Out-of-Favor China Stocks Bounce Back as Investors Go Bargain Hunting

Chinese internet and technology stocks have rallied in Hong Kong and the U.S. after plunging last week over concerns that tough regulations will hurt profits, although investors and analysts remain cautious about the medium-term investment outlook.

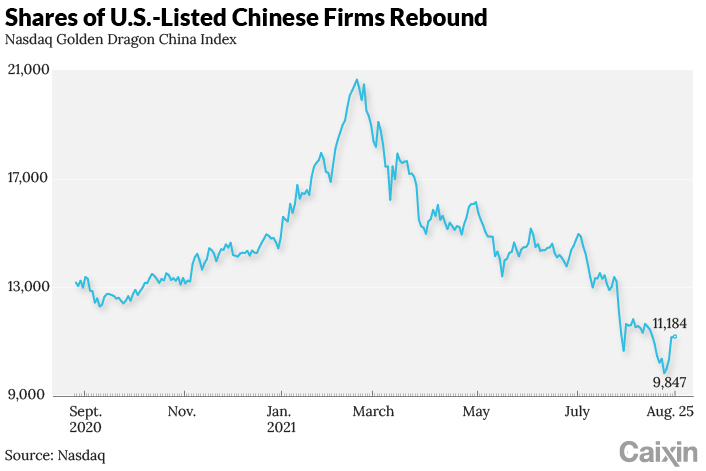

The Hang Seng TECH Index, which tracks the 30 largest tech companies listed in Hong Kong, rose 9.6% over the three days through Wednesday, recovering from an 11% slide last week that saw the gauge drop to an over one-year low on Friday. The Nasdaq Golden Dragon China Index, which tracks 98 Chinese companies listed on the U.S. exchange, has jumped 13.6% since slumping to the lowest in more than a year on Aug. 19.

|

Shares of overseas-listed Chinese companies have been pummeled over the last few months as the government’s tightening regulations on major technology companies has deepened and spread to the education and tutoring industry. Investor sentiment has also been hit by the U.S. stock regulator’s decision to suspend the use of shell companies as listing vehicles for Chinese firms, speculation that the Federal Reserve will begin tapering bond purchases which will pave the way for higher interest rates, and increasing evidence that China’s economic recovery (link in Chinese) is losing steam.

Read more

Reg Watch 5: A Timeline of China’s Latest Regulatory Storm

Concerned that the regulatory headwinds will increase, institutional investors, especially those in the U.S. have turned negative on China stocks and some high-profile names have been offloading their holdings.

Catherine Wood, founder of ARK Investment Management LLC and an influential fund manager, said she slashed her holdings of Chinese technology and internet shares, including those of Tencent Holdings Ltd., while hedge fund guru George Soros’ Soros Fund Management sold off Chinese companies including Tencent Music Entertainment Group, Baidu Inc., Vipshop Holdings Ltd.

Bank of America Corp.’s latest Global Fund Manager Survey showed betting against China stocks was seen as one of the most popular trades among participants and some 16% of those surveyed said the biggest risk was “China policy,” up from almost zero in July’s poll. RBC Wealth Management, the wealth management arm of Royal Bank of Canada, last week recommended investors cut the allocation of Asia ex-Japan equities in their portfolios to market weight from overweight, citing the “combination of Chinese regulatory zeal and the increased threat from the delta variant.”

Although there was no new policy or market news to spur this week’s rally, many investors saw the sell-off as overdone and took advantage of depressed prices and good earnings reports from some companies to snap up stocks. On Monday, Wood bought American depository receipts (ADRs) of JD.com Inc., Bloomberg News reported. As of Aug. 26, the fund manager’s ARK Autonomous Technology & Robotics ETF holds 1.3 million of JD.com’s ADRs with a market value of about $99.5 million, making up 3.63% of the fund.

Many analysts say that with the potential for more regulatory changes coming out of China, investors should remain cautious in the short term, but on a long-term view, Chinese stocks and bonds still have a place in investors’ portfolios.

“In the short term, China’s regulatory tightening could be challenging and may include restrictions on companies listing overseas using the Variable Interest Entity (VIE) structure,” Amundi SA, Europe’s largest asset manager, wrote in a report this month. “Furthermore, in autumn 2022, the Chinese Communist Party (CCP) will hold its 20th National Party Congress, adding uncertainty over new policies. This could keep volatility high. However, this short-term correction coupled with possible further weakness should prove healthy for the market in the medium term and could be seen as an opportunity for investors looking for sustainable returns.”

Tai Hui, chief Asia-Pacific market strategist at JP Morgan Asset Management Inc., said that while regulatory uncertainty means investors could remain cautious for now, China remains an “integral part of any investors’ portfolio.” Although abrupt changes in regulations could continue to influence sentiment, not all change is necessarily negative for markets, he wrote in a report. “For example, ambitions in self-sufficiency in semiconductor manufacturing and software development or in achieving greenhouse gas reduction targets mean certain industries stand to benefit from policy tailwinds in the medium- to long-term,” he said.

Kenny Wen, a wealth management strategist at Everbright Sun Hung Kai Co. Ltd., a Hong Kong-based brokerage, said internet and technology stocks listed in Hong Kong were oversold, and this week’s jump in prices was a normal rebound. Even so, it’s too early to say that the market has started to stabilize, he said.

Contact reporter Zhang Yukun (yukunzhang@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR