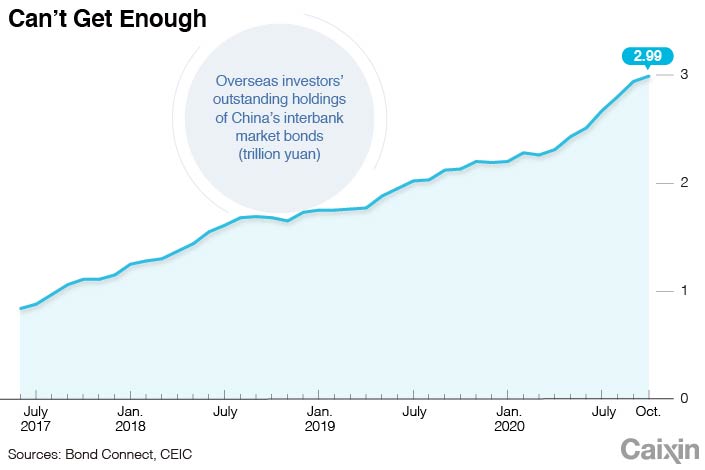

Chart of the Day: Overseas Investors Can’t Resist China’s Interbank Bonds

Foreign holdings of China’s interbank bonds hit a record high, as investors couldn’t resist the relatively high yields of the securities.

Outstanding overseas holdings of interbank bonds rose to 2.99 trillion yuan ($447.9 billion) by the end of October, up 1.9% from the end of September, according to data from Bond Connect Co. Ltd., a Hong Kong-based company that helps overseas investors trade in the Chinese mainland bond market.

|

That value of overseas-held interbank bonds accounted for 3% of all outstanding interbank bonds, according to a statement (link in Chinese) released by the Shanghai branch of the People’s Bank of China (PBOC).

The growth in overseas holdings of the bonds has been mainly driven by an increase in holdings of Chinese government bonds, which rose 3% to 1.73 trillion yuan as of the end of October from a month earlier, the PBOC statement said. China’s 10-year sovereign yield has climbed in recent months amid a quick economic recovery from the Covid-19 pandemic.

It also came after global index provider FTSE Russell announced in late September that it would add Chinese government bonds to its flagship World Government Bond Index next year, a move expected to drive a significant influx of foreign capital.

China has accelerated steps to open up its domestic bond market to foreigners. In September, it unveiled new draft rules that would simplify application procedures for foreign bond investors and unify rules governing various investment channels.

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR