic growth means any China observer worth their salt should follow them closely.

But as with many worthwhile, foundational reforms, resistance will be stiff. Rural residents, who have little social security, currently have the option to fall back to their home villages and plow their share of rural land, as many of them perhaps have during the pandemic.

Many fear that changes to the current land policy will deprive rural residents of this option and create social unrest, not to mention concern from urban elites about migration into their cities.

Weathervane

This week’s biggest signal actually came from the quarterly People’s Bank of China (PBOC) report, rather than the Politburo or any other high-level political event. The central bank’s first-quarter monetary policy implementation report (link in Chinese) released Sunday notably did not include its previous vow to “avoid flood-like stimulus.”

It also reiterated its pledge to adopt a “more flexible” monetary policy to counter the “unprecedented” impact of the Covid-19 outbreak on the economy, in line with the April 17 Politburo meeting’s call (discussed in our April 22 brief) to use “stronger macro policy tools (link in Chinese) to cushion the epidemic fallout” and leverage monetary policy tools such as reserve requirement ratio cuts, interest rate reductions and re-lending.

All this would suggest that Beijing is preparing to roll out a broader stimulus in line with the “six guarantees” to ensure employment and keep SMEs afloat.

Looking ahead

Two Sessions starting next Thursday, May 21 (NPC on May 22) We’ve discussed the key things to watch in last week’s briefing.

A string of economic data will be available on May 15, including retail sales, fixed asset investment and unemployment for April, which may offer us a clearer sense of how the recovery is.

Infrastructure spending in particular will be interesting to review, after several policies to boost infrastructure investment were rolled out in April.

Contact analysts Gavin Cross (gavincross@caixin.com) and Zhang Qizhi (qizhizhang@caixin.com)

This weekly brief is provided by Caixin Global Intelligence, the strategic advisory arm of Caixin Global. We help clients assess policy risk and macroeconomics in China, providing actionable insight with custom market and policy analysis.

For more analysis, please follow our Twitter @caixin_intel

If you have any inquiries, please contact us at cgi@caixin.com