Wang Tao: China’s GDP Will Grow 8.2% in 2021

Wang Tao is the head of Asia economics and chief China economist at UBS Investment Bank.

In our new baseline forecast, we expect China’s GDP growth to rebound to 8.2% in 2021, led by exports and domestic consumption.

Our original baseline assumed that at least one vaccine will be approved by March 2021 and be available to 20% of global population by end 2021. In light of the recent positive news about multiple vaccine trials, our new baseline assumes that rapid production of high efficacy vaccines will lead to a sharp drop in virus cases from mid-2021 onward, with half of global population gaining immunity by the end of next year.

The new baseline still assumes that Biden takes office in January with a divided U.S. Congress, and Covid-19 has lasting impact on both the Chinese and global economies, amplifying existing forces of decoupling.

Under the new baseline, we expect economic growth to recover further, led by exports and domestic consumption as activities normalize more quickly than previously assumed. As global growth rebounds from recession this year to 6.2% growth in 2021, we see exports growing by 11% to 12% on average as demand for non-Covid-related products recovers while that for some medical supplies declines.

We predict China’s growth will slow to 6% in 2022 after the post-Covid rebound in 2021, supported by continued global recovery.

Consumption to outpace investment

In recent quarters, consumption growth has lagged that of investment and exports, as the pandemic’s impact on the labor market and consumer behavior lingered. Retail sales growth recovered to 4.3% year-on-year in October while China’s National Day holiday only saw 70% of tourism revenue that it had one year ago.

Going forward, we see both employment and income growth recovernig further, and expect an improvement in consumer confidence along with a revived economy as the pandemic comes under control, especially after vaccines become available.

Consumption is expected to grow by 10% in 2021 in real terms partly thanks to low base this year, with consumer services like restaurants and travel significantly recovering.

Fixed investment is expected to inch up, led by a significant improvement in manufacturing capital expenditure while infrastructure and property investment weaken on fading policy support. Manufacturing capital expenditure should get a boost from strong revenue and profit growth, along with improvement in business sentiment as uncertainty lessens.

A modest slowdown of real estate activity

Property sales and investment have rebounded since the second quarter, helped by easier credit and the release of pent-up demand. The government has tightened property policy marginally in some overheating cities, as well as on developer financing, a trend that is likely to continue in 2021 and weigh on activity.

The latest UBS China housing survey showed that homebuyers’ purchasing intentions and confidence improved from the Covid shock, but remained weaker than a year ago.

On the other hand, we expect the weakening of property sales and investment in 2021 to be cushioned partly by expected income rebound and continued reforms to land and household registration policies. We expect overall property sales to decline by 1% to 3%, new starts to fall by 3% to 5%, and property investment growth to slow to 1% to 3% in 2021. For the latter, a continued shanty-town renovation initiative may offer some modest offset to tighter control over developer financing.

Overall infrastructure investment to soften

In 2020, China has increased new issuances of special local government bonds by 1.6 trillion yuan ($242.9 million) to 3.75 trillion yuan, while infrastructure investment has not rebounded as strongly as expected since the second quarter (7% from April to October).

A robust rebound in property investment, lower fiscal revenue coupled with increased spending responsibilities, and limited use of special local government bond funds for project capital may have given local governments less of an incentive or limited their capacity to ramp up public investment.

Looking ahead, the strong recovery in 2021 will likely reduce the need to boost infrastructure investment while the government will also focus more on local government debt, leading to weaker-than-expected fiscal policy support. We expect overall infrastructure investment growth to slow to 2% to 3% in 2021.

“New infrastructure” investment should pick up

Overall infrastructure fixed-asset investment may be supported by construction of existing projects, increased spending on public projects related to the new five-year plan, and “new infrastructure.”

The former’s focus may include public transportation systems, rail transit in city clusters and metropolitan areas, oil and gas pipelines and storage, water projects, environment and health care systems.

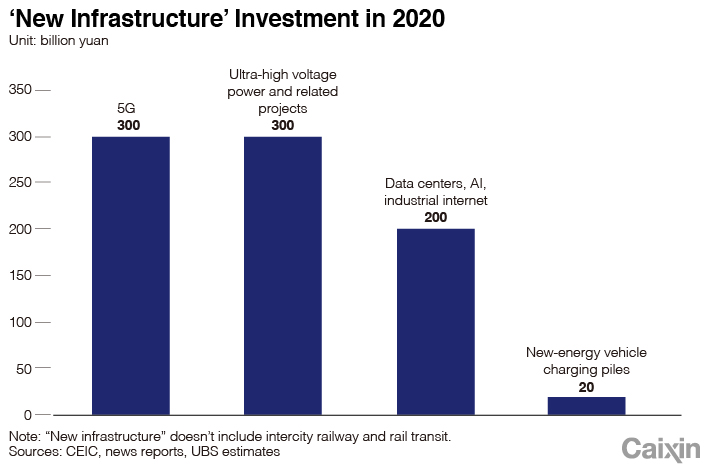

Most “new infrastructure” projects may be part of corporate investment, including 5G, artificial intelligence, industrial internet, data centers, new-energy and electric vehicle infrastructure, among others. We estimate that the narrowly defined “new infrastructure” fixed-asset investment may total more than 1 trillion yuan in 2020.

|

We expect new infrastructure fixed-asset investment to grow strongly in 2021 and the next five years, with average annual growth above 15% thanks to explicit policy support, which should help China sustain its leadership in digitalization.

The views and opinions expressed in this opinion section are those of the authors and do not necessarily reflect the editorial positions of Caixin Media.

If you would like to write an opinion for Caixin Global, please send your ideas or finished opinions to our email: opinionen@caixin.com

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

Wang Tao is the head of Asia economics and chief China economist of UBS Investment Bank.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas