Charts of the Day: China’s Incredible Shrinking P2P Lending Industry

The draconian cleanup campaign of China’s scandal-ridden peer-to-peer (P2P) industry has led to a three-year implosion that has put the sector almost back to where it was in 2014.

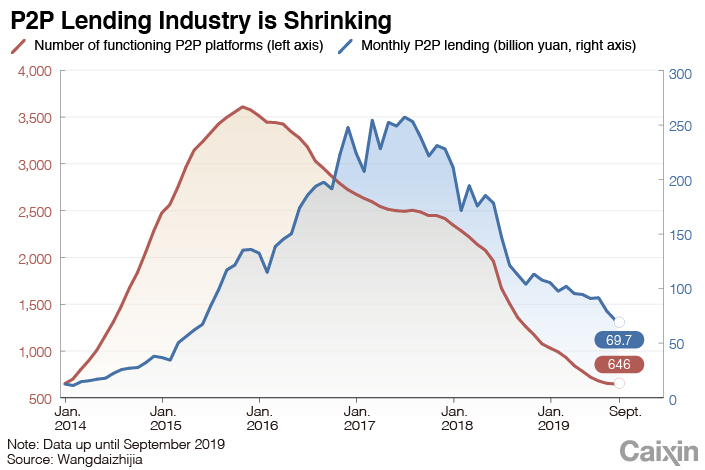

The number of functioning P2P lending platforms fell to 646 in September, a decline of nine compared with August and the lowest since early 2014 when the industry was booming, data compiled by Wangdaizhijia, an online lending research portal, show. The scale of the drop has been dramatic — at its peak in November 2015, the sector had more than 3,600 platforms.

|

New lending was just 69.7 billion yuan ($9.9 billion) in September, 37% lower than a year earlier and the least since early 2015, the data show. At the height of the boom in late 2016 and early 2017, platforms were facilitating loans of as much as 250 billion yuan a month.

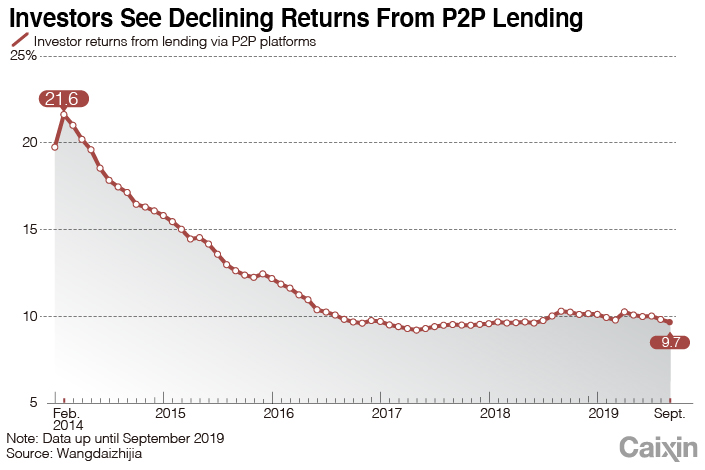

Investors who lent money to borrowers through the P2P platforms have also seen their returns shrink dramatically. The average return dropped to 9.7% last month, less than half what they were getting at the peak in February 2014, but slightly higher than the returns seen at the lowest point in 2017 when they were tracked at 9.2%.

|

The P2P lending industry is a shadow of its former self after a string of scandals and fraud forced the authorities to embark on a cleanup campaign. A new regulatory framework with stricter oversight and operating requirements for platforms has been set up, and watchdogs and local governments, who are responsible for supervising platforms in their jurisdiction, are in the process of scrutinizing and weeding out those who are unable to comply. P2P lending platforms that have survived the turmoil are being encouraged to turn themselves into licensed microlending companies which use their own money to make loans rather than acting as intermediaries for other lenders.

For many local governments, finding P2P platforms who can pass their scrutiny and meet the new regulations, has been almost a mission impossible. Last week, financial watchdogs in the central province of Hunan decided to ban all P2P lending institutions, saying that none had managed to pass muster. That followed an initial outlawing of 53 P2P platforms in 2018 made after an earlier round of reviews.

The government initially encouraged the development of the P2P industry as a means of channeling credit to small businesses and individuals who were poorly served by traditional banks. A P2P lending platform, in principle, is not a lender itself and only serves as an intermediary that matches lenders and borrowers via an online system.

Runaway bosses

The sector began to flourish in China in 2011, following the P2P model pioneered by Zopa Ltd. in the U.K. in 2005. But the lack of effective oversight from financial regulators along with the high returns promised by platforms as they competed for investors’ money stoked a lending boom that attracted speculators and borrowers with poor credit records that couldn’t pay back their loans.

The high-profile collapse of some prominent platforms due to fraud or lax management and risk controls, and stories of investors being bilked of billions of yuan by runaway bosses, triggered a regulatory crackdown and the withdrawal of many lenders from the industry. The slowdown in the domestic economy and a widespread campaign to deleverage the financial sector led to rising defaults by small businesses and individuals.

With growth prospects for the sector significantly dimmed, some of the biggest players are restructuring or considering pulling out of the industry altogether.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas