China Mulls Allowing Foreign Institutions to Invest Offshore Yuan in Shanghai Stocks

China is considering a trial that would allow qualified foreign institutions to invest offshore yuan in Shanghai’s Nasdaq-style STAR Market, to both boost the global use of the currency and further open up the domestic financial markets.

The proposed trial is part of a set of guidelines (link in Chinese) issued Thursday by the ruling Communist Party and the State Council, China’s cabinet, which broadly maps out a blueprint for building the city’s Pudong New Area into a business and financial powerhouse.

The guidelines encourage the establishment of an international financial assets trading platform in Pudong to facilitate the trial. If the trial goes ahead, foreign investors would be allowed to invest offshore yuan in the STAR Market through the Qualified Foreign Institutional Investor (QFII) program. That can help improve the internationalization of the yuan and boost the amount of foreign capital flowing into the board, said Dong Dengxin, director of the Finance and Securities Institute of Wuhan University.

In the future, regulators will also likely allow foreign investors to invest offshore yuan in the STAR Market outside the QFII program, a source close to the regulators told Caixin.

Read more

Four Things to Know About China’s Cross-Border Yuan Clearing System

The QFII system, introduced in 2002, is a major channel for overseas investors to access Chinese mainland financial markets. Currently, the program only allows institutions to remit foreign currency (link in Chinese) to the Chinese mainland that can then be converted to onshore yuan for investment in China’s financial markets.

QFII investors are allowed to invest in stocks, bonds, futures and mutual funds.

By the end of May 2020, around 300 QFII investors had won approval to invest a total of $116.3 billion on the mainland, according to the State Administration of Foreign Exchange (link in Chinese).

Previously, QFII investors were subject to a quota to invest in the Chinese market, due to the country’s foreign exchange controls. China in May scrapped the quota restrictions in an effort to lure more foreign investors to the domestic market.

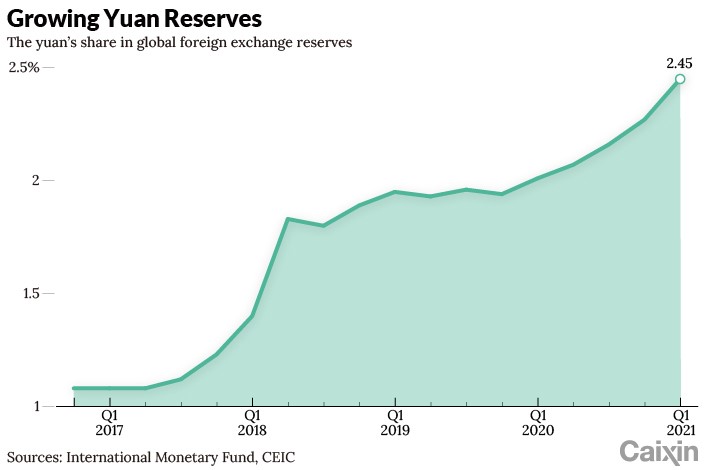

China in recent years has accelerated its push to globalize the yuan, including efforts such as developing a cross-border yuan clearing and settlement system.

Currently, the yuan only makes up a fraction of the global currency market. At the end of March, 2.45% of global forex reserves were held in the yuan, making the Chinese currency’s share of global forex reserves fifth — after the U.S. dollar, the euro, the yen and the British pound — according to International Monetary Fund data.

|

Han Wei contributed to this report.

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.