In Depth: Nio Stalls in Its Quest to Become China’s Tesla

A plunge in first-quarter sales, a cut to expected deliveries, a reduction in government subsidies and a couple of cars that burst into flames — 2019 hasn’t been a great year for Nio Inc.

And it doesn’t look like it’s going to get much better anytime soon.

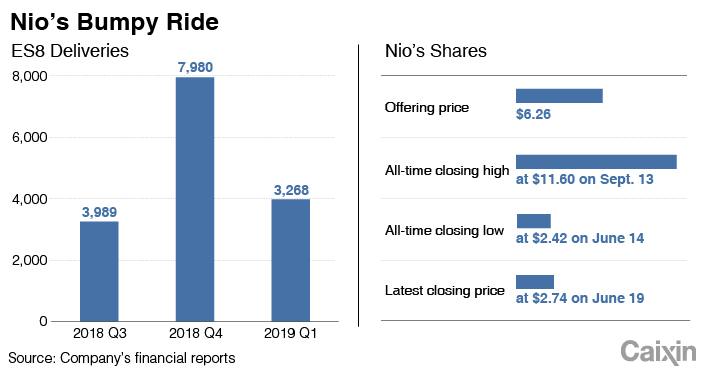

The electric-vehicle maker sometimes called China’s answer to Tesla (and sometimes just called a wannabe) began deliveries on Tuesday of its second model, the five-seat ES6 SUV. The milestone, along with a recently announced partnership with a new investor, might leave some wondering if the automaker, whose shares have lost 60% of their value since its initial public offering on Sept. 12, is on the cusp of a turnaround.

Nio’s sales have been rising and China’s electric car market is growing rapidly. But it likely won’t be enough for Nio, which faces an overcrowded market at home and a foreign competitor that remains the 400-pound gorilla in the industry. And there is still the matter of its cars catching fire.

Everbright Securities Co. Ltd. has forecast that Nio will stay in the red for the next three years, though its negative gross margin will narrow from -7.3% this year to -2.2% in 2021, the brokerage said in a note on Saturday.

Chasing Tesla

Founded in 2014 and based in Shanghai, Nio boasts a slew of big-name backers that include Tencent Holdings Ltd., Hillhouse Capital and Sequoia Capital. It had a big-name chief development officer, Padmasree Warrior, a veteran of Cisco Systems Inc. and Motorola, before she left in December. Nio’s founder and CEO William Li is a serial entrepreneur and an angel investor.

Nio went public on the New York Stock Exchange at $6.26 per American depositary share, which was at the lower end of its price range. But its shares soared 76% on the second day of trading, making it a new star of the tech world with a market cap of $7 billion.

Nio aspires to be “China’s Tesla.” Its first model, the ES8, a seven-seat SUV, costs half as much as Tesla Inc.’s Model X in China.

Read More

From June 2018 to this May, Nio sold 17,500 ES8s, and it received 12,000 orders for its new ES6, the company said.

While Nio has said that it will feel less of a pinch than Tesla from the intensifying China-U.S. trade conflict, analysts have said otherwise — fierce competition in the industry and the capital-intensive nature of the business could weigh on the company’s growth.

With more than 400 players, there is severe overcapacity in China’s electric car industry, according to the Chinese Academy of Engineering.

In 2018, local governments announced new electric car projects involving 250 billion yuan ($36.2 billion) of total investment, official data showed. The planned new projects have a combined production capacity of 6 million vehicles. That’s a lot of capacity considering there were 1.25 million new-energy vehicles sold in China last year, according to the China Association of Automobile Manufacturers. The industry group has forecast sales of 1.5 million this year and 2 million in 2020.

Everbright Securities expects Nio to sell 22,000 this year and 38,000 in 2021, according to its note.

Investors appear aware of the challenges facing Nio. Its stock price has come way down from its September high. It closed at $2.74 a share on Wednesday, giving it a market cap of $2.8 billion.

|

Bringing in help

Nio’s dreary profit outlook is why it has decided to bring in a new investor. In May, it announced plans to form a joint venture with Beijing E-Town International Investment and Development Co. Ltd., which will invest as much as 10 billion yuan in the tie-up. E-Town will offer support in building a new manufacturing facility for vehicles set to hit the market around 2021, Nio said.

Nio’s vehicles are currently produced in partnership with state-owned Anhui Jianghuai Automobile Group Co. Ltd. In March, Nio abandoned a plan to build a factory in Shanghai two months after Tesla broke ground on its first facility in China.

Tesla’s $5 billion production complex in Shanghai will be both its first auto plant outside the U.S. and the first wholly foreign-owned electric vehicle project in China under new industry regulations.

Tesla has said that construction will wrap up this summer and the first China-made Model 3 will roll off the production line by the end of the year. According to Tesla’s fourth-quarter financial report, it aims for the Shanghai plant to produce 3,000 Model 3s each week.

Fires to put out

Stiff competition aside, Nio still has to convince consumers that its cars are safe. In April, a parked Nio ES8 burst into flames after undergoing maintenance at an authorized Nio service shop in the northwestern city of Xi’an. The company said later that an investigation determined that the fire was caused by a battery short circuit.

That same month, a parked Tesla reportedly burst into flames in Shanghai. The company said it was looking into the cause of the fire.

The incidents prompted the Ministry of Industry and Information Technology to issue an order Monday demanding carmakers conduct safety checks and submit their findings by October. The ministry told automakers to check all of their vehicles, including those that have already been sold, for potential safety flaws related to battery boxes, waterproof protection, high-voltage wiring harnesses and on-board charging devices.

That same day, a second Nio ES8 caught fire in a parking lot in the central city of Wuhan, according to a report by the business news site KrASIA. Nio said it was investigating.

Contact reporter Jason Tan (jasontan@caixin.com)