In Depth: Artificial Intelligence Startups Face Genuine Hurdles to Going Public

With its youthful founders, international tech awards and close government ties, Beijing-based facial recognition specialist Megvii Technology Ltd. looks a lot like its peers in China’s crowded field of artificial intelligence (AI) startups with big valuations.

However it seemed the 8-year-old firm would stand out by becoming the first Chinese AI firm to list overseas — until U.S. sanctions torpedoed that plan, at least for the time being.

Megvii didn’t become the first IPO candidate of its cohort for no reason. It had big name investors such as Alibaba Group Holding Ltd. and Lenovo Group Ltd., and a $4 billion valuation. It had a good record of growth, with revenue more than tripling in the first half of this year to 949 million yuan ($136.7 million) and losses narrowing, according to its prospectus.

But when Megvii applied to list in Hong Kong in August, Caixin reported that the firm’s path to going public was beset with risks including its murky relationship with the Chinese authorities and the possibility of being blacklisted by the U.S.

These concerns materialized in early October, when Megvii was among the eight Chinese tech firms placed on a U.S. blacklist due to alleged involvement in oppression of Muslim minorities in Northwest China, which Beijing has denied. That prohibits American companies from having commercial relationships with the firms on the list.

Megvii’s listing was expected sometime in the fourth quarter. However, according to a Dec. 3 report from financial media outlet IFR, Megvii has postponed its listing until next year and will aim to raise up to $1 billion. The company declined to comment on the latest development when reached by Caixin. Bloomberg reported it is now facing further enquiries from the Hong Kong bourse, such as whether it had adequately disclosed risks related to U.S. sanctions.

Although the impact of the blacklisting is undoubtedly huge, industry experts told Caixin that the prospects of China’s AI unicorns have long been troubled, with serious questions being asked about their profitability, growth prospects, funding and supply chains. The companies will have to face these questions if they want to go public.

Slowing security spending

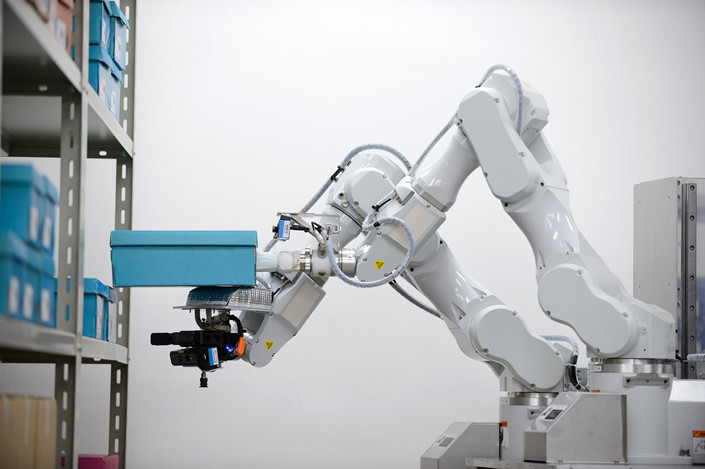

As they pursue public cash, the sustainability of the cash flows that have been propping up Chinese AI startups has been a big question. For many of these firms, especially those specializing in facial recognition, public investment has been a huge driver of revenue growth — which looks as though it may be slowing, insiders said.

The CEO of an AI voice recognition company told Caixin that AI firms’ sales growth in the last few years has been mostly driven by government security investment.

|

Megvii says a majority of its business comes from corporate clients who use its facial recognition technology in AI and internet of things-led “smart city” projects, which often include policing. This connection, even at a step removed, to China’s public security apparatus has raised concerns among foreign investors.

As the tide of public security investing gradually goes out, struggles in maintaining high-speed business growth will become a reality for these firms. One Megvii executive told Caixin that he expected at least two of the four biggest Chinese facial recognition firms — Megvii, SenseTime Group Ltd., Yitu Technology, and Yuncong — to go bust in the next two years. According to him, smaller players will face an even greater struggle.

Along with declining revenue, all of the major firms have leaned on massive infusions of private equity to fund their expansions, which has given them all high valuations. The highest valued among them, 5-year-old SenseTime, is now the world’s most valuable AI firm with a valuation of $7.5 billion after its latest funding round in September.

Analysts expressed concern that these companies’ overreliance on investors’ money and their exceedingly high valuations may mean that they could struggle to maintain their market value after they list, especially as profits seem a remote possibility at this stage.

Breaking the supply chain

The blacklisting has cut off supplies of the U.S. chips on which these AI firms rely, meaning they’ll likely have to pay more for chips from less-than-ideal suppliers, a veteran IDC analyst told Caixin.

While this possibility was brought into sharp focus earlier this year when Huawei faced similar sanctions, the countermeasures the companies have taken will likely not provide a lasting solution. One industry insider familiar with Megvii told Caixin that the company had tried some domestically made AI chips before the ban was announced. However, the products were less effective and it could take months to get them to the point where they could begin to meet the company’s technical needs.

Nevertheless, Megvii’s Chief Technology Officer Tang Wenbin was assertive that his team needs to be prepared for the possibility that their first choice U.S. chipmaker, Nvida Corp., might have to stop sales.

Nvida is an industry leader, especially for the graphics processing units (GPUs) that form the foundation of AI computing power. GPUs are such a crucial part of AI development that firms sometimes use the number of GPUs they own as a proxy for their technical capability.

SenseTime has over 15,000 GPUs — each costing tens of thousands of yuan to use each year. Combined with other equipment purchases, meeting technical requirements can cost hundreds of millions yuan per quarter.

Besides GPUs, there is also a lack of non-U.S. alternatives to other key parts widely used by these firms, including Intel’s central processing units and Xilinx’s field programmable gate arrays, experts told Caixin.

Contact reporter Isabelle LI (liyi@caixin.com)