Cover Story: Power Revamp Rebooted as State Grid Resumes Divestiture Plan

China’s long-stalled power industry overhaul is regaining steam as the country’s largest state-owned grid operator resumes efforts to downsize its mammoth business after nearly a decade of resistance that blocked further restructuring industrywide.

State Grid Corp., the larger piece of China’s power transmission duopoly and the world’s biggest utility, is expected to spin off all of its equipment manufacturing operations by the end of 2021, according to a timetable unveiled by the National Development and Reform Commission (NDRC), China’s top economic planner.

Equipment-making units to be split from State Grid will include Xuji Group Corp. (000400.SZ), Pinggao Group Corp. (600312.SH), Shandong Electrical Engineering & Equipment Group Co. Ltd. and NARI Group Corp., according to Xu Shanchang, a senior NDRC official, in a November speech.

In September, the State Council vowed to support grid operators' withdrawal from equipment-making businesses and other competitive sectors in one of the highest-profile signals of renewed efforts to shake up the power industry.

|

State Grid has made its resolve clear. In March 2020, the company said it was determined to exit the manufacturing and property businesses. In August, the company transferred its entire stake in property company Luneng Group to a state-owned enterprise free of charge.

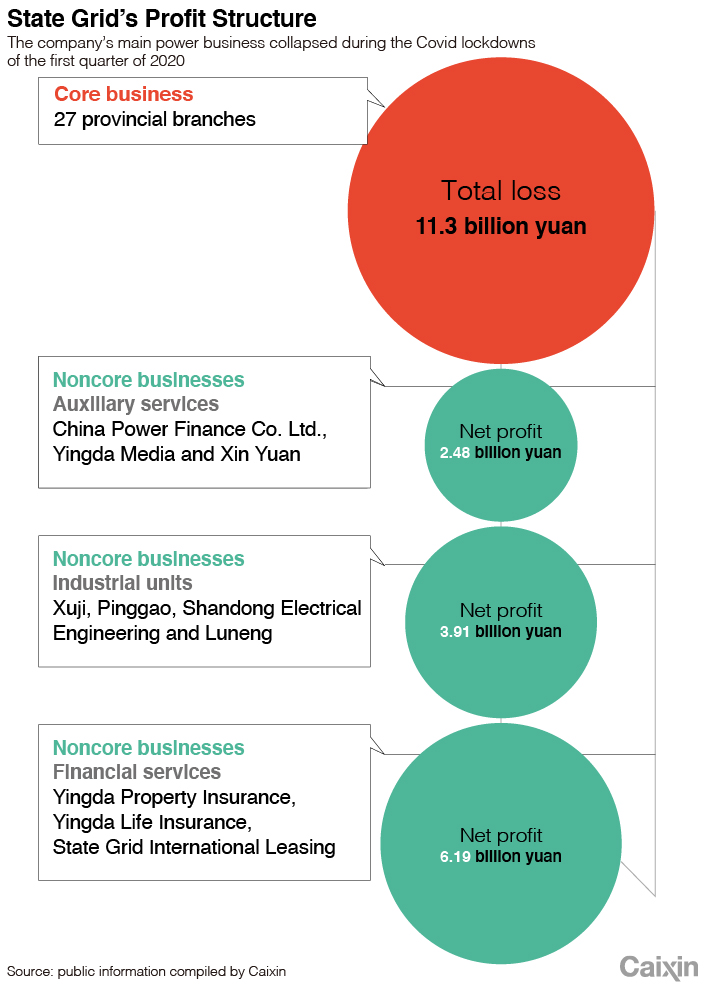

The divesture will click the restart button for the highly anticipated restructuring to reduce the power giant’s noncore businesses, which contribute hundreds of trillions of yuan annually to profits. The long-sought move is a key part of China’s sweeping overhaul to break up the power giant’s vertically integrated monopoly and introduce market-driven competition into the closely held power industry.

China initiated an ambitious power industry revamp in early 2002 to break up the state-monopolized sector amid rising complaints over state-controlled power prices and low efficiency. Three steps were designed to reshuffle the power industry. The first step was completed as planned by the end of 2002 when a state power titan was dismantled, creating two power grids — the State Grid and the smaller China Southern Power Grid — and five generating enterprises.

|

The next step that was supposed to follow was to divest grid companies’ auxiliary businesses, such as power design, equipment manufacturing and power construction, to make power pricing more transparent and pave the way for the final step of setting up market-oriented power transmission and distribution markets.

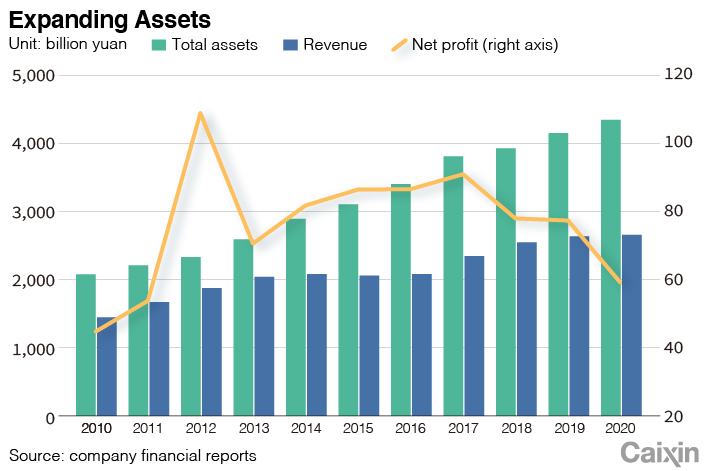

However, the divestiture of State Grid’s noncore assets never proceeded as planned. Instead, the company engaged in sprawling acquisitions over the past decade and expanded into a wide range of nonpower businesses such as finance, property and hotels, amassing assets of more than 4 trillion yuan ($614 billion).

Unrealized restructuring of State Grid became the main obstacle to further overhaul of the power industry over the past 18 years. But calls to resume the power industry revamp have mounted amid changes in China’s economic structure and the energy market. The Covid-19 pandemic and rising uncertainties from external markets added to urgency for China to streamline its domestic power market to support economic recovery.

|

“Equipment manufacturing is in decline, and the company needs to cut excess capacity through restructuring to make sure the industry can survive a business downturn,” a person close to State Grid’s latest spinoff plan said.

“Grid companies will continue investing but in different areas from where they once did,” said another source from Shandong Electrical Engineering.

On Dec. 23, the listed units of Xuji and Pinggao published separate statements saying their parents were studying strategic restructuring plans. Caixin learned that the revamp is likely to transfer the assets of Xuji and Pinggao to China XD Electric Co. Ltd. (601179.SH), creating a new equipment manufacturing giant with annual revenue topping 100 billion yuan.

But spinning off the state-owned manufacturers will not be easy as it involves complicated personnel and interest ties. Meanwhile, Xuji and Pinggao have been struggling financially, even though they have stable orders from State Grid, as an expected boom in power grid construction has not materialized.

Controversial deals

State Grid’s 2010 acquisitions of Xuji and Pinggao were highly controversial as some experts said they violated fair competition in the industry and contradicted the intention of power industry restructuring.

Expanding into the equipment sector enabled State Grid to control standards-setting, manufacturing and purchases, undermining fair competition in the equipment industry, several experts said.

Zhou Heliang, a former official at the China Machinery Industry Federation, an industry association that strongly opposed the deals, said that while the NDRC objected to the acquisitions, the deals won support from the State-owned Assets Supervision and Administration Commission (SASAC) at the time, which sought to empower state-owned enterprises.

|

State Grid cited rising equipment demand to build ultrahigh-voltage (UHV) power networks in arguing for the purchase of Xuji and Pinggao. An expert said the deals also reflected State Grid’s urgent need to seek new revenue sources at the time under company leaders’ incentives to expand assets to meet performance goals.

UHV lines can carry more than 800 kilovolts on direct current lines and more than 1,000 kilovolts on alternating current ones — several times the capacity of lines used in most of the rest of the world today. Such lines can also cover distances of thousands of kilometers with relatively little loss of electricity.

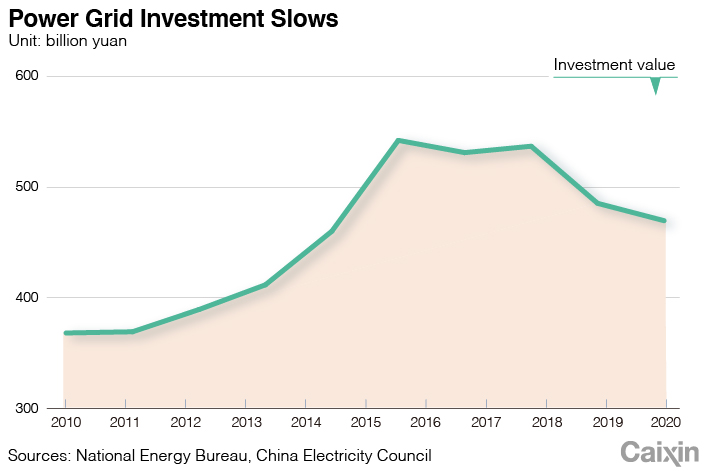

Since 2009 State Grid pushed UHV construction nationwide, aiming to invest 600 billion yuan in the projects by 2020. So far, the company was involved in the construction of 26 out of 30 UHV lines in operation in China, involving investments of about 500 billion yuan.

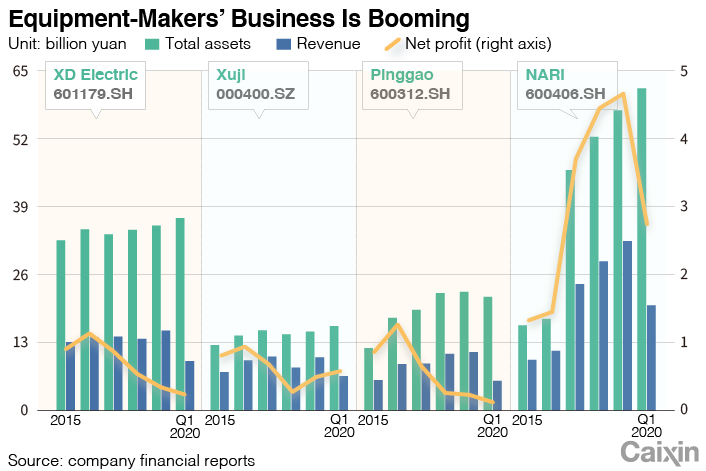

Thanks to the construction boom, State Grid’s manufacturing subsidiaries enjoyed rapid business growth. Between 2009 and 2016, Xuji’s revenue surged 120% while Pinggao posted a 240% sales jump. The companies’ profits also grew—by sixfold for Xuji and tenfold for Pinggao.

Benefiting from the State Grid’s orders, Xuji and Pinggao transformed into dominant players in their sectors from marginal roles before the acquisition.

But China’s frenzy of UHV construction gradually cooled since 2017 amid concerns over the projects’ underperformance. Most of China’s existing UHV lines have been operating below their designed capacities partly because of a lack of partners that could provide them with steady supply to utilize their capacity, fueling criticism of waste.

In October 2020, the National Energy Administration in a report to the national legislature acknowledged that China’s UHV lines failed to reach operational expectations.

“UHV projects benefit China” due to the country’s imbalanced power supply structure, “but construction has been too much and too fast, creating many problems,” said one official from the China Machinery Industry Federation.

China’s power project investment has declined since 2018 after decades of expansion. In 2019, national investment in power networks dropped 9.6% to 485.6 billion yuan, followed by a 6.2% decline in 2020.

Xuji and Pinggao’s business quickly weakened amid shrinking demand from State Grid. In 2018, Xuji posted 23 million yuan of profit, compared with 1.28 billion yuan in 2016. Pinggao booked 640 million yuan of net loss in 2018, compared with 1 billion yuan net profit in 2016.

Related-party transactions with State Grid contributed 60% of Xuji’s 2018 sales and 68% of Pinggao’s, according to market data.

Rebooting reform

Falling power construction demand and rising emphasis on clean energy has pressed State Grid to resume its restructuring efforts to refocus on core power transmission, analysts said.

The first step in the resumed overhaul will involve the free asset transfer of Xuji, Pinggao and other manufacturing units to state-owned equipment maker XD Electric, Caixin learned. The restructuring will expand XD Electric’s assets from 40 billion yuan to more than 100 billion yuan, making it a global power equipment champ.

Sources close to the matter said State Grid is still battling to retain control of its home-grown equipment unit NARI Group. With 70 billion yuan of total assets, NARI owns self-developed technologies in UHV direct transmission, grid safety control and network coordination, among other areas.

Compared with Xuji and Pinggao, NARI has a record of much stronger business performance with steady growth. In 2019, the company reported 32.4 billion yuan of revenue, rising from 29.5 billion yuan in 2018. Net profit climbed to 4.3 billion yuan from 3.7 billion yuan the previous year.

Under pressure to cut power prices amid the pandemic slowdown, State Grid suffered a 30% profit drop in 2020, making NARI an increasingly important source of income. In 2019, NARI contributed 7% of State Grid’s total profit.

“Since early discussions about the spinoff plan in 2018–19, State Grid has insisted on keeping NARI,” one person close to the discussions said.

It is still unclear whether NARI will be included in the latest divestiture, although the NDRC listed NARI in November among the assets to be spun off. State Grid has strongly opposed the plan, the person said.

If there must be a spinoff, State Grid may give up some of NARI’s low-end manufacturing businesses such as wire and cable, one company source said.

The direction of divestment has been set. In a policy document released in late January, the NDRC demanded that State Grid and its provincial branches exit from manufacturing while easing control over power design and construction businesses. State Grid and its subsidiaries were told to clearly disclose their holdings in competitive sectors.

According to the NDRC’s Xu, regulators have set out a timetable for State Grid to withdraw from part of the power design business by the end of 2022 and exit power construction by 2023.

But there is no clear plan to tackle State Grid’s massive nonpower businesses including finance, media, e-commerce, hotels and health care. State Grid Yingda Group, the power giant’s finance business segment founded in 2010, currently manages more than 1 trillion yuan of assets and reported more than 6 billion yuan in net profit in the first quarter 2020. In the media industry, State Grid holds stakes in at least six media outlets including people.com.cn.

The manufacturing spinoff will serve as an important step to kick off State Grid’s long-awaited shakeup, a power industry analyst said. If the divestitures can’t be achieved successfully, other affiliated businesses of State Grid may “continue thriving,” the analyst said.

Contact reporter Han Wei (weihan@caixin.com) and editor Bob Simison (bobsimison@caixin.com).

Download our app to receive breaking news alerts and read the news on the go.

Follow the Chinese markets in real time with Caixin Global’s new stock database.

- PODCAST

- MOST POPULAR