Update: Growth Rebounds in China’s Consumption, Industrial Production

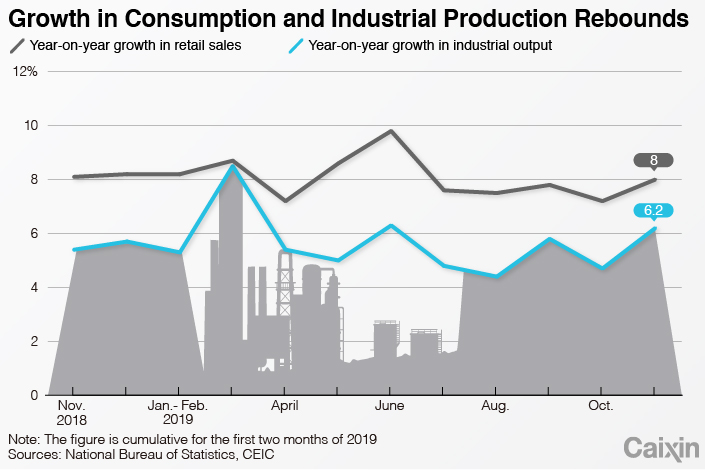

China’s economy saw signs of recovery in November as growth in consumption and industrial production both rebounded significantly, even as infrastructure and property investment continued to decelerate.

Retail sales, which include spending by governments, businesses and households, grew 8% year-on-year in November, faster than the 7.2% growth rate in the previous month and marking the highest level in five months, according to data (link in Chinese) released Monday by the National Bureau of Statistics (NBS). The reading outperformed the median estimate for a 7.8% increase in a Caixin survey of economists (link in Chinese).

The uptick in retail sales growth came due in part to a consumption boost created by the annual “Double 11” event on Nov. 11, an online shopping extravaganza that has become the Chinese equivalent of Black Friday in the U.S. China’s online retail sales rose 16.6% year-on-year in the first 11 months this year, up from 16.4% growth in the first 10 months, NBS data showed.

|

Value-added industrial output, which measures production at factories, mines and utilities, rose 6.2% year-on-year in November, up sharply from 4.7% growth in the previous month and marking the fastest expansion in five months, NBS data showed (link in Chinese). The reading beat economists’ median estimate for 5.2% growth.

“We believe these readings could decline again in December; as the downward pressures remain intact, the growth slowdown should continue,” economists with Nomura International (Hong Kong) Ltd. commented in a research note. They said that the rise in growth of retail sales and industrial output was “more likely noise than a trend.”

Fixed-asset investment excluding rural households, a key driver of domestic demand that includes infrastructure investment, increased 5.2% year-on-year in the first 11 months of this year, unchanged from the pace in the first 10 months, NBS data showed (link in Chinese). Both cumulative readings marked the lowest level since the whole of 1995, according to NBS data compiled by economic data provider CEIC. The latest reading was in line with the median estimate in the Caixin survey.

Government-driven infrastructure investment rose 4% year-on-year in the first 11 months of the year, down slightly from 4.2% growth in the first 10 months and marking the second straight month of deceleration.

|

The lackluster picture of infrastructure spending comes as local governments have nearly used up their special-purpose bond quotas, which are used to raise money specifically for public works, including infrastructure projects. In November, China’s Ministry of Finance said it had approved early allocation of next year’s quotas in a bid to speed up sale of the bonds as part of Beijing’s efforts to further support flagging economic growth.

Investment in real estate development rose 10.2% year-on-year in the first 11 months, down marginally from 10.3% growth in the first 10 months and marking the second consecutive month of slowdown, NBS data showed (link in Chinese).

“Real estate, a key prop to growth in recent quarters, is primed for further moderation as financing to the sector is being squeezed by a regulatory crackdown,” economists with Capital Economics Ltd. said in a research note.

Due in part to the trade dispute between China and the U.S., China’s gross domestic product (GDP) growth slid to 6.6% in 2018 from 6.8% in the previous year, the weakest annual expansion in 28 years, according to NBS data. China’s GDP growth dropped further to 6.2% year-on-year in the first nine months of this year.

On Friday, negotiators from the two countries announced that the two sides had reached an agreement on a phase one deal to pause the 18-month trade war, rolling back additional tariffs. Economists said that the long-awaited agreement will give China a more favorable environment to increase its economic growth next year.

Louis Kuijs, head of Asia economics at research firm Oxford Economics, said in a note that the firm has raised its China GDP growth forecast for next year to 6% from 5.7% after China and the U.S. closed the phase one deal and the NBS released data on Monday.

At China’s three-day Central Economic Work Conference that concluded Thursday, top policymakers pledged to implement more effective measures to ensure stable growth next year. However, the leadership’s reiteration of its commitment to preventing financial risks suggests there will be no major stimulus next year, some analysts noted.

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Caixin Global has officially launched Caixin CEIC Mobile, a mobile-only version of a world-class platform for macroeconomic and microeconomic data.

From now on, all users can enjoy a one-month free trial on the Caixin App through December 2019. If you’re using our App, click here. If you haven’t downloaded the App, click here.

- PODCAST

- MOST POPULAR