China Business Digest: Disease Control Measures Aren’t Going Away, Medical Expert Says; Shanghai Offers Citywide Virus Testing

|

|

A leading Chinese Covid-19 expert says countries around the world should accept that disease control measures will be part of daily life for the foreseeable future. Global races to develop vaccines accelerate as six candidates start human trials. And in Shanghai, anyone who wants a virus test can now get one.

— By Guo Yingzhe (yingzheguo@caixin.com) and Han Wei (weihan@caixin.com)

** ON THE CORONAVIRUS

Shanghai promotes virus testing to serve reopening

China’s financial hub Shanghai offered citywide easy access to coronavirus testing for residents as it picks up the pace of resuming social and business activities.

Any individual or company in Shanghai can book nucleic acid tests for the virus at their own expense in designated hospitals and clinics. The tests will be conducted on a voluntary basis, the city government said in a statement (link in Chinese). Shanghai’s move followed a central government call Wednesday for large-scale virus testing to secure the economic reopening.

Six coronavirus vaccines in human trials, WHO says

The World Health Organization said Thursday that six potential vaccines for the new coronavirus have entered human trials, with 77 more in preclinical evaluation.

The figures mark an increase from April 13, when the United Nations organization said there were 70 vaccines under development with three in human trials.

Disease control measures will be part of life for a long time, expert says

One of China’s most prominent medical experts said countries will have to accept long-term disease control measures as a part of life even after their coronavirus outbreaks peak.

Zhang Wenhong, who heads Shanghai’s Covid-19 clinical expert team, said Wednesday that the world will move into a phase of “normalized epidemic prevention and control” as caseloads fall and more nations eye returns to economic productivity.

Vaccine candidate shows positive results in animal tests

Animal testing for a Covid-19 vaccine candidate has shown positive results after inducing production of antibodies in mice, rats and nonhuman primates, a preprint of a study conducted by Chinese researchers showed.

In the first animal testing result of its kind to be made public, the researchers suggested that the purified deactivated vaccine candidate they developed is safe and could be possibly effective in neutralizing coronavirus strains around the world.

Other virus news

• Chinese foreign ministry spokesperson Geng Shuang on Thursday said (link in Chinese) that China will donate $30 million to the World Health Organization on top of the $20 million it donated last month for coronavirus control.

• The number of confirmed cases in Africa rose 54% in the week to April 21, reaching 23,505, according to the Africa Centres for Disease Control and Prevention. A report by the U.N. Economic Commission for Africa earlier this month estimated the Covid-19 pandemic could kill over 300,000 people on the continent.

• The Chinese mainland reported 10 new Covid-19 cases on Wednesday, six of those imported, the nation’s health authority said (link in Chinese). Hong Kong had four new cases and Taiwan had one.

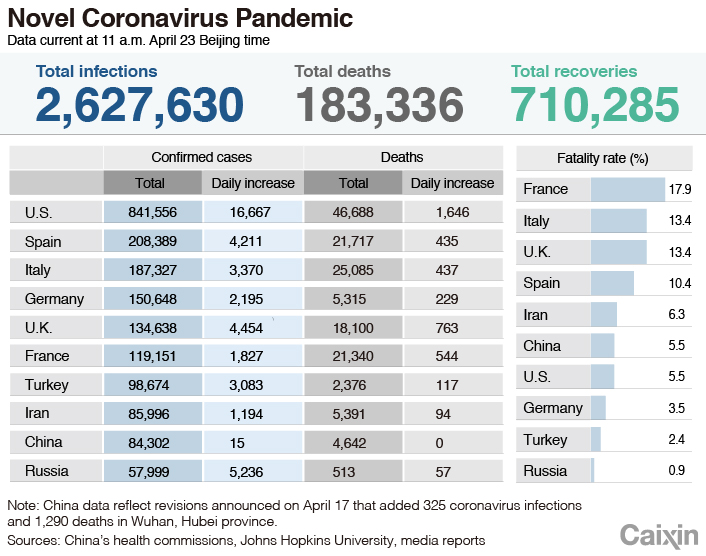

• As of Thursday evening, global infections had reached over 2.6 million, with over 184,000 deaths, according to data compiled by Johns Hopkins University.

Read more

Caixin’s coverage of the new coronavirus

** TOP STORIES OF THE DAY

Pandemic shows uneven impacts on Chinese economy

Chinese provinces have shown different resilience to the economic blow of the Covid-19 pandemic. While the epicenter Hubei reported the worst decline in first-quarter GDP of 39.2%, the remote region of Xinjiang recorded a decrease of only 0.2%, government releases showed.

Provinces’ economic impacts vary because of different levels of severity of the outbreak. Local authorities have stepped up investment measures to revive growth.

China cuts NEV subsidy by 10%

China will cut subsidies on new energy vehicles (NEVs) by 10% this year while rising the criteria for vehicles to qualify. The reduction followed a decision last month to extend incentives to NEVs for two more years till 2022. The subsidy will be lowered a further 20% in 2021 and 30% in 2022, the Ministry of Finance said.

The Swiss bank set aside 97 million Swiss francs ($100 million) for soured loans, primarily related to Luckin Coffee. Credit Suisse led the initial public offering for Luckin in New York last year and is among the biggest creditors on defaulted loans to founder Lu Zhengyao.

China’s airline sector sees minor recovery

Chinese airlines were facilitating an average of 494,400 air trips a day from April 1 to Tuesday, up 7.9 % from the March average, but still down over two-thirds from the same period last year, official data showed (link in Chinese).

Hiring demand falls faster than number of jobseekers

Recruitment demand and the number of job hunters in China fell by 22.6% and 9.4% year-on-year respectively in the first quarter, a report (link in Chinese) showed.

Property conglomerate drops plan to alter bond rate

Shanghai-listed property conglomerate Gemdale has dropped a plan (link in Chinese) to slash the interest rate of one of its bonds after it aroused regulators’ interest, people familiar with the matter told Caixin.

The plan led to complaints it was breaking promises made in its bond issuance prospectus.

U.S. securities regulator warns of risks in emerging markets’ financial reports

The U.S. securities regulator has warned of the dangers of investing in emerging market stocks, singling out China in particular, weeks after two U.S.-listed Chinese firms admitted to accounting scandals that triggered sell-offs.

“In many emerging markets, including China, there is substantially greater risk that disclosures will be incomplete or misleading and, in the event of investor harm, substantially less access to recourse, in comparison to U.S. domestic companies,” a statement from the U.S. Securities and Exchange Commission said.

Investors in crude product rage at huge losses amid oil price turmoil

Investors in a crude futures product sold by Bank of China Ltd. lost millions of yuan following the collapse of global crude prices. They blamed the bank for the losses amid the market turmoil.

|

** OTHER STORIES MAKING THE HEADLINES

Economy & Finance

• Nearly 10 gigawatts of coal power projects were approved (link in Chinese) by local Chinese governments in the first three months, around the same amount as for the whole of 2019.

• The Export-Import Bank of China, a policy lender, has set up a 50 billion yuan ($7.1 billion) assistance program for manufacturers and traders hit hard by the pandemic, according to (link in Chinese) state broadcaster China Central Television.

• China Life Insurance reported (link in Chinese) its net profit fell 34.4% year-on-year to 17.1 billion yuan in the first quarter.

• The government of Beijing’s Xicheng district has decided to issue spending vouchers worth 150 million yuan (link in Chinese) to boost consumption.

• China and the U.S. need a “serious rethinking” of their relationship as the pandemic is shaking up global politics and ties between the world’s two biggest economies, said Cui Tiankai, the Chinese ambassador to the U.S.

Business & Tech

• Hong Kong-listed Xiaomi announced Wednesday that it will issue 10-year bonds worth $600 million, the first time it has issued overseas bonds.

• Exxon Mobil Corp. on Wednesday began construction of a $10 billion petrochemical complex in Huizhou, Guangdong province, Xinhua reported (link in Chinese).

• Chinese server-maker Dawning Information Industry announced (link in Chinese) on Wednesday it would raise 4.8 billion yuan through a private placement, of which 2 billion yuan would be used to increase the use of Chinese-made chips in its manufacturing facilities.

Personnel

• Zhao Weixing, president of online lender Sichuan Xinwang Bank will serve as a vice president of Xiaomi Finance, a finance arm of Xiaomi, Caixin has learned exclusively (link in Chinese).

• Yang Fan, CEO of China Merchants Securities International, will join (link in Chinese) UBS Group AG in May as chairwoman of its Asia investment banking arm.

• Lin Zhihai, general manager of Hong Kong- and Shenzhen-listed GF Securities, has resigned for health reasons, according to a statement (link in Chinese) from the company.

** AND FINALLY

Children and volunteers hold globes on Wednesday marking the 51st Earth Day in Rugao, East China’s Jiangsu province.

|

** LOOKING AHEAD

April 30: Caixin China manufacturing PMI

May 7: Caixin China services PMI

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editors Yang Ge (geyang@caixin.com) and Joshua Dummer (joshuadummer@caixin.com)

Read more

China Business Digest: China Vows to Expand Covid-19 Testing; Chinese Steel Mills’ Profit Halved

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas