WeWork Hands Local Partner Keys to China Venture

Shared workspace specialist WeWork said Thursday it is ceding control of its China operation to one of its local partners, as it continues working its way out of a debt crunch that sent its valuation plummeting last year.

The deal will see Trustbridge Partners pay $200 million for an undisclosed stake of WeWork China, and take over running the venture in the process. Trustbridge named its operating partner Michael Jiang as acting CEO of WeWork China effectively immediately.

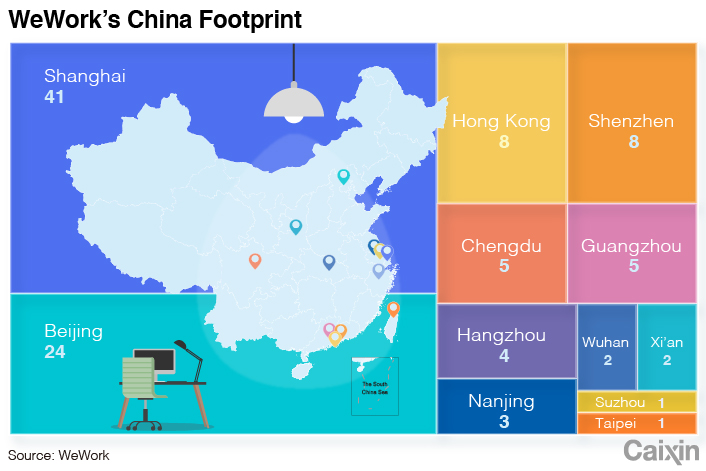

The operation being taken over by TrustBridge includes about 100 locations in 10 cities on the Chinese mainland, as well as several locations in Hong Kong and Taipei. That number is down from about 115 sites the company operated in China about a year ago, reflecting the pressure WeWork is facing due to stiff competition and large debt acquired through an aggressive expansion.

“Having watched the execution of WeWork in Greater China over the past few years, and the growing need for flexibility accelerated by the pandemic, Trustbridge firmly believes the demand that WeWork provides will only continue to increase,” said Feng Ge, managing partner at Trustbridge. “Trustbridge is confident of the growing demand for space-as-a-service as companies in Greater China continue to grow and maximize the unprecedented growth opportunities ahead.”

WeWork was once a darling of the shared economy, helping to usher in a new generation of flexible, shared office spaces with trendy touches like coffee bars and on-site gyms. But its rapid growth came to a sudden end about a year ago when it had to abort an IPO after failing to attract investor interest at the high valuation it was seeking.

|

After that, the company’s valuation tumbled from around $47 billion at the start of 2019 to less than $10 billion, with co-founder and CEO Adam Neumann getting ousted in the process.

Trustbridge was one of the original investors in WeWork China, alongside local partner Hony Capital and Japan’s SoftBank. WeWork held 59% of ChinaCo., which owned the joint venture, though it admitted in the prospectus for its aborted IPO that China had been a drag on the company’s overall profit margins.

It wasn’t immediately clear how much of WeWork China would be owned by Trustbridge after the latest sale, and a company spokeswoman had no immediate comment. Bloomberg reported Trustbridge would hold a majority, while Reuters said WeWork would maintain a “participating interest” in the venture and receive annual payments for use of its brand.

WeWork entered China in 2016 with a location in Shanghai, the country’s commercial hub. Shanghai is easily the company’s biggest presence today with 41 locations. But Shanghai and other markets have become increasingly competitive with the entrance of single-site operators as well as homegrown rivals. One of those, Ucommune International, is in the process of trying to make a backdoor listing in the U.S. after scrapping plans for a traditional IPO.

WeWork previously raised a combined $1 billion for its China venture in two major funding rounds, including one in mid-2018 with participation by Trustbridge, Hony, SoftBank and Singaporean sovereign wealth fund Temasek. Earlier in 2018, WeWork China paid a reported $400 million for Naked Hub, a Shanghai-based operator of 24 shared workspace locations in the country.

WeWork China’s new controlling stakeholder Trustbridge has offices in Shanghai, Hong Kong and Boston and invests in the technology, media and telecoms sectors. “This investment is a testament to our business and in Trustbridge we have truly found the best local partner for WeWork China’s next chapter,” said WeWork CEO Sandeep Mathrani.

Contact reporter Yang Ge (geyang@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- MOST POPULAR