China Business Digest: Tech Stock Surges 10-Fold on STAR Market Debut; Foreign Minister Calls for ‘Tough Issues’ Talks With U.S.

|

|

A Chinese tech company skyrocketed on the first trading day amid the stock market frenzy. PICC’s second-largest shareholder decides to sell down its stake. Controlling shareholder of embattled Kangmei is placed in custody after $12.6 billion financial reporting fraud. China’s foreign minister calls on the U.S. to resume official talks to review “tough issues.” And globally, the number of coronavirus cases passes 12 million, with a quarter of infections in the U.S.

— By Tang Ziyi (ziyitang@caixin.com) and Han Wei (weihan@caixin.com)

** TOP STORIES OF THE DAY

Chinese tech stock jumps 10-fold in trading debut

QuantumCTek Co., which develops quantum technology-based information products, soared more than 1,000% during its first trading day on China’s tech-heavy STAR Market, underscoring the country’s recent stock market frenzy. Shares of QuantumCTek closed at 370.45 yuan ($52.8) a share, up 924% from the 36.18 yuan initial public offering price.

PICC's major shareholder plans to reduce holding

China' National Council for Social Security Fund (NCSSF), which manages the nation's state pension fund, plans to reduce its stake in People's Insurance Co. (Group) of China Ltd. (PICC) by as much as 2%, the state-backed insurer said in a Thursday filing. NCSSF is the second-largest shareholder of PICC with a 16.5% stake. The planned sale would generate around 7.3 billion yuan ($1.04 billion) of cash for the fund.

Owner of scandal-plagued drugmaker faces criminal charge

Ma Xingtian, the controlling shareholder of Kangmei Pharmaceutical Co. Ltd., is under “forceful measures” by police for suspected violation of information disclosure, the company said Thursday, without giving details. Sources close to the matter said Ma may face criminal charges for the massive fraud at his company.

Kangmei was accused of financial reporting fraud involving 88.6 billion yuan ($12.6 billion) of overstatements between 2016 and 2018. The company was fined 600,000 yuan by the top securities regulator.

Rising food prices drive uptick in consumer inflation

China’s official consumer price index, which measures the prices of a basket of consumer goods and services, rose 2.5% year-on-year in June, up slightly from the previous month. Floods in southern China and a new wave of Covid-19 infections in Beijing caused vegetable prices to rise.

The producer price index, which gauges changes in the prices of goods circulated among manufacturers and mining companies, fell at a milder rate of 3% year-on-year last month as domestic demand recovered and global commodity prices picked up.

Chinese foreign minister calls for review of China-U.S. red lines

China’s top diplomat Wang Yi said Thursday that Sino-American relations are facing their “most severe challenge” since the establishment of diplomatic ties in 1979, calling on the U.S. to resume official talks to review red lines in their relationship, including “tough issues” that the two will have little chance to agree on in the near future.

China blacklists illegal securities margin lending platforms

China’s top securities regulator on Wednesday exposed 258 funding platforms that illegally lend money for investors to buy stocks with. The regulator urged investors to avoid such platforms and to inform authorities if they get swindled by such platforms.

Investors have flooded into China’s stock market as it entered a technical bull market on Monday amid a recovering economy and loose monetary policy in response to the pandemic.

Shaanxi International Trust to raise up to 3.7 billion yuan

Shenzhen-listed Shaanxi International Trust Co. Ltd., one of the only two trust companies listed on the Chinese mainland, plans to raise up to 3.7 billion yuan ($527.8 million) by issuing new shares, according to a company filing (link in Chinese) on Monday evening. Net proceeds will be used to replenish the company’s capital, which is a key factor for regulatory ratings. (Read a related in-depth story here.)

CCB Trust Co. Ltd., a subsidiary of state-owned China Construction Bank Corp., also plans to replenish its capital by around 8 billion yuan (link in Chinese). That plan was approved by the local banking regulator in Beijing last week.

|

** OTHER STORIES MAKING THE HEADLINES

• The outstanding value of Chinese insurance companies’ overseas investments was about $70 billion last year, according to a survey (link in Chinese) released Monday by an insurance industry group.

• The average vacancy rate of the highest-quality offices in Beijing rose to 13.6% in the second quarter this year amid the coronavirus pandemic, the highest point since 2010, a report (link in Chinese) by London-listed property agent Savills PLC showed.

• Nasdaq-listed Chinese video streaming site Bilibili Inc. is reportedly considering a secondary listing in Hong Kong amid rising tensions between China and the U.S. (Reuters)

• Ford Motor Co. reported Thursday that its sales in China rose 3% year-on-year in the second quarter. By comparison, the U.S. automaker’s sales in China delined nearly 35% year-on-year in the previous quarter.

• Martin Lau Chi-ping, president of Tencent Holdings Ltd., cashed in on the social media and gaming giant’s surging stock price this year to the tune of HK$920 million ($131 million) by selling off shares.

** ON THE CORONAVIRUS

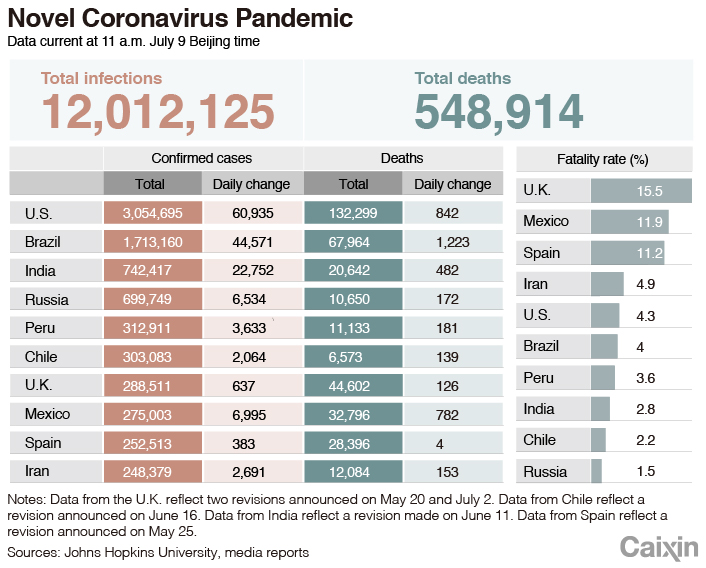

• As of Thursday afternoon Beijing time, the number of coronavirus infections globally had exceeded 12 million, with the death toll passing 549,000, according to data compiled by Johns Hopkins University. Meanwhile, the number of total cases in the U.S. topped 3 million.

Read more

Caixin’s coverage of the new coronavirus

• The Chinese mainland reported nine new symptomatic Covid-19 cases (link in Chinese) for Wednesday, all imported, according to China’s top health body. Beijing reported zero (link in Chinese) new symptomatic cases for the third straight day.

** LOOKING AHEAD

July 14: Release of China’s import and export data

July 16: Release of China’s investment, retail sales and industrial output data

** AND FINALLY

E-commerce company Dangdang’s co-founder Li Guoqing has been detained along with several other former company employees after allegedly stealing the company’s official stamp — the latest development amid an ongoing saga stemming from a messy divorce between the company’s two co-founders.

|

Li Guoqing, co-founder of Dangdang. |

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editors Lin Jinbing (jinbinglin@caixin.com) and Joshua Dummer (joshuadummer@caixin.com)

- MOST POPULAR