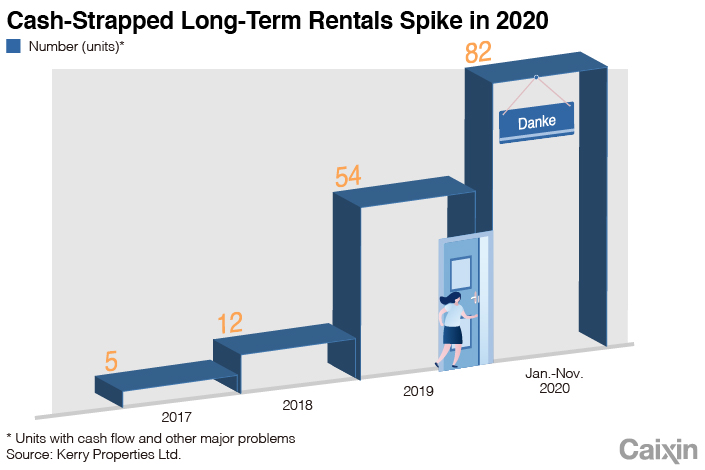

Cover Story: How Chinese Apartment Rental Giant’s Business Fell Apart

The financial turmoil that crippled Danke Apartment, one of China’s largest online apartment rental platforms, spilled into the streets across China in recent weeks as angry tenants clashed with landlords.

Now employees are threatening to sue Danke, whose name means “eggshell” in Chinese, over unpaid wages. Danke faces disputes over 3.4 billion yuan ($520 million) of unpaid debts, including 1.6 billion yuan of loans from Tencent-backed WeBank, 1.2 billion yuan owed landlords and renters, and 600 million yuan due contractors, Caixin learned.

The collapse of Danke’s controversial business model sent shockwaves through China’s massive rental market and sounded alarms over the online rental industry’s debt-fueled growth. Danke and its competitors rent flats from landlords on long-term leases and then sublet the properties to tenants after making renovations.

These companies are supposed to make money on the premiums they charge tenants over the rent they pay landlords. But to attract tenants and landlords, many companies like Danke have been offering higher rents to landlords than they collect from tenants.

|

To maintain cash flow, Danke and its rivals adopted a business model that requires tenants to pay a year’s rent upfront and encourages them to raise the cash by signing up for rental loans with partner banks. This allows the rental companies to pool tenants’ money to fund further business expansion.

But like many of its industry counterparts, Danke has yet to make any money despite rapid business expansion. It ran into financial difficulties this year amid the pandemic, underscoring the sector’s struggle with thin profit margins and risks stemming from debt-driven growth.

Danke, run by New York-listed Phoenix Tree Holdings Ltd., manages 415,000 flats across 13 big cities in China. It was one of the upstarts in China’s long-term rental market, which has boomed since 2015 with government support. Beijing has encouraged the development of the long-term rental market in hopes of serving urbanization and diversifying the country’s white-hot housing market.

Founded in 2015, Danke raised more than $600 million from global investors including Joy Capital, Tiger Fund, China Media Capital and Ant Group, before its $149 million initial public offering on Nasdaq in January.

Danke’s financial stress started to emerge earlier this year as the Covid-19 pandemic cooled the rental market. It quickly escalated after the June detention of Gao Jing, Danke’s founder and CEO. Although the investigation of Gao is said to be unrelated to Danke’s business, the incident slammed the brakes on the company’s fundraising, leading to an immediate collapse of the company’s highly leveraged business model.

Angry property owners who failed to collect rental payments from Danke took actions such as cutting off the electricity or water or changing the locks to force out tenants. But tenants said they already paid rent to Danke, many using bank loans arranged by the company, and resisted giving up their apartments.

The clashes escalated in many major cities including Beijing, Shanghai, Shenzhen and Hangzhou. Some disputes spilled into the streets, forcing local authorities to step in.

|

Hundreds of renters and property owners gathered outside rental service Danke Apartment’s headquarters in Beijing in November |

Danke employees in several cities said the company’s offices have closed and many of the workers haven’t received any payment since October. Some employees are planning to take legal action against the company, one staffer said.

The collapse of Danke and the massive debt disputes stirred concerns over the risks of rental loans arranged under partnerships between lenders and rental platforms. Experts questioned whether WeBank, Danke’s financing partner, did enough due diligence and risk control for loans linked to Danke and whether the bank shouldn’t be held accountable in the disputes.

Last week, WeBank said it would waive interest payments and extend the loan terms for more than 160,000 borrowers linked to Danke at least until the end of 2023. But several Danke renters who borrowed from WeChat for upfront payments said they were not satisfied with the bank’s offer.

Several local governments stepped in to mitigate the social turmoil caused by Danke. Caixin learned that authorities are pushing industry leaders including SoftBank-backed Ziroom and Beijing 5i5j Real Estate Brokerage Co. Ltd. to bail out Danke.

Meanwhile, Danke is discussing a plan with WeBank to convert the debts to equity, people familiar with the matter said. The company is also seeking to raise $150 million yuan to ease its cash crunch, sources said. But no deal has been reached.

Risky growth

The loan partnership with WeBank, which provided the backbone of Danke’s expansion, became the focal point of the controversies.

Under the partnership, when a tenant signs a lease with Danke, the tenant also signs a rental loan contract with WeBank to pay a full year’s rent in advance to Danke. Then the tenant makes monthly loan payments to WeBank. To encourage tenants to take out loans, Danke often offers subsidies to reduce their interest costs.

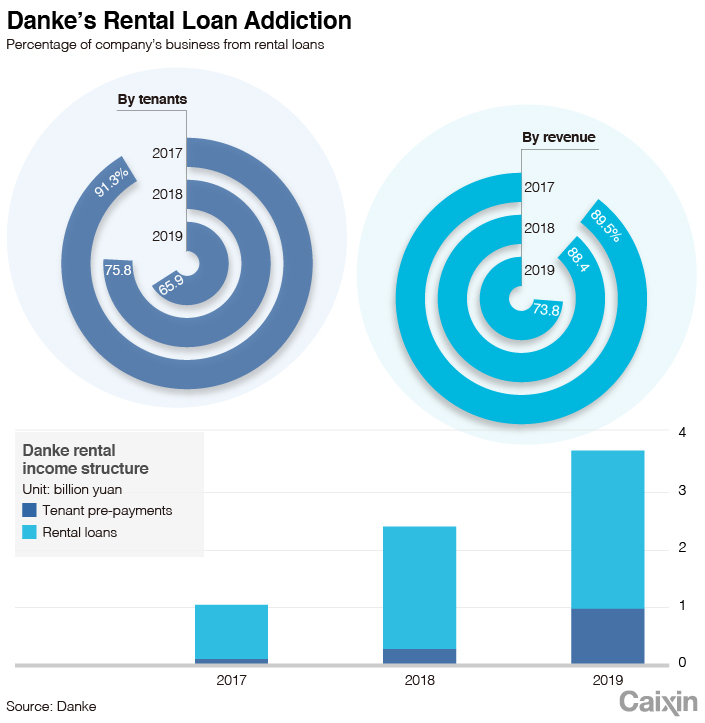

By the end of 2019, more than 65.9% of Danke’s tenants made rent payments using rental loans, dowm from 75.8% in 2018 and 91% in 2017, according to the company.

|

Rental loans, more than 90% of them issued by WeBank, became the main source of cash for Danke. According to a company disclosure, rental loan-backed payments totaled 2.75 billion yuan, accounting for 73.8% of Danke’s total revenue in 2019. That same year, Danke received 980 million yuan of upfront cash payments from tenants.

Chinese regulators have stepped up scrutiny of rental loans since 2018 after several rental platforms went bust. In December 2019, six central government agencies issued guidelines to regulate long-term apartment rental businesses, setting a 30% cap on the share of rental loans in total rent revenues.

People with knowledge of the situation told Caixin that Danke and WeBank worked out a plan under the guidelines, aiming to reduce loan-backed rent payments to 40% by the end of this year and meet the 30% requirement by the end of 2021. But Danke’s business reshuffle plan didn’t go as planned, they said.

The massive sum of loan-backed upfront payments allowed Danke to pool enough money to expand its property reserves, but it also posed great leverage risks as the company’s capital chain is fragile, industry analysts said.

To grab market share, Danke offered higher rents to landlords than it collected from tenants in major cities. A document viewed by Caixin showed the company paid 8,500 yuan to a flat owner in downtown Beijing and sublet the property at 7,850 yuan.

In a letter to company executives during his detention, Danke CEO Gao Jing said Danke needed to maintain rapid growth until it reached the stage of sustainable growth and achieved profitability, enabling the company to cut reliance on outside financing.

“But the pandemic disturbed our plan and led to today’s troubles,” Gao wrote.

According to a company report, the 415,000 flats Danke had in operation as of March 31 was nearly double the number a year ago. The company’s operating costs rose 59% year-on-year to 3.1 billion yuan during the first three months this year, while its net loss continued expanding to 1.2 billion yuan. Danke posted a net loss of 3.15 billion yuan in 2019, compared with losses of 1.37 billion yuan in 2018 and 270 million yuan in 2017.

The last straw was the detention of Gao. Danke said June 18 that Gao was being investigated over previous business dealings that were unrelated to Danke. In his letter, Gao said he was probed for violations by an advertising company where he worked in 2014.

But the incident cut off Danke’s access to equity financing and bank loans, a person close to the company said, a significant blow because of the company’s reliance on financing.

Risk control loopholes

Analysts said the financing partnership between Danke and WeBank has a significant hole in risk control. In practice, renters sign a contract with WeBank to apply for individual rental loans and authorize the bank to make payments to Phoenix Tree Holdings.

“Rental loans are targeted to individual borrowers, but the money is used by the company,” said a bank executive. It means the bank has no right to monitor how the funds are used as it doesn’t have a loan contract with Danke, the executive said.

“Such a loan model has loopholes in risk control, and almost no big bank is willing to do it,” he said.

Rental loans targeting individual renters thrived in China in recent years along with the rise of the long-term rental market. Small and private banks are the main players in the market. WeBank, China’s first internet-only lender, started the rental loan partnership with Danke in mid-2018 and later became the company’s biggest financing partner, Caixin learned.

Several banking sources said they are surprised that WeBank became so deeply involved in the riskier rental loan business with Danke as the bank has sound profitability. In 2019, WeBank reported 3.95 billion yuan of net profit and 14.9 billion yuan of revenue, topping all private banks

Caixin learned that WeBank also worked with rental business leaders Ziroom and Beijing 5i5j in rental loan partnerships. The bank said it monitors the partners’ financial and business disclosures closely for risk control and requires the companies to put up 5% to 8% of the total loan value as a provision against loan losses.

In the agreement with Danke, WeBank also limited the use of the rental loans to paying landlords and related spending. Danke promised to return funds to the bank if contracts with tenants are terminated early. But analysts said it is difficult for the bank to monitor how Danke used the money.

As Danke’s financial crisis intensified, WeBank terminated the partnership in November. The bank still holds 1.6 billion yuan of unpaid loans to Danke renters.

Although no agreement has been reached on a solution for Danke’s loan disputes with clients, some legal experts said WeBank should also assume part of the responsibility because of the risk control flaws.

Cai Zhen, a real estate industry expert at the National Institution for Finance & Development, said the renters’ loan obligations should be transferred to Danke for WeBank to claim its debts.

Qu Hui, Tang Ziyi, Anniek Bao contributed to this story.

Contact reporter Han Wei (weihan@caixin.com) and editor Bob Simison (bobsimison@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Correction: The story is updated to correct the share of rental loans in Danke's revenues in 2017 and 2019.

- PODCAST

- MOST POPULAR