China Business Digest: China to Revamp Benchmark Shanghai Equity Index in July; Two Canadians Indicted on Espionage Charges

|

|

|

|

One more area in Beijing is listed as high risk for coronavirus as other parts of China report cases linked to the city’s resurgence. China to overhaul Shanghai stock index next month, the first time in nearly three decades. Meanwhile, China indicts two Canadians on espionage charges after they’ve spent more than 18 months in detention.

— By Lu Yutong (yutonglu@caixin.com) and Han Wei (weihan@caixin.com)

** ON THE CORONAVIRUS

Beijing adds one area of high risk for coronavirus

Beijing raised the Covid-19 risk alert in the Xihongmen town of its southern district of Daxing to high-level Friday afternoon after two new cases were reported in the area. Both cases involve people who worked at the Xinfadi wholesale market, where the new outbreak started last week.

The capital city currently has two areas listed as high risk and 33 more with mid-level risks. Residents from such areas are barred from leaving Beijing except for special reasons.

China reports 32 new Covid-19 cases, including 25 in Beijing

The Chinese mainland reported (link in Chinese) 32 new coronavirus cases on Thursday, up from 28 the previous day. Of those, 28 were domestic infections, including 25 in Beijing as the capital city deals with a local outbreak.

Some 183 patients are currently hospitalized with the virus in Beijing, according to the Beijing Municipal Health Commission. Since the national outbreak began in January, Beijing has reported at total of 603 confirmed coronavirus cases.

Official defends claim Beijing outbreak is ‘under control’

The China CDC’s chief epidemiologist Wu Zunyou said his assertion that Beijing’s outbreak is “under control” was “science-based” in an interview with national broadcaster on Friday, even as other parts of China discovered infections linked to the food market at the center of the outbreak in the Chinese capital.

“I hope this information doesn’t mislead people. We can’t afford to let our guard down or relax the restrictions,” Wu said, adding that it would be premature to lower Beijing’s emergency response level at this stage.

Kazakhstan’s first president tests positive for Covid-19

Former Kazakh president Nursultan Nazarbayev, who will turn 80 next month, has tested positive for the coronavirus, his official website said Thursday.

Nazarbayev, who is called the “leader of the nation,” is currently in self-isolation and will work remotely.

Denmark to cull 11,000 minks that contracted the coronavirus

Some 11,000 minks at a farm in Denmark were found to be infected with Covid-19 and will be culled (link in Chinese), the Danish Veterinary and Food Administration said Wednesday. The outbreak comes after the Netherlands reported a similar outbreak at 10 local mink farms, where animals were also culled after some tested positive for Covid-19.

Other virus news

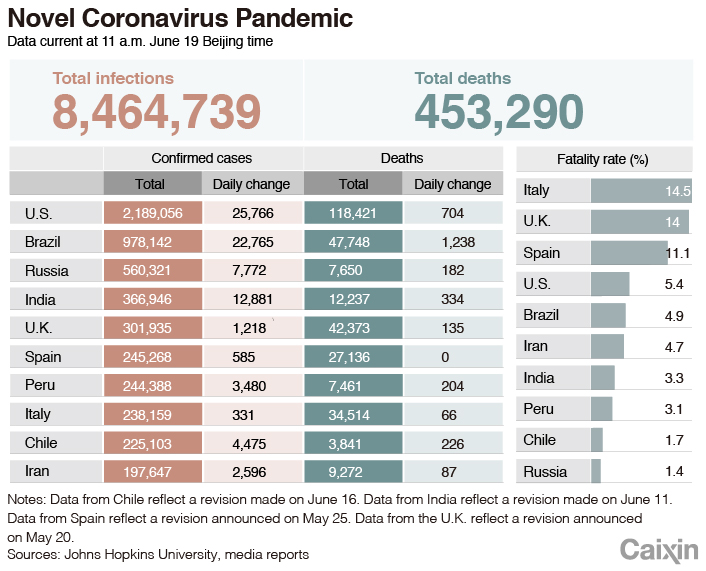

As of noon Beijing time on Friday, the number of global infections was approaching 8.5 million, with fatalities surpassing 450,000, data from Johns Hopkins University showed.

The U.K. has become the fifth country in the world to report more than 300,000 coronavirus cases, after the U.S., Brazil, Russia and India.

Read more

Caixin’s coverage of the new coronavirus

** TOP STORIES OF THE DAY

China to revamp Shanghai benchmark stock index in July

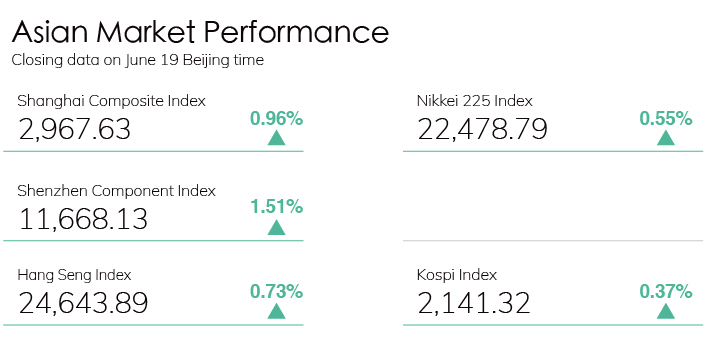

The Shanghai Stock Exchange will launch a revamp of the benchmark Shanghai Composite Index July 22, the first major revision in nearly three decades, the bourse said. Changes will include introducing more high-tech weighting and removing loss-making companies.

The Shanghai bourse announced a plan in early June to study a potential overhaul of its benchmark index to make it better reflect China’s fast-evolving economy.

Syngenta Group debuts in ChemChina, Sinochem restructuring

Syngenta Group officially debuts Thursday as part of China’s massive government-led merger of two state-owned chemical giants — ChemChina and Sinochem. The newly formed Syngenta, which was registered last year, evolved from the Swiss pesticide producer that ChemChina acquired in 2016 and took in agricultural assets from ChemChina and Sinochem. The company has total assets of 500 billion yuan ($70.5 billion). About 25% of its first-quarter sales were generated in China. Caixin reported earlier that the new company will seek to go public in China by mid-2022.

China’s fiscal revenue continued dropping in May

China’s fiscal revenue dropped 13.6% year-on-year in the first five months of the year, including a 10% decline in May from a year earlier, data from China’s Ministry of Finance showed Thursday.

The decline was led by a drop in tax income, which was down 14.9% in the first five months of 2020. Government expenditure dropped 2.9% in the January to May period, on par with the pace recorded in the first four months this year.

JD.com’s $34 billion gala haul may signal consumer rebound

Chinese e-commerce giant JD.com said it racked up 239.2 billion yuan ($34 billion) in transactions during the “6.18” summer extravaganza that wrapped up Thursday, up 33% from the same time a year earlier. The strong growth suggests the country’s nascent consumer spending recovery has legs.

JD.com projected revenue growth of 20% to 30% this quarter, and is on track to meet that goal, said the company’s retail CEO Xu Lei.

China indicts two Canadians held since 2018 on spying charges

The formal charges against Michael Kovrig, a Hong Kong-based International Crisis Group analyst and a former Canadian diplomat, and Michael Spavor, who organized trips to North Korea, suggest they’ll soon face trial after more than 18 months of detention. Kovrig was charged with spying on state secrets while Spavor was accused of stealing and illegally providing state secrets to other countries, according to statements released Friday by prosecutors in Beijing and the northeastern border city of Dandong, Bloomberg reported.

CEO of Nasdaq-listed Phoenix Tree is under government investigation

Gao Jing, CEO of Nasdaq-listed Phoenix Tree Holdings Ltd., a provider of apartment rental services, has been placed under investigation by “local government authorities,” the company said in a Thursday announcement, without detailing which authorities are involved. The announcement said that the investigation is looking at Gao’s business activities before Phoenix Tree was founded in 2015, and has no connection to its business.

The announcement also said no board members have received official notices related to the investigation, and that Phoenix Tree co-founder Cui Yan had been appointed interim CEO.

Phoenix Tree’s share prices closed down 5.35% on Thursday.

Former central banker says China’s companies need more transparency

China needs to improve transparency, accounting standards and governance of listed companies and financial markets as more businesses seek to move listings to their home market amid growing regulatory pressures abroad, Zhou Xiaochuan, the country’s former central bank governor, said Thursday.

“Some people defended the lack of transparency with national security concerns, which I can’t agree with,” said Zhou.

|

** OTHER STORIES MAKING THE HEADLINES

Business & Tech

• Colgate-Palmolive Co. is carrying out a review of “all aspects” of its Darlie toothpaste — a product that once used an offensive racial epithet for a black person as its English name and still uses a Chinese name that refers to black people — as the company grapples with the racist past of the brand sold in China.

https://www.caixinglobal.com/2020-06-19/colgate-to-overhaul-racist-chinese-toothpaste-brand-101569776.html

• China has drawn up a draft regulation governing the transport and storage of hydrogen fuel that could pave the way for the use of liquefied hydrogen, a material cheaper than the pressurized gas now most commonly used.

• Chinese smartphone-maker Oppo canceled a planned livestream launch of its first 5G smartphone offerings in India, in an attempt to mitigate anti-China sentiment that has been smoldering during the coronavirus outbreak, and dramatically worsened this week after territorial clashes in a disputed border area.

** AND FINALLY

Chinese liquor giant Kweichow Moutai Co. is close to overtaking state-owned Industrial & Commercial Bank of China Ltd. (ICBC) as the nation’s biggest stock by market value. Kweichow’s market capitalization briefly surpassed that of ICBC on Friday before it fell slightly to 1.808 trillion yuan versus ICBC’s 1.813 trillion yuan when the market closed.

Contact reporter Lu Yutong (yutonglu@caixin.com) and editors Yang Ge (geyang@caixin.com) and Joshua Dummer (joshuadummer@caixin.com)

- 1Luckin-Backer Centurium Capital to Buy Blue Bottle Coffee From Nestlé

- 2Two Sessions: With 4.5%-5% Growth Target, China Aims to Create Space for Reform

- 3China Business Uncovered Podcast: Brazil’s ‘Very Chinese Moment’

- 4Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 5First Tanker Crosses Strait of Hormuz Since Iran’s Closure Threat

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas