China Business Digest: Gold Rallies to Record High Above $2,000; Central Bank Sets Up Fintech Unit

|

|

|

|

|

|

Gold prices touched a historical high after rising nearly 30% this year. China’s services sector’s expansion softened to a three-month low in July. The People’s Bank of China (PBOC) established a fintech subsidiary as part of its plan to set up a digital central bank, while the insurance industry regulator mapped out a three-year development plan for property insurers. Meanwhile, there will be more flights to China from Japan and South Korea in August.

— By Guo Yingzhe (yingzheguo@caixin.com) and Han Wei (weihan@caixin.com)

** TOP STORIES OF THE DAY

Gold price surpasses $2,000 for the first time in history

Gold rallied to a record above $2,000 an ounce Wednesday as investors fled to “safe haven” assets amid growing uncertainties in the global economy. Bullion is up more than 30% this year, and analysts said the climb will continue. Spot gold rose as much as 1.3% to a record $2,044.86 an ounce Wednesday.

Regulator maps out three-year development plan for property insurers

The China Banking and Insurance Regulatory Commission issued the first general roadmap designed for the country’s property insurance industry. The plan mapped out major targets and business requirements for property insurers for the next three years to encourage the industry’s growth and tame risks.

China adds flights from Japan and South Korea

China allowed more scheduled passenger flights from Japan and South Korea as the Asian countries gradually ease coronavirus travel curbs. Weekly flights operating between China and the two countries will be increased to 15 each in August, providing more options for international travelers to reach China by air.

Central bank sets up a fintech arm

The PBOC has recently established a fintech subsidiary, Chengfang Financial Technology Co. Ltd., as part of its plan to set up a digital central bank. It was created by five companies and public institutions controlled by the PBOC with a registered capital of about 2 billion yuan ($287 million). (Read the full story.)

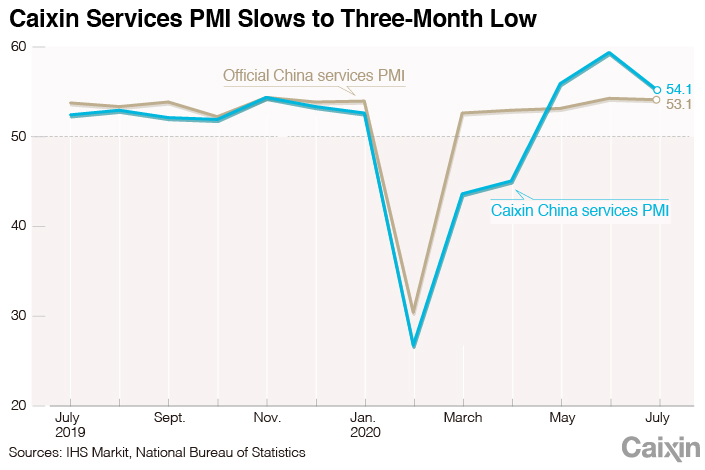

Caixin PMI shows China services sector losing momentum

|

China’s services sector expansion softened to a three-month low in July as an increase in new business slowed. The Caixin China General Services Business Activity Index, which gives an independent snapshot of operating conditions in the services sector, fell to 54.1 last month from a decade high of 58.4 in June. (Read the full story.)

Luckin shareholders seek to reverse board changes

Luckin Coffee Inc. opened a new chapter in an ongoing boardroom fight for control of the scandal-plagued company, scheduling an emergency shareholder meeting next month to discuss undoing board changes made in July that installed two directors allegedly loyal to ousted co-founder and former Chairman Charles Lu Zhengyao. (Read the full story.)

State Grid reports big drop in net profit

Power conglomerate State Grid Corp. of China recorded an 81% year-on-year plunge in net profit in the first half amid the Covid-19 pandemic, people familiar with the matter told Caixin. (Read the full story.)

Overseas expansion becomes a priority for Ant Group

Financial services giant Ant Group is intensifying efforts to expand its global presence, as it scrapes its head on the ceiling of the domestic market. The move is part of a plan to broaden revenue streams and secure 1 billion users overseas by 2025. The company has added internationalization to its three business growth pillars — alongside digital payments, financial services and technology. (Read the full story.)

** OTHER STORIES MAKING THE HEADLINES

• S&P Global Ratings Inc. has revised down its outlook for China Guangfa Bank Co. Ltd. from stable to negative, citing its deteriorating loan quality and worse-than-expected profitability recovery amid the Covid-19 pandemic.

• HSBC Holdings PLC plans to hire between 2,000 and 3,000 wealth planners within four years in China to lift sagging profits, increasing its presence in the face of mounting political tensions between Beijing and Western governments. (Bloomberg)

• Six of the world’s 10 largest unicorns — startups worth more than $1 billion — are headquartered in China, according to a recent report. (Read the full story.)

• China’s local governments issued (link in Chinese) a total of 3.76 trillion yuan of bonds in the first seven months of 2020, up 10.8% year-on-year.

** ON THE CORONAVIRUS

• China aims to boost Hong Kong’s coronavirus testing capacity to 20 times its current level, said the leader of a support team sent from the Chinese mainland to aid the city in its worst outbreak yet. (Bloomberg)

• The Chinese mainland recorded (link in Chinese) 27 new symptomatic Covid-19 cases on Tuesday. Of those, 22 were local transmissions found in the Xinjiang Uygur autonomous region.

Read more

Caixin’s coverage of the new coronavirus

• As of Wednesday afternoon Beijing time, the number of global coronavirus infections had surpassed 18.5 million as the death toll rose past 700,000, according to data from Johns Hopkins University.

** AND FINALLY

More than 100 people have been killed and thousands injured in an explosion that occurred Tuesday in the port area of Lebanon’s capital of Beirut, according to local authorities. The blast produced a shock wave that shattered windows and knocked down buildings kilometers away. Although officials said a cache of highly explosive materials stored in a warehouse six years ago was the cause of the blast, it remains unclear if it was an accident or an attack.

|

A cloud of debris rises above Beirut after the explosion. |

** LOOKING AHEAD

Aug. 6: SMIC reports second-quarter financial results

Aug. 7: Release of China’s import and export data for July

Contact reporter Guo Yingzhe (yutonglu@caixin.com) and editors Flynn Murphy (flynnmurphy@caixin.com) and Joshua Dummer (joshuadummer@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas