Chart of the Day: First High-Tech Board Candidates Move Closer to Listing

The queue to list on China’s new Nasdaq-style high-tech board is getting longer.

The Shanghai Stock Exchange gave the first green light on June 5 to three companies to list on the Science and Technology Innovation Board after reviewing their applications to ensure they’ve followed the correct procedures. It is set to review six more applicants this week and seven others next week, which will take the total number of initial public offering (IPO) candidates to 16, according to bourse statements (link in Chinese). More companies could be added to next week’s review.

As of Tuesday, 121 companies had filed applications for listing on the high-tech board, according to data from the Shanghai exchange.

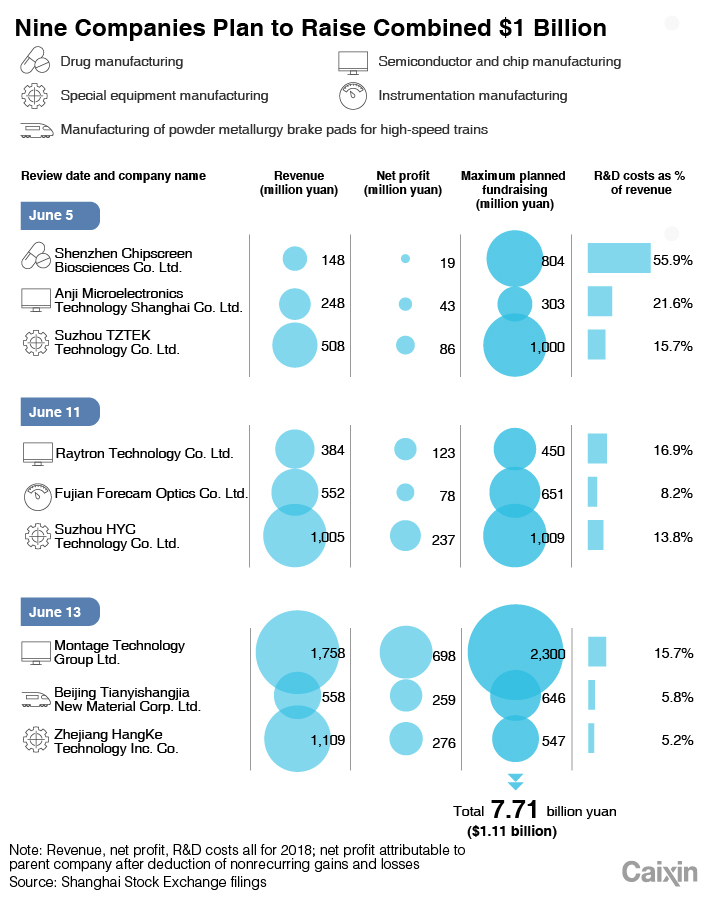

Here’s a quick rundown of the nine companies that have either been reviewed or will be reviewed by the end of this week. In total, they plan to raise 7.71 billion yuan ($1.11 billion) through their IPOs.

|

| Graphic: Gao Baiyu/Caixin |

Of the nine, chip manufacturer Montage Technology Group Ltd. had the largest revenue and net profit last year, and plans to raise the most money. In terms of research and development (R&D) costs as a percentage of revenue, drugmaker Shenzhen Chipscreen Biosciences Co. Ltd. ranked first, and semiconductor-maker Anji Microelectronics Technology Shanghai Co. Ltd. came in second.

Once they pass this key hurdle in the listing process, the next step for applicants is to have consent documents issued by the Shanghai bourse, which will file their listing registrations with the China Securities Regulatory Commission (CSRC), according to CSRC rules (link in Chinese). The securities regulator then has up to 20 working days to decide whether to consent to the registrations. Once that is given, the companies will need to list within one year.

The high-tech board, proposed by President Xi Jinping in November, is designed to improve the Chinese mainland’s appeal to technology companies and encourage them to list at home rather than overseas. A key change is the shift to a market-based registration system for new listings that will hopefully resolve the shortcomings in the current lengthy, bureaucratic IPO process that listing candidates face on other mainland boards.

China’s existing IPO system is based on an approval system where the CSRC vets every application. It is unpredictable and prone to corruption because of the power it gives officials to approve or reject applications. The system also imposes stringent requirements on companies and gives them little control over the price at which they offer their shares. Approvals can take months, or even years.

Sun Qian and Li Jinghua contributed to this report.

Contact reporter Lin Jinbing (jinbinglin@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas