In Depth: EU Wind Power Probe Could Blow Chinese Expansion Plans Off Course

Listen to the full version

The EU’s recent probe into Chinese wind turbine suppliers has deepened uncertainty around these companies’ overseas expansion, which has become increasingly important as domestic demand slows.

On April 9, the European Commission announced it was investigating subsidies for companies that supply turbines to five European countries. This is just one of a series of probes into Chinese new energy firms that have kicked off in recent months, as the bloc looks to shelter local industries from cheaper competition.

Unlock exclusive discounts with a Caixin group subscription — ideal for teams and organizations.

Subscribe to both Caixin Global and The Wall Street Journal — for the price of one.

- DIGEST HUB

- The EU's investigation into Chinese wind turbine subsidies has raised concerns about market competition, with China criticizing the probe as protectionist.

- Domestic demand for wind turbines in China has significantly declined, driving manufacturers like Goldwind to explore international markets despite challenges such as tariffs and certification issues.

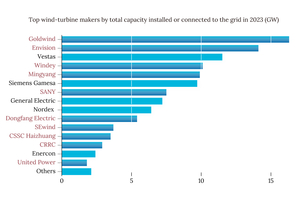

- Chinese wind turbine exports surged over 60% in 2023, with growth notably in Belt and Road Initiative countries like Uzbekistan and Egypt, while also targeting India and Brazil despite obstacles.

The EU's recent investigation into Chinese wind turbine suppliers has increased the uncertainty for these companies' international expansion, a crucial move as domestic demand wanes [para. 1]. On April 9th, the European Commission announced a probe into subsidies for turbine suppliers in five European countries, reflecting broader EU efforts to protect local industries from cheaper Chinese competition [para. 2]. China has criticized these probes as protectionist and urged the EU to change its approach, with industry groups like the Chinese Wind Energy Association arguing that the EU’s actions distort market competition under the guise of fairness [para. 3].

Past investigations similar to this one have led to additional tariffs and project cancellations. For instance, since December 2021, the EU has imposed tariffs ranging from 7.2% to 19.2% on Chinese wind turbine towers [para. 4]. Besides tariffs, Chinese manufacturers face other challenges in entering European markets, such as financing difficulties and stringent certification requirements, prompting some to focus on emerging markets linked to Beijing's Belt and Road Initiative (BRI) [para. 5].

An executive from a leading turbine manufacturer pointed out that the international wind power market is currently more lucrative than the domestic market, where top players have gross margins below 10% [para. 6]. Domestic demand has fallen since 2021 following the end of national-level subsidies for new wind projects, creating an oversupply issue, especially in the offshore sector [para. 7-8]. China's annual offshore wind turbine production capacity is around 15 gigawatts (GW), but only 5 GW were installed in 2022, highlighting significant underutilization [para. 9]. This oversupply has driven prices down significantly, with the average bid for onshore and offshore wind turbine projects halving compared to early 2021 [para. 10].

Amidst fierce domestic competition, companies like Goldwind are seeking new growth avenues. Goldwind, for instance, is targeting Europe, which accelerated its energy transition after Russia's invasion of Ukraine in 2022. Goldwind signed an agreement with Banco Santander to explore wind projects in Europe and Latin America [para. 13]. Other Chinese players are also making inroads; Ming Yang Smart Energy supplied turbines for Italy's first offshore wind farm in 2022, and other component-makers secured projects in the UK, Denmark, and Germany [para. 14].

The EU aims to increase its total wind power capacity to over 500 GW by 2030, requiring an additional 37 GW annually. However, achieving this through local suppliers alone will be challenging [para. 16]. While the EU built a record 17 GW of new wind farms in 2023, maintaining this pace is critical to meet future targets [para. 17].

European and American wind turbine manufacturers are generally struggling due to high inflation and rising costs in Europe. Chinese turbines are often 20-50% cheaper than their European counterparts and offer flexible payment terms, allegedly supported by unfair public subsidies [para. 20-22]. Previous probes in other sectors, such as the one into CRRC Corp., have resulted in Chinese firms losing out on projects due to protectionist measures [para. 24]. Despite this, the China Chamber of Commerce believes the current wind power probe will have limited impact on Chinese suppliers due to their primary focus on the domestic market [para. 26].

Chinese manufacturers, although challenged by higher costs and certification hurdles, are encouraged to adopt a "two-legged" approach, targeting both lucrative Western markets and more accessible BRI countries [para. 36]. This strategy is already yielding results, with significant exports to BRI countries [para. 37]. Brazil, for instance, has become a key market due to its favorable conditions and strong wind power demand [para. 39]. However, markets like India pose challenges due to their business environments and shifting policies [para. 42]. To succeed globally, Chinese manufacturers must build strong local relationships and offer comprehensive solutions, enhancing their product quality and international reputation [para. 46-47].

#### Contact Information

Reporter: Wang Xintong (xintongwang@caixin.com)

Editor: Joshua Dummer (joshuadummer@caixin.com) [para. 49].

- Goldwind Science & Technology Co. Ltd.

- Goldwind Science & Technology Co. Ltd. (002202.SZ) is a leading Chinese wind turbine manufacturer facing shrinking profits and stiff domestic competition. It’s focusing on overseas expansion, including Europe, due to a more lucrative international market. In September, Goldwind partnered with Banco Santander SA to explore wind projects in Europe and Latin America, part of its strategy to find new growth avenues amid the energy transition accelerated by the Ukraine conflict.

- Ming Yang Smart Energy Group Ltd.

- Ming Yang Smart Energy Group Ltd. (601615.SH) supplied turbines for the first offshore wind farm in Italy and the Mediterranean in April 2022. The company is among the Chinese wind turbine manufacturers that have won or completed orders for projects in countries such as the U.K., Denmark, and Germany.

- Dajin Heavy Industry Co. Ltd.

- Dajin Heavy Industry Co. Ltd. (002487.SZ) is a component maker that supplies towers. The company won or completed orders for wind power projects in the U.K., Denmark, and Germany in 2022.

- Jiangsu Zhongtian Technology Co. Ltd.

- Jiangsu Zhongtian Technology Co. Ltd. (600522.SH) is a manufacturer specializing in submarine cables. The company has supplied components for wind projects in countries like the U.K., Denmark, and Germany.

- CRRC Corp. Ltd.

- CRRC Corp. Ltd. is a Chinese state-owned train manufacturer. In February, the EU began investigating it for allegedly using subsidies to bid lower for a Bulgarian public train project. The investigation ended after CRRC withdrew its bid about a month later, and the company cited trade protectionism in a recent earnings report as making it more difficult to fulfill overseas orders.

- Ping An Securities Co. Ltd.

- Ping An Securities Co. Ltd. provided data indicating that the average bid for onshore wind turbine projects in China fell by half to around 1,500 yuan ($207) per kilowatt from 3,000 yuan in early 2021. During the same period, the average bid for offshore wind turbine projects also more than halved from about 7,000 yuan per kilowatt.

- Envision Energy Co. Ltd.

- Envision Energy Co. Ltd. has targeted the Indian market, where profit margins are reportedly much higher than in China. However, industry insiders advise caution due to India's challenging business environment and unpredictable foreign investment policies. In the global wind energy sector, Envision is engaging in strategic partnerships to improve its international presence.

- Banco Santander SA

- Banco Santander SA, headquartered in Spain, has partnered with Goldwind Science & Technology Co. Ltd. to explore global wind projects. This collaboration, established in September, aims to find partners for prospective wind energy initiatives in markets including Europe and Latin America, amid heightened demand for renewable energy post-Russia's invasion of Ukraine.

- MOST POPULAR