Caixin Insight: PBOC Disappoints Banks as Covid-19 Returns to Beijing

NBS data release

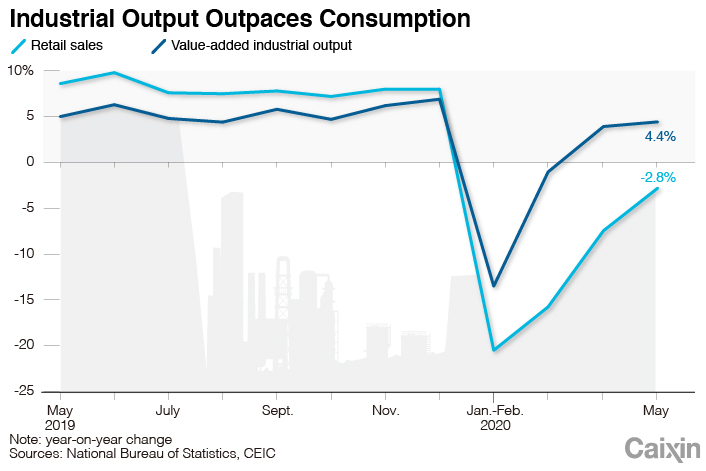

China’s economy continued its gradual recovery from the fallout of the Covid-19 pandemic in May, as major indicators released Monday (link in Chinese) showed investment, consumption and industrial output all improved from the previous month. But the recovery wasn’t as fast as economists expected, and the surveyed unemployment rate in big cities hit a record high.

- infrastructure investment down 6.3% y-o-y in first five months, narrowing from 11.8% in first four

- fixed-asset investment down 6.3%, narrowing from 10.3%

- real estate development down 0.3%, narrowing from 3.3%

- value-added industrial output up 4.4% y-o-y in May, up from 3.9% in April

- retail sales down 2.8% in May, an improvement from a 7.5% decline in April

- exports down 3.3% in dollar terms, imports down 16.7%

|

State Grid announces 25 billion yuan new infrastructure investment

State Grid Corp. of China, China’s biggest electricity distributor, announced (link in Chinese) it will invest 24.7 billion yuan ($3.5 billion) in “new infrastructure” in 2020, which it hopes will drive further investment of 100 billion yuan from other sources. The amount represents an 82% increase from State Grid’s 2019 investment in digitalization. This isn’t the first time we’ve talked about new infrastructure in this newsletter, and it won’t be the last. But State Grid’s investment is a nice illustration of some of the dynamics driving the initiative.

In terms of financing, State Grid’s plan is a good example of how the state is hoping to leverage its own money to drive private investment in new infrastructure, rather than spending directly as was the case for traditional infrastructure like roads and rail. The state-owned giant also announced on June 15 that it had signed cooperation agreements with Huawei, Alibaba, Tencent, Baidu and others.

State Grid’s plan for how to use the money is also representative of the broader initiative, with much discussion of win-win cooperation and the “two sixes” alongside a list of 10 key projects (i.e. power AI, power blockchain, power 5G, power big data, power Beidou...you get the idea), but relatively vague on the details, excluding a clearer target to build seven provincial-level big data centers and an energy industry cloud platform.

PBOC sends tightening signal

The central bank announced on June 15 that it would keep the medium-term lending facility (MLF) rate at 2.95% and inject 200 billion yuan ($28.2 billion) into the financial system. Some analysts had predicted the PBOC would leave the repo rate unchanged, but most expected a larger liquidity injection.

Ming Ming, vice director of CITIC Securities’ research center, argues (link in Chinese) the move is a clear signal of the PBOC’s intention to tighten monetary policy as the central bank plans to support the economy with more targeted measures, and greater focus on easing credit requirements for the real economy. In addition, the strength of the dollar puts pressure on the yuan given declining global risk appetite, constraining China’s monetary policy space, Ming said.

However, Nomura economists argue the Covid-19 resurgence in Beijing suggests it is “too early for the government to reverse its easing stance,” and that the PBOC may soon further cut RRRs or the one-year benchmark deposit rate, which has not been marketized like the loan prime rate and hasn’t been modified since 2015.

Beijing faces a new wave of coronavirus

In just a week, Beijing became the new epicenter of the coronavirus outbreak in China. The capital has logged 137 infections since Thursday after 57 virus-free days. The new wave is believed to stem from Xinfadi, China’s largest wholesale food market in southwestern Beijing.

On Tuesday, authorities raised the city’s public health emergency response level from three to two. Strict lockdown measures have been reintroduced, including closures of schools, several residential compounds and businesses. People are encouraged to work from home and not to leave the city unless necessary. 40% of flights in Beijing’s two airports were grounded, and those people who have to leave Beijing need to provide a coronavirus test result from within the past seven days. Several Chinese cities and provinces, including Shanghai and Sichuan, require those coming from high-risk areas of Beijing to be quarantined for 14 days upon arrival.

The city government announced Wednesday that it had completed screening of people who had recently been to the Xinfadi market, and tested 356,000 residents in roughly five days.

What to watch for

- Tenders for the first two batches of special treasury bonds, consisting of 50 billion yuan each, are submitted on June 18.

- This marked the beginning of the issuance of STBs. According to the Ministry of Finance, the entire 1 trillion yuan quota will be issued by the end of July.

- Treasury bonds are always overbooked in China, but by checking how many times each issuance is overbooked, we can tell how much the market likes these STBs.

- Outcomes of the U.S.-China meeting in Hawaii led by Mike Pompeo and Yang Jiechi

- Official dispatches of the meeting described it as “constructive”

- Both sides agreed to communicate further and act upon the consensus reached by the leaders of the two nations. However, the outside will not know what exact “consensus” was reached until the next steps are taken.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas