China Business Digest: Merger Planned for 2 Shenzhen Stock Boards; China Banks Adjust Models for Yuan Fixing

|

|

|

|

Industrial profits rose 10.1% in September as China continued to bounce back from Covid-19. China’s regulator plans to streamline the Shenzhen Stock Exchange by merging the main board with the SME board. Banks adjust formulas to calculate the yuan’s daily reference rate. And China International Capital Corp. is set this year to overtake U.S. stalwarts Goldman Sachs Group Inc. and Morgan Stanley after Ant Group’s record IPO.

— By Lu Yutong (yutonglu@caixin.com)

** TOP STORIES OF THE DAY

China banks adjust models for Yuan fixing after rapid rally

Some Chinese banks stopped using the counter-cyclical factor recently in the formulas that go to the country’s central bank to calculate the yuan’s daily reference rate, China Foreign Exchange Trade System said Tuesday. The factor is part of how the banks calculate a quote for the reference rate, known as the fixing. Such a change would in effect allow Beijing to give up some influence over the exchange rate.

China’s duty-free giant posts strong sales rebound

China Duty Free Group Co. Ltd., the country’s largest duty-free retailer, posted strong sales growth in the third quarter, reflecting a buying spree supported by policy changes to bolster duty-free shopping. China Duty Free, which controls about 90% of China’s duty-free retail market, said third-quarter sales totaled 15.8 billion yuan ($2.4 billion), up 39% from a year ago. Net profit rose 142% to 2.2 billion yuan.

Coal-rich Shanxi looks to offload smaller projects

Shanxi province will seek outside investment for nearly 94 state-owned projects, many from its traditional strength in coal mining, as part of Beijing’s broader drive to boost efficiency in such traditional industries by introducing private-sector partners. Among the projects, 40 are coal-related, including coal development and coal cleaning projects involving more than 62 million tons of capacity, officials said Monday at a meeting.

China’s industrial profits up 10.9% in September

China’s industrial profit for the first nine months of this year fell 2.4% year-on-year to 4.37 trillion yuan ($652 billion), according to fresh data (link in Chinese) from the National Bureau of Statistics (NBS). The latest figure marked a 2 percentage point improvement from the previous reading for the first eight months of the year, as China’s economy rebounds from the Covid-19 pandemic.

For the month of September, profits were up 10.1% year-on-year, marking a 9 percentage point slowdown from August, due to rising factory-gate prices and material costs, said Zhu Hong, a senior statistician from NBS.

China-built metro line up and running in Pakistan

A metro line in Pakistan’s second largest city, Lahore, began (link in Chinese) commercial operation on Sunday, after five years of construction. The line is a project of China’s Belt and Road Initiative and was wholly built by Chinese companies. Guangzhou Metro announced the signing of an eight-year contract to operate and maintain the line in February.

Shenzhen Stock Exchange plans to merge main board and SME board

China’s regulator is planning to streamline the Shenzhen Stock Exchange’s structure by merging the main board with the SME board, which caters to small and midsize listed enterprises, Caixin has learned. The main board is home to 469 firms with a combined market cap of 8.8 trillion yuan ($1.3 trillion), while 982 companies are listed on the SME board with a total market capitalization of 13 trillion yuan.

China retaliates for U.S. labeling of Chinese media outlets as ‘foreign missions’

China is requiring six U.S. news outlets, including American Broadcasting Co. and the Los Angeles Times, to report on their local operations in seven days, in retaliation for the U.S. decision to designate six more Chinese media organizations as “foreign missions,” Zhao Lijian, spokesman for the Chinese Foreign Ministry, said (link in Chinese) on Monday.

|

** OTHER STORIES MAKING THE HEADLINES

Economy & Finance

• China International Capital Corp. is set this year to overtake U.S. stalwarts Goldman Sachs Group Inc. and Morgan Stanley once Ant Group completes what’s set to be a record $34.5 billion IPO in Hong Kong and Shanghai. (Bloomberg)

• Gaorong Capital, a Beijing-based venture capital firm focused on early- and growth-stage investments, has closed a new yuan-denominated fund and its fifth U.S. dollar fund at over 10 billion yuan, bringing Gaorong’s assets under management to nearly 28 billion yuan. (Deal Street Asia)

• Bank of China Ltd. plans to expand its headcount in the offshore bond business by 40% as it fights with global banks for a greater slice of a market that has seen a surge in Chinese borrowers. (Bloomberg)

Business & Tech

• Sales of new-energy vehicles (NEV) will make up 50% of overall new car sales in China, the world’s biggest auto market, by 2035, Reuters reported, citing an industry official’s speech on Tuesday.

• Tencent Holdings Ltd., the world’s largest gaming company by sales, has led a $100 million funding round for Shanghai-based e-sports event organizer Versus Programming Network (VSPN), boosting its bets on the booming e-sports market.

• ECARX, an auto tech startup backed by Chinese automaker Geely, has raised 1.3 billion yuan in its Series A funding round led by Baidu Inc., increasing its valuation to more than 10 billion yuan.

• China’s oil imports from the U.S. in September spiked more than 600% year-on-year to 3.9 million tons, hitting an all-time high, fresh data (link in Chinese) from Chinese customs suggested. The U.S. is now the fourth-biggest oil exporter to China by volume, behind Saudi Arabia, Russia and Brazil.

• China’s national legislature is set to increase punishments for assaulting police officers, more than doubling the maximum jail time to seven years from three, in response to rising violence against police officers.

** ON THE CORONAVIRUS

• China’s far western prefecture of Kashgar has launched a mass testing program for the area’s 4.75 million people after 137 new asymptomatic cases were detected on Sunday and another 26 on Monday.

• The cluster of infections in Xinjiang’s Kashgar area emerged in a garment factory built by the local government in a bid to boost the area’s economy, Caixin has learned (link in Chinese). The 500-square-meter factory has more than 250 workers, according to data service provider CEIC and a report by state media Changan Magazine.

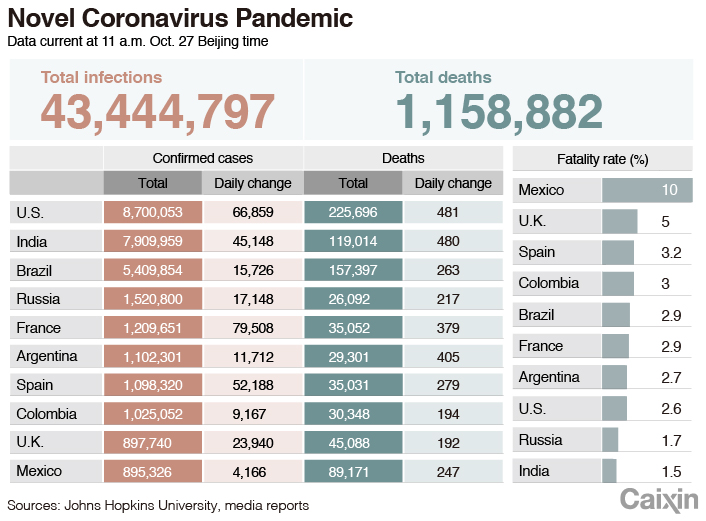

• As of Tuesday afternoon Beijing time, the number of global coronavirus infections has passed 43.5 million, with more than 1.16 million deaths, according to data from Johns Hopkins University.

Read more

Caixin’s coverage of the new coronavirus

** AND FINALLY

Sparkling Lake, a popular scenic spot in the Jiuzhaigou Valley National Park in southwestern China, reopened on Sept. 28 after three years of reconstruction. A magnitude 7.0 earthquake shook Jiuzhaigou county, damaging and destroying many places in the park in 2017.

|

Water spills over the Sparkling Lake falls Saturday at Jiuzhaigou Valley National Park in Southwest China’s Sichuan province. |

** LOOKING AHEAD

Quarterly financial results:

Oct. 28: ZTE

Oct. 29: BYD

Nov. 3: Lenovo

Contact reporter Lu Yutong (yutonglu@caixin.com) and editor Yang Ge (geyang@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- MOST POPULAR