Charts of the Day: China’s Money Laundering Penalties Hit Record in 2020

China’s central bank last year handed out a record amount of penalties to institutions and their employees who failed to adequately guard against money laundering, with banks receiving the most fines.

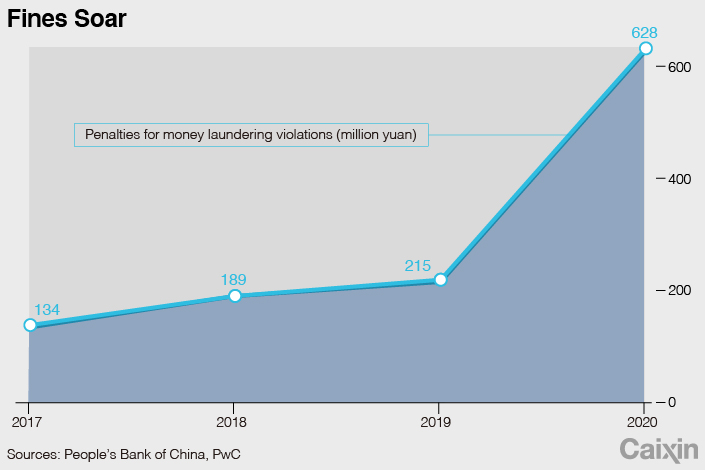

The People’s Bank of China (PBOC) penalized 417 institutions and their staff, issuing a total of 628 million yuan ($97 million) in fines for violations of money laundering regulations in 2020, nearly three times the amount of the previous year, according to a report (link in Chinese) from PricewaterhouseCoopers LLP (PwC) last week.

|

The number of large fines jumped as the PBOC changed the way it calculates the punishment it metes out after critics said previous penalties were not severe enough to act as an effective deterrent. There were 20 fines exceeding 5 million yuan each in 2020, about seven times the number the previous year, the PwC report said.

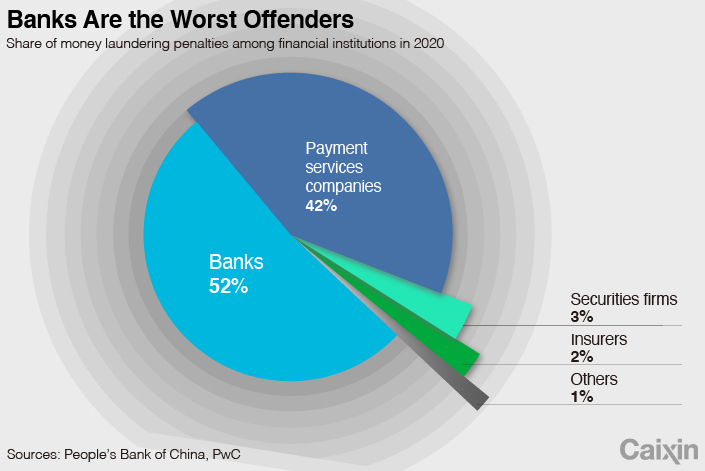

Banks received the most penalties among the various financial institutions, with the PBOC fining them a total of nearly 330 million yuan, accounting for 52% of the total.

Fines issued to payment service providers also soared, with some given high penalties for facilitating illegal gambling. The fines issued to payment companies reached 263 million yuan last year, which is eight times the figure in 2019 and accounted for 42% of the total.

|

Failing to check clients’ identity and report large or suspicious transactions in accordance with regulations were the top two reasons institutions were issued fines last year, the report said.

China’s central bank has ramped up its fight against money laundering over the past few years, partly in response to criticism from the Paris-based Financial Action Task Force, which said the country’s penalties in 2017 were “not effective, dissuasive, nor proportionate” given the size of its financial sector.

Read more

Cover Story: How China Is Racing to Catch Up With Money Launderers

Authorities have been working to flesh out regulations, with PBOC Governor Yi Gang saying last year that China is revising its anti-money laundering law to enhance its effectiveness and increase the severity of penalties.

Last month, the PBOC set out draft guidelines on how financial institutions should establish internal control and risk management systems to tackle money laundering.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR