In Depth: Why Hong Kong Faces a Recession

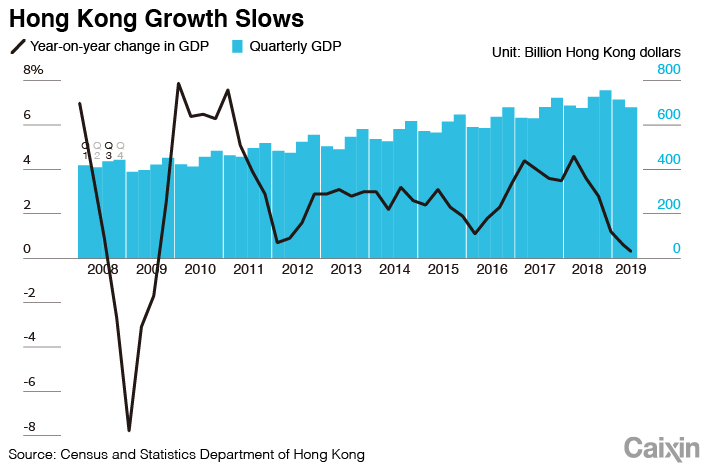

Hong Kong is on the verge of recession. Government data released on Aug. 16 showed that in the second quarter, the city’s GDP grew only 0.5% from the same period last year — its slowest increase in nearly a decade. It was also down 0.4% on the previous quarter.

Paul Chan Mo-po, the financial secretary of the special administrative region, has pointed out that it will enter a technical recession if GDP continues to decline quarter-on-quarter in the third quarter.

Ongoing protests since June have made things worse. Thousands of flights were canceled when Hong Kong International Airport was occupied by protestors on Aug. 12 and 13. Many fear that the social turmoil is not only affecting the retail and travel industries, but damaging Hong Kong’s image as a global financial center.

Carrie Lam, Hong Kong’s embattled chief executive, has told reporters that the situation is worse than the economic damage caused by severe acute respiratory syndrome (SARS) and the 1997 Asian financial crisis.

Meanwhile Charles Li, chief executive of Hong Kong Exchanges and Clearing, said on Aug. 14 that the recent events will “have a long-term impact on Hong Kong’s economy.”

Less people, less money

Hong Kong’s four pillar industries — trading and logistics, financial services, tourism and retail, and professional services and other producer services — account for more than half of the city’s economy in 2017. Tourism and retail have so far borne the brunt of the impact from the unrest.

Many shops have temporary closed since the protests started in June. Billy Mak Sui-choi, an associate professor at the Department of Finance and Decision Sciences of Hong Kong Baptist University, says shops might face as much as a 7% revenue decline if they’re forced to shut for a day each weekend. Losses exceeding 10% could trigger pay cuts or layoffs.

By Aug. 23, altogether 31 countries and regions had issued travel warnings for Hong Kong, likely leading tourists to reconsider visiting according to government data (link in Chinese). Hong Kong’s Secretary for Commerce and Economic Development Edward Yau recently disclosed that the number of people visiting Hong Kong fell almost 50% year-on-year in the period from Aug. 15 to 20.

This has taken its toll on Hong Kong’s retail industry. Sales of luxury goods, including jewelry, watches, clocks and other valuable gifts, tumbled 17.1% year-on-year in June. Hotel rooms are offering big discounts owing to fewer tourists. A Chinese mainland visitor named Yang Hong told Caixin that her hotel room was almost half price. Yau acknowledged that many hotels’ occupancy rates have suffered double-digit falls in recent months.

Like Lam, Mak compares the current situation to the SARS crisis in 2003, during which almost 1,500 restaurants collapsed — roughly 10% of all restaurants — because of the travel warnings issued by the World Health Organization at the time. This time around, he calculates, as many as 2,000 restaurants could be affected, putting an estimated 10,000 workers’ jobs at risk.

|

Ongoing trade war

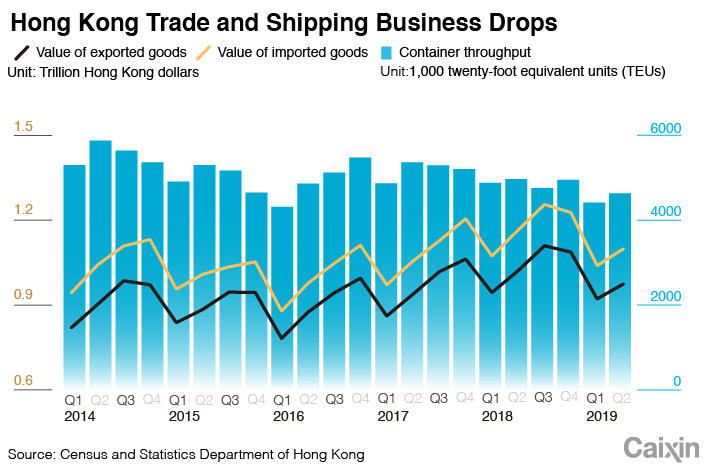

But even before the protests, the trade war between China and the U.S. was battering Hong Kong’s economy. Orders were falling. For the first half of 2019, the value of Hong Kong’s goods exports and imports dropped 3.6% and 4.5% year-on-year respectively. The value of goods exported to the Chinese mainland fell 6%, while those exported to the U.S. fell 11.1%.

Trading and logistics is Hong Kong’s biggest industry, accounting for about 21.5% of GDP in 2017. Almost 99% of the value of its exported goods is for re-export, the majority of which serves the Chinese mainland, according to data (link in Chinese) from the Hong Kong Trade Development Council (HKTDC).

The electronics industry has also taken a dive. In 2018, electronics products exported via Hong Kong accounted for 68.3% of the total value of exported goods. Billy Wong, deputy director of research at the HKTDC, said the vast majority of electronics products exported to the Chinese mainland from Hong Kong are unfinished, and need to be processed on the mainland before being exported to the U.S. If American demand decreases, raw materials and unfinished product trasferred via Hong Kong will be further affected.

Another major issue for Hong Kong’s re-export trade, according to Paul Tang, chief economist of The Bank of East Asia, is the transfer of manufacturing supply chains out of the Chinese mainland, where costs have been steadily increasing in recent years. As a result, manufacturing of low-end products such as toys, garments and plastic products is gradually moving to Southeast Asia, where costs are considered relatively low.

“Once the production chains move out of the Chinese mainland and orders no longer need to be transferred via Hong Kong, it will have a long-term, structural impact on Hong Kong’s trade position,” Tang said.

Meanwhile, the rapid development of the mainland’s trade and shipping business has diminished Hong Kong’s role as a “middleman” between it and the outside world. Recent data show that for the first half of 2019, the container throughput of Hong Kong fell markedly to 9.06 million twenty-foot equivalent units (TEU), down 8.1% compared to a year ago, and ranking No. 9 in the world. Shenzhen’s 12.41 million TEU and Guangzhou’s 10.94 million TEU rank them No. 4 and No. 5 in the world. TEU is a measurement of volume based on the size of a standard 20-foot shipping container.

|

The U.S., under the United States–Hong Kong Policy Act of 1992, treats Hong Kong as a separate customs territory from the mainland. Reacting to the Hong Kong government’s proposed legal amendments which sparked the protests, Washington warned the changes could jeopardize the city’s special trade status. Should trade relations between China and the U.S. deteriorate further, the U.S. could follow through on such a threat, which The Economist has described as the “nuclear option.”

Health of the financial services industry

Hong Kong is widely seen as one of the world’s most important financial centers. Financial services, professional services and other producer services, combined, contributed about 31.1% of the city’s GDP in 2017. From 2012 to 2017, financial services industry grew an average of 8.6% per year, comfortably beating the 4.9% average growth of GDP. Some experts think the financial industry is better positioned to weather the impact of recent social events.

Hong Hao, head of research at Bocom International, told Caixin that Hong Kong’s bond market has been very active in the first half of this year and is little affected; on the stock market, it’s true that the secondary market has been greatly affected, but the scale of capital raised on the primary market is still remarkable.

Altogether 84 companies had their IPOs on the Hong Kong Stock Exchange in the first half of this year, raising total capital of HK$71.8 billion ($9.1 billion), up 39%. The number of new shares issued ranks No. 1 in the world, while the capital raised ranks No. 3, according to data from the Hong Kong bourse.

Mak of Hong Kong Baptist University notes that over 60% of the companies listed in Hong Kong are based outside Hong Kong, meaning recent social events haven’t had too much of an impact on them. In addition, most of the investors in Hong Kong are institutional investors, who are normally more rational and objective when making investment decisions. These days almost all securities trading is done through online channels, which are not easily disrupted unless there’s power outage or network attack.

|

However, investors started taking a more risk-averse stance in June. The benchmark Hang Seng Index went over 30,000 in May but has lost about 20% since. Research eports have been circulating of investors pulling money out of Hong Kong stocks in past months. The insurance business, which relies heavily on clients from the Chinese mainland, has been unusually subdued. One partner at a law firm complained to Caixin that a number of IPO projects have either been cancelled or shelved due to the current turmoil.

A Hong Kong-based headhunter, who asked to remain anonymous, told Caixin that some investment banks have frozen recruitment or even cut front office employees. One Singapore-based private banker revealed that many more Hongkongers have been opening bank accounts in Singapore recently, although Bloomberg recently quoted another private banker who claimed most of the Hongkongers who are thinking of moving their assets to Singapore are not ultra-rich, but tend to own assets in the $10 million to $20 million range.

The value of Hong Kong

Decades ago, Hong Kong’s economy underwent a smooth transition from a manufacturing-based to a service-based one. Yet the transfer to an economy based on science, technology and innovation has been somewhat slow in recent years.

While northern neighbor Shenzhen has been dubbed “China’s Silicon Valley,” Hong Kong is gradually being left behind. In a city where nearly half of the universities rank among the top 100 in the world, the value of innovation and technology only accounted for 0.7% of GDP from 2014 to 2017, with an industry workforce of less than 40,000 people — not even 1% of the total working population, according to government data.

Starting their own businesses has never been easy for young graduates from Hong Kong’s universities. Liu Wei (pseudonym), a 2019 doctoral graduate from the Hong Kong University of Science and Technology, told Caixin that almost no one from senior years he knew of chose to start up their own businesses during the four years he was at school. “Hong Kong’s universities have a very favorable environment for doing scientific research, and it’s quite easy for professors to obtain research grants. But the human costs and office rent are very high in Hong Kong,” Liu said.

Apart from that, many Hong Kong graduates can earn a handsome salary by going into finance or property. Why, then, opt to be an entrepreneur, when the risk is much higher, he said.

According to a report published in November 2018 by the City University of Hong Kong, downloads and citations of Hong Kong-produced academic papers far exceeded those of other cities in the Greater Bay Area. This shows Hong Kong holds a leading position in fundamental scientific research. However, this research is rarely commercialized there.

An increasing number of people have started to ask whether Hong Kong will still be valuable to the Chinese mainland if the mainland economy becomes fully developed.

“(Hong Kong) has no capital control, multiple channels to raise capital and very low tax rates,” says a person who works for a multinational food company in the city. She told Caixin that the Chinese mainland is their biggest market, while Hong Kong’s market is not only small, but money-losing. But they won’t close down their Hong Kong office, because it’s considered a liquid and manageable capital pool.

Mak stresses that Hong Kong remains the largest offshore financial market for the Chinese mainland. Many Chinese companies, once listed in Hong Kong, are free to raise foreign currency and develop international business, whereas the yuan reserves they raised on the Chinese mainland are not freely convertible and cannot be easily moved abroad. The Chinese government also needs a convenient and trustworthy offshore market. Hong Kong should be able to keep its position, at least for now, he said

A senior executive in the financial industry warns that Hong Kong’s advantages in the financial services industry could be weakened if the Chinese mainland further opens up its financial market. He said the Greater Bay Area has long been regarded as the “back garden” of Hong Kong, until recent events made some people think perhaps the opposite is correct: Hong Kong increasingly looks like the “back garden” of the Greater Bay Area.

Contact editor Yang Ge (geyang@caixin.com)

- PODCAST

- MOST POPULAR