China Business Digest: China’s Economic Growth Gets a Vote of Confidence; Hong Kong Retail Investors March to Ant IPO

|

|

|

|

Analysts say they expect Ant Group’s record dual listing to attract 1 million retail investors in Hong Kong. Covid-19 flare-up in Xinjiang region declared contained. French carmaker PSA suffers continued sales slump in China. Meanwhile, China may scrap the counter-cyclical factor in its currency fixing mechanism, and a former chief economist of the World Bank said China could maintain annual growth of 6% in ordinary years until 2030.

— By Lu Yutong (yutonglu@caixin.com) and Han Wei (weihan@caixn.com)

Dear readers: Today will be the final China Business Digest. Starting on Friday, we will replace the daily product with a new "Best Reads of the Week" series written at the end of each week by our team of senior editors. As always we welcome your feedback at hello@caixin.com. Thanks for your support.

— Doug Young, Caixin Global Managing Editor

** TOP STORIES OF THE DAY

Ant Group’s IPO expected to attract 1 million retail investors in Hong Kong

The Hong Kong leg of Ant Group’s record dual listing is likely to attract (link in Chinese) 1 million retail investors. That would top the 970,000 retail investors involved in Industrial and Commercial Bank of China Ltd.’s IPO and the 960,000 who participated in Bank of China Ltd.’s, said Pamela Chung, managing director at business consulting firm Tricor Group.

Covid-19 flare-up in Xinjiang region declared contained

The latest coronavirus flare-up in Kashgar, Xinjiang autonomous region, has been contained after mass testing of the 4.75 million residents over three days, local health authorities said Wednesday. The infections were linked to a local garment factory, and authorities ruled out the possibility of further spread of the virus in the region.

French carmaker PSA’s China sales continue free fall

France’s Groupe PSA reported a 67.9% drop in China car sales in the third quarter as the company struggles with a shrinking share of the world’s largest auto market. For the first nine months, the company’s sales in China declined 64% to 31,000 vehicles. The China market represents PSA’s biggest sales drop globally. The company reported 1.2% growth of its third-quarter global sales.

Biomass electricity producer Kaidi to be delisted

Kaidi Ecological and Environmental Technology Co. Ltd., one of China’s biggest biomass electricity producers, will be delisted from the Shenzhen Stock Exchange Wednesday after its auditor refused to sign off on financial statements for three consecutive years. The company is suffering from a debt crisis two years after defaulting on a nearly 700 million yuan ($105.7 million) bond in May 2018.

China could maintain annual growth of 6% in regular years until 2030, expert says

The world’s second-largest economy could maintain annual growth of 6% in “regular years” until 2030, and have the potential to expand by 8%, said (link in Chinese) Justin Yifu Lin, a former chief economist of the World Bank.

China’s environment ministry calls for end to aluminum industry moving west

In response (link in Chinese) to a development plan approved by the country’s top economic planner, China’s environment ministry on Tuesday said the aluminum industry, as a sector that causes severe pollution and has too much capacity, should not be encouraged to develop in the country’s west.

China may scrap counter-cyclical factor in its currency fixing mechanism forever

The counter-cyclical factor, a key factor in the formulas China’s central bank uses to calculate the yuan’s daily reference rate, may be scrapped once and for all after a three-year trial, Caixin has learned.

Mobile browser crackdown ensnares big names including Huawei and Tencent

Browsers operated by some of China’s biggest internet names, including Huawei Technologies Co. Ltd., Alibaba Group Holding Ltd. and Tencent Holdings Ltd., were caught up in a crackdown by the cyberspace regulator, which requested they be swept clean by Nov. 9 of “rumor-mongering,” “sensational headlines” and material that violates “socialist core values.”

Ant Group picks four foreign strategic investors for Shanghai leg of record IPO

GIC Pte. Ltd., Singapore’s sovereign wealth fund, and the Canada Pension Plan Investment Board are the two biggest foreign strategic investors of Ant Group’s $34.5 billion IPO, each paying around 2 billion yuan ($298 million) for 28.6 million shares. Temasek Fullerton Alpha Pte. Ltd., which is owned by Singapore state-owned investment group Temasek Holdings Pte. Ltd., and the Abu Dhabi Investment Authority (ADIA), the sovereign wealth fund of the Emirate of Abu Dhabi, each paid around 1.5 billion yuan for 21.5 million shares.

|

** OTHER STORIES MAKING THE HEADLINES

Business & Tech

• Top Republican Senator Marco Rubio has introduced legislation to block access to U.S. capital markets for Chinese companies that have been blacklisted by Washington, threatening a blow against Chinese firms that rely on U.S. investors for funding. (Reuters)

• GeneCast Biotechnology Co. Ltd., a Chinese biotech startup that specializes in second-generation sequencing technology and bioinformatics, has closed its 1 billion yuan series E funding round led by China Structural Reform Fund.

• Shanghai-based medical rehabilitation robot startup Fourier Intelligence Co. Ltd. has secured 100 million yuan in its series C funding round, led by Vision Plus Capital.

• Tencent-backed Krafton Inc., the company behind the hit mobile game PlayerUnknown’s Battlegrounds, said it hired Mirae Asset Daewoo to lead an initial public offering planned for next year, in what could be South Korea’s largest ever debut. (Bloomberg)

• In advance of the “Double 11” shopping festival on Nov. 11, also known as Singles’ Day, Alibaba signed partnerships with German luxury car maker BMW AG and McDonald’s China so consumers can shop for Big Macs and luxury cars on Alibaba’s e-commerce platform.

• Japanese convenience store chain Lawson plans to double its number of stores in China to 6,000 by 2022, and further increase it to 10,000 by 2025 through opening stores featuring round-the-clock delivery and register-less mobile payments. (Nikkei Asia)

• The Communist Party’s anti-corruption watchdog in Inner Mongolia disclosed investigations Tuesday of four current and former officials in the government of the autonomous region in northern China.

** ON THE CORONAVIRUS

• The Chinese mainland reported (link in Chinese) 42 new coronavirus cases for Tuesday, 20 of those imported. The other 22 were locally transmitted asymptomatic cases found in the Xinjiang Uygur autonomous region’s Kashgar prefecture, where a cluster of infections has been linked to a local garment factory.

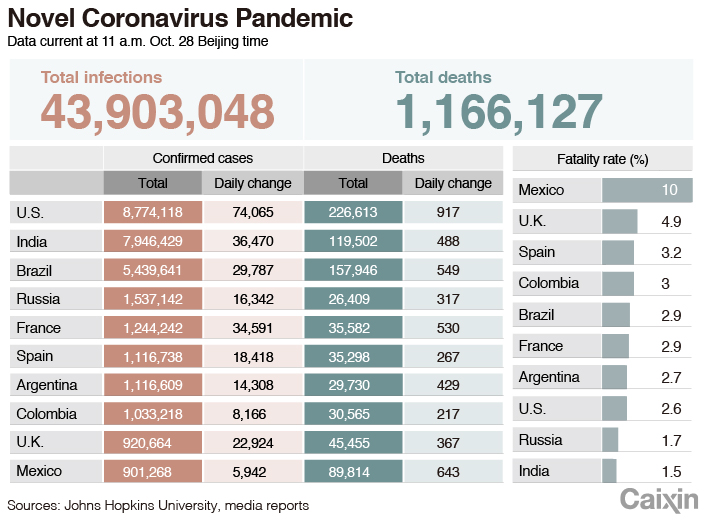

• As of Wednesday afternoon Beijing time, the number of global Covid-19 cases has topped 44 million, with more than 1.16 million deaths, according to data from Johns Hopkins University.

Read more

Caixin’s coverage of the new coronavirus

** LOOKING AHEAD

Quarterly financial results:

Oct. 28: ZTE

Oct. 29: BYD

** AND FINALLY

Pakistan’s first subway line started running Sunday in the eastern city of Lahore. The Orange Line, consisting of more than two dozen stations across nearly 16 miles, was built by China State Railway Group and China North Industries, and was funded in part by the Export-Import Bank of China. The subway’s trains run about 50 miles per hour and will carry an estimated 250,000 passengers a day, local officials say.

|

The Orange Line Metro Train runs through Pakistan’s eastern city of Lahore on Monday. |

Contact reporter Lu Yutong (yutonglu@caixin.com) and editors Yang Ge (geyang@caixin.com) and Gavin Cross (gavincross@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- MOST POPULAR