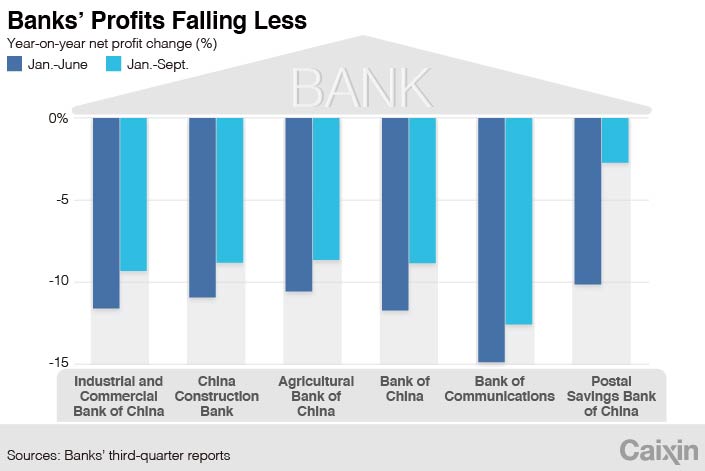

Chart of the Day: Banks Stem Profit Decline in Third Quarter

After China’s banking regulator relented on its demand that banks’ profits fall by roughly a set amount this year, many big lenders saw their net profit declines narrow in the first three quarters, compared to the first half.

The net profit performance of China’s six biggest state-owned commercial banks — Industrial and Commercial Bank of China Ltd. (ICBC), China Construction Bank Corp. (CCB), Agricultural Bank of China Ltd. (ABC), Bank of China Ltd. (BoC), Bank of Communications Co. Ltd. and Postal Savings Bank of China Co. Ltd. — all improved from the first half, despite all seeing a decline from the first nine months of 2019.

This narrowing of profit declines is mainly due to the banks setting aside less money to guard against loan losses, according to their latest quarterly reports. At the end of the second quarter, Chinese commercial banks’ nonperforming loan (NPL) ratio rose to an 11-year high.

BoC, for example, set aside (link in Chinese) 96.8 billion yuan ($14.4 billion) through September this year, 59.3% more than in the same period last year. That was down from a nearly 100% increase in its loan-loss provisions in the first half. This led to its profit decline shrinking roughly 3 percentage points to an 8.7% decrease in the first three quarters.

|

In the second quarter, the banking regulator repeatedly called on lenders to increase their loan-loss provisions, moderate profit growth, and prepare for a major rebound in NPLs, as the impact of Covid-19 had not yet been fully exposed. In response, many listed banks increased the size of their provisions.

Banking regulators informally ordered the six state-owned banking giants to record a 10% net profit decline in the first half, and a 15% to 20% drop in the third quarter, large banks’ senior management told Caixin.

However, following repeated complaints from lenders, the regulators dropped their “one size fits all” approach to banks’ profits, sources with knowledge of the matter said.

Bank stocks will go up in the fourth quarter, as “regulatory forces oppressing banks’ profit growth are waning,” wrote (link in Chinese) analysts with securities firm Northeast Securities Co. Ltd.

Read more

Exclusive: Watchdog May Loosen Rules on Banks’ Nonperforming Assets

By the end of September, the “Big Four” state-owned commercial banks — ICBC, CCB, ABC and BoC — held 978.6 billion yuan of NPLs, up nearly 18% from the end of last year, according to Caixin calculations based on their third-quarter results. The lenders have been asked to support virus-hit small businesses by lending more and extending loan repayment deadlines.

Contact editor Joshua Dummer (joshuadummer@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- PODCAST

- MOST POPULAR