China Business Digest: U.S. to Sell Hong Kong Property; Beijing to Boot Fossil Fuel Projects off Green Bond List

|

|

The U.S. government is selling some Hong Kong property after President Donald Trump said he would strip the city of its special trade status. China plans to make fossil fuel projects ineligible for green bond financing to push ahead its green energy strategy.

** ON THE CORONAVIRUS

China reports 16 new cases, Hong Kong local transmission continues

The Chinese mainland reported (link in Chinese) 16 new coronavirus cases on Sunday, all imported, including 11 in Sichuan province. The country added 16 asymptomatic cases on the same day, 13 of those imported.

Hong Kong reported two coronavirus cases with no travel history on Sunday, ending 15 consecutive days with no locally transmitted cases. Chuang Shuk-kwan, head of the communicable disease branch of the city’s Centre for Health Protection, said the city’s local virus transmission chain has yet to be broken. Separately, the city’s airport was set to reopen to transit travel Monday after several months of closure to such traffic.

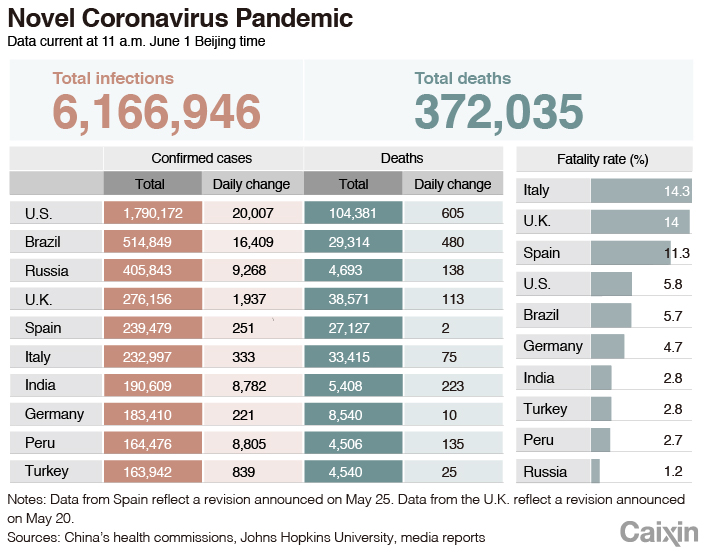

Global cases pass 6.1 million

As of Monday Beijing time, global infections have surpassed 6.1 million, with fatalities reached 372,000, according to data compiled by Johns Hopkins University. The U.S. caseload was approaching 1.8 million, the most in the world, while Brazil had the second most cases with more than 514,000.

India extends partial lockdown for another month

India extended its partial lockdown in high-risk zones by another month to June 30 as the nation continues to fight its local outbreak, it announced Saturday. The country reported 8,380 cases on Sunday morning, marking a new daily high for the country.

Read more

Caixin’s coverage of the new coronavirus

** TOP STORIES OF THE DAY

Hong Kong stocks see relief gains

Stocks in Hong Kong jumped at the open on Monday with early gains of over 3%, after U.S. President Donald Trump on Friday stopped short of specifying tough sanctions over China’s new national security law for Hong Kong.

The escalation in tensions between the U.S. and China last month had threatened to derail a recovery in global equities. While the U.S. president’s speech Friday was heated in rhetoric, it lacked specifics around measures that would directly affect Beijing.

U.S. sells Hong Kong property

A spokesperson for the U.S. Consulate General in Hong Kong and Macau confirmed to Caixin Sunday that it is selling property in Hong Kong, after U.S. President Donald Trump announced the country will begin to change Hong Kong’s privileged trade status.

According to the region’s Land Registry, the property is currently used as dormitory for consulate employees. Local media reported that a total of 8,800 square meters (94,720 square feet) of land owned by the U.S. is up for sale at an estimated value of HK$10 billion ($1.29 billion).

This move “reinforces the U.S. Government’s presence in Hong Kong,” said the spokesperson, who didn’t say whether the sale is related to recent political events.

Caixin PMI shows China manufacturing rebound

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI) rose to 50.7 in May from April’s 49.4, a report released Monday showed. The reading was the highest since January this year.

Read our breakdown on PMI data here.

Survey shows three-fifths of American firms have resumed business in China

According to a survey conducted by the American Chamber of Commerce in China, 59% of its roughly 900 member companies said they have resumed their business in China, and 49% said their local manufacturing was running at full capacity.

The survey also showed American companies are most concerned about when China will open its border to foreigners.

China plans to make fossil fuel projects ineligible for green bond financing

China plans to remove fossil fuel projects from the list of programs eligible to be financed by green bonds, as Beijing tightens up standards for such investment targets. The removal will bring China’s green bond standard further in line with international standards, said Liu Junyan, a senior climate and energy campaigner with Greenpeace East Asia.

PBOC to buy 400 billion yuan of microloans from banks

China’s central bank started buying microloans Monday from qualified local lenders, aiming to spur banks to lend as much as 1 trillion yuan ($140.2 billion) to small businesses amid the Covid-19 pandemic. The central bank will use 400 billion yuan under a special relending quota to purchase the loans. Banks need to buy back the loans at the original amount after a year, the People’s Bank of China (PBOC) said on its website.

|

** OTHER STORIES MAKING THE HEADLINES

• Leading global contract chipmaker Taiwan Manufacturing Semiconductor Co. (TSMC) will invest $10 billion to build a new chip testing and assembly plant in Taiwan’s Miaoli county. Construction on the complex will be completed in May next year, with its first phase set to start production shortly afterwards.

• Four Chinese firms — Xiaomi, Vivo, Realme, Oppo — were among India’s top five smartphone vendors in the first quarter of 2020, according to research firm CyberMedia Research (CMR).

• Chinese carmaker BAIC Group has agreed to buy a 21.26% stake in Ucar Inc. The sale of the stake in the limousine-services provider comes as its chairman, Lu Zhengyao, who is also chairman of scandal-beset Luckin Coffee Inc., sells down his assets to pay his debts.

• China Youran Dairy Holding Ltd. is working with advisers to raise between $300 million and $400 million in a new funding round before its potential initial public offering, Bloomberg reported, citing people familiar with the situation.

• JD.com-backed grocery delivery operation Dada Nexus Ltd. updated its prospectus Monday for a U.S. initial public offering of as much as $280.5 million, moving a step toward becoming the first Chinese company to list in the U.S. after new legislation passed the Senate last month that would make such listings more difficult.

• Chinese online gaming company NetEase kicked off its secondary listing in Hong Kong to raise about $2.6 billion, according to a term sheet seen by Caixin. NetEase plans to sell 171.48 million ordinary shares at a maximum offer price of HK$126 ($16.25) per share.

** AND FINALLY

World-famous circus producer Cirque du Soleil will soon reopen its resident show “X the Land of Fantasy” in Hangzhou, East China’s Zhejiang province, after facing bankruptcy in March. Actors attended a dress rehearsal on Sunday afternoon after resting for months.

|

Performers make a curtain call at the end of their rehearsal. |

** LOOKING AHEAD

June 3: Release of Caixin China services PMI

June 7: Release of China trade data for May

Contact reporter Lu Yutong (yutonglu@caixin.com) and editors Yang Ge (geyang@caixin.com) and Joshua Dummer (joshuadummer@caixin.com)

Read more

China Business Digest: South Korea Sees New Covid-19 Spike; Chinese Mainland Reports No New Cases

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas