China Carbon Watch: Emissions Allowance Market Prices Hold Firm Despite Slump in Trading

Over the past trading week (Aug. 23-27), China’s national carbon emissions allowance (CEA) market saw a hefty decrease in total trading volume, but maintained steady prices overall. Meanwhile, the total volume for the China Certified Emission Reduction (CCER) across all nine regional markets increased by 5.5% from the previous week, while individual markets saw varying degrees of change.

In addition, the city of Shenyang is expected to launch its local emissions trading system (ETS) in September, making it the 10th and likely last regional ETS market in China.

Resource management agencies in the Chinese central government saw opportunities in furthering the protection and restoration of China’s marine, forest, and grassland ecosystems through participation in ETSs.

Read more

Energy Insider: Sinopec Swings to Profit on Oil Price Rebound

Carbon markets update

• Over the past trading week (Aug. 23-27), the CEA market saw a hefty decrease in total trading volume, but maintained a steady overall price.

|

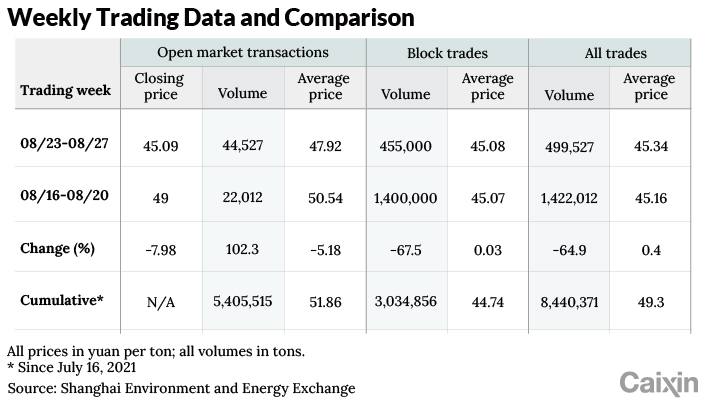

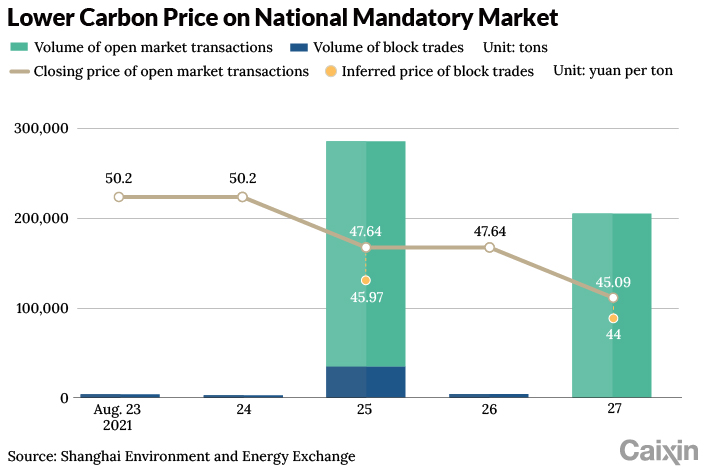

The market ended the week with a weekly total volume of 499,527 tons, which included block trades — trades with a volume of 100,000 tons or above at a price set usually by bilateral negotiation — of 455,000 tons. Calculated from the disclosed total trading volume and value, the average overall price was at 45.34 yuan ($7.01) per ton. Compared to the previous week (Aug. 16-20), the total volume from all trades decreased 64.9%, while the price increased 0.4%.

For the past trading week, open market transactions closed at 45.09 yuan per ton, a decrease of 7.98% from the previous week. Although volume more than doubled (102.3%) at 44,527 tons, open market transactions continued to be a small portion of the total market, accounting for only 8.9% of the total volume. On the other hand, block trade volume decreased by 67.5% to 455,000 tons, but still accounted for 91.1% of the total volume. Inferred prices for block trades changed little (up 0.03%) from the previous week at 45.08 yuan per ton, converging with the price of open market transactions.

Since the launch of trading on July 16 and as of Aug. 27, the national CEA market had a cumulative total trading volume of 8,440,371 tons and an overall average price of 49.3 yuan per ton. Block trades accounted for 36% of the total volume. Excluding the launch day volume, block trades accounted for 70% of the total volume. Cumulative average prices for open market transactions and block trades were 51.86 yuan and 49.30 yuan per ton, respectively.

|

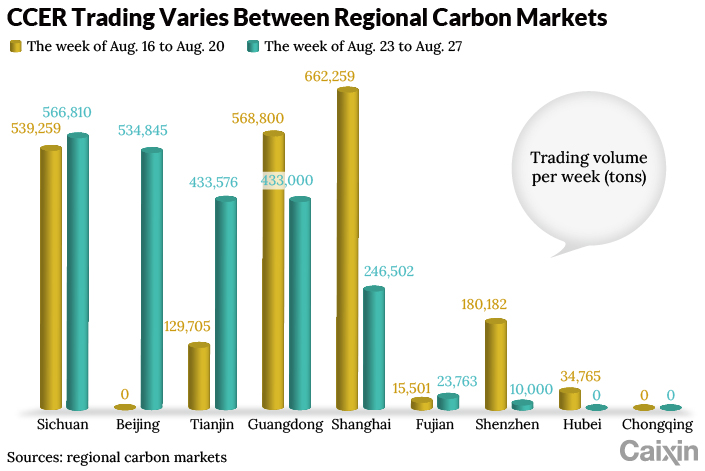

• For the week of Aug. 23-27, CCER markets’ total volume increased by 5.5%, while individual markets saw widely different changes.

In the absence of a national CCER market, the nine regional pilot markets continued fairly active trading of emission offsetting credits. The weekly total volume across the nine markets increased by 5.5% from the week before to 2,248,496 tons. The Sichuan market had the highest volume at 566,810 tons, while Hubei and Chongqing did not trade any. Tianjin’s volume increased threefold to 433,576 tons. Shenzhen and Shanghai saw a decrease of 94.5% and 62.8%, respectively. Beijing in particular went from no trades in the previous week to a total of 534,845 tons, second only to Sichuan.

|

Of the nine markets, only Shanghai, Beijing and Hubei disclose daily CCER price information, while Guangdong reports weekly average prices on Mondays for the previous week. Beijing and Hubei disclose only online (open market) trade prices. Shanghai, in addition to online prices, also discloses the cumulative total value of trades from all spot products, from which prices of offline (negotiated) trades can be calculated (inferred price). Guangdong in particular separates CCERs traded on its exchange into compliance-eligible and compliance-ineligible classes. It provides weekly average prices for both classes but does not break down the trading volume.

During the week, Shanghai did not have any open market CCER trades. For the three days where offline trades took place, the inferred prices from lowest to highest were zero (free transfer), 8.18 yuan per ton, and 34.42 yuan per ton with an average of 13.53 yuan per ton. The average price is 2.4% higher than the previous week. Cumulatively from the launch of trading in late 2013 and up to Aug. 27, 2021, the Shanghai market had an overall average price of 18.42 yuan per ton for open market transactions and 5.11 yuan per ton for offline trades.

Beijing saw three days with online CCER trades. The weekly average price was 36.42 yuan per ton with a range of 35 yuan per ton to 38.86 yuan per ton. The latest available price information from the Guangdong market was for the previous week (Aug. 16-20). The weekly average price for compliance-eligible CCER was 45.22 yuan per ton, and for compliance-ineligible CCER was 19.13 yuan per ton. Compared to the week before (Aug. 9-13), the average price for compliance-eligible CCER remained the same while compliance-ineligible CCER increased by 14.9%.

• Shenyang to launch its local ETS in September.

On Aug. 25, the city government of Shenyang, the capital of the northeastern Chinese province of Liaoning, announced in a press conference that it expects to launch trading on its local ETS in September. It will be the 10th regional ETS in China after those in Shenzhen, Shanghai, Beijing, Tianjin, Guangdong, Hubei, Chongqing, Fujian and Sichuan, which were established at various points from 2013 to 2016. Shenyang has been in the process of developing an ETS since 2016, well ahead of the national ETS’s launch in July, which is likely the reason it was still able to gain approval from the central government. The Shenyang ETS covers annual emissions of about 27 million tons of carbon dioxide from over 500 companies, including 161 machinery equipment manufacturers, 97 heating companies and 49 petrochemical firms. This reflects the city’s role as a hub of car manufacturing and petrochemical production, as well as its cold climate. About 90% of the emissions allowances will be distributed for free with the remaining 10% split evenly between government auction and CCER purchases. As the national ETS draws away the key power generation sector from the regional ETSs, it remains to be seen how market liquidity performs for this latest member of China’s regional ETS markets.

Read more

Caixin ESG Biweekly: No More ‘Campaign-Style’ Carbon Reduction Measures

Policy update

• The Ministry of Ecology and Environment (MEE) targets blue carbon in marine ecosystems.

In its monthly press conference on Aug. 26, a deputy head of the Department of Ocean Ecology and Environment of the MEE, Zhang Zhifeng, indicated that the ministry will take as a priority maintaining and developing blue carbon — carbon fixed and stored in marine ecosystems — as an important means to contribute to China’s peak carbon and carbon neutral goals. The agency will focus on steadily improving the carbon fixing capacity of marine ecosystems through three work areas, namely increasing the monitoring and evaluation of ocean adaptation to climate change; promoting the synergy between ocean pollution reduction and climate change adaptation; and strengthening marine ecosystems’ climate change resilience through the inclusion of carbon neutralization and climate change resilience as key indicators in the protection and restoration of characteristic marine ecosystems such as mangrove forests, seaweed beds and salt marshes.

• China’s National Forestry and Grassland Administration (NFGA) to participate in the national CEA market.

In a press conference on Aug. 20, the head of the NFGA’s Department of Ecological Protection and Restoration, Zhang Wei, indicated that forestry and grassland agencies will participate in national CEA trading, utilizing carbon fixed and stored in forest and grassland to offset CEA requirements. Private investment in forest and grassland carbon sink projects will be encouraged. Zhang also indicated that the agency will investigate the potential of establishing a trading platform for carbon reductions by forest and grassland.

Industry news

• China State Power Investment Corp. Ltd. (SPIC) closes first-ever loan guaranteed by CEAs.

On Aug. 23, Guizhou Jinyuan Qianxi Power Plant, a subsidiary of SPIC, closed a 28 million yuan loan from Minsheng Bank guaranteed by the power plant’s CEAs after the allowances were officially registered on the national CEA registry. The loan is reported to have “better terms” on the interest rate, and was arranged by another SPIC subsidiary specialized in carbon asset management.

• China’s new coal power plants approvals down dramatically but still substantial.

A Greenpeace report on Aug. 25 showed that China’s provinces approved 24 new coal power plants in the first half of 2021, totaling 5.2 gigawatts. This is down by 78.8% from the same period last year. The most common justification for these new projects is “securing long-term electricity supply,” according to the report. Continued expansion of coal power sends mixed signals on coal, especially in light of China’s goals of peak carbon by 2030 and achieving carbon neutrality by 2060. “Reliance on coal is turning energy security and economy into sources of inertia, not development,” says Li Danqing of Greenpeace East Asia.

Bai Bo is chairman and co-founder of the Cyberdyne Tech Exchange, a digital green exchange based in Singapore.

Contact editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

Get our free ESG newsletter.

- MOST POPULAR