China’s Manufacturing Recovery Takes a Breather, Caixin PMI Shows

China’s manufacturing sector expanded at the slowest pace in three months in June, as growth in both production and new orders softened, a Caixin-sponsored survey showed.

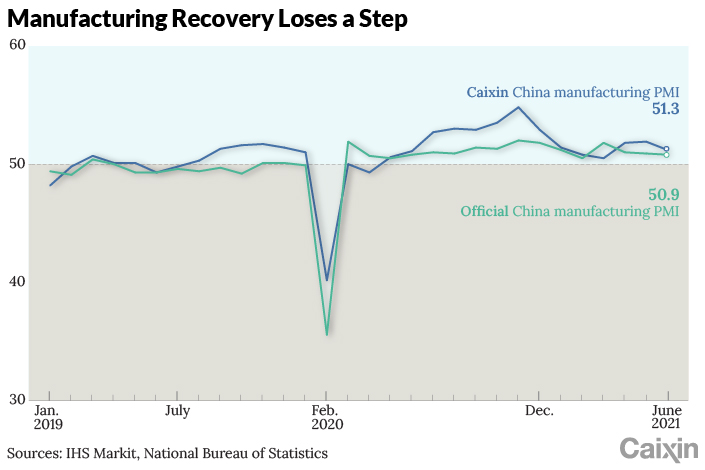

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, fell to 51.3 in June from 52 the previous month, according to a report released Thursday. A number above 50 signals an expansion in activity, while a reading below that indicates a contraction.

|

“Companies indicated that the recent uptick in Covid-19 cases and supply chain difficulties weighed on output, while the pandemic dampened demand both at home and abroad,” the report said.

Both output and total new manufacturing orders grew at the lowest rate in three months in June. New export orders were broadly stagnant last month, expanding at the slowest pace in four months.

Meanwhile, inflationary pressure continues to weigh on the sector. Input costs rose for the 13th straight month, though at the slowest pace in seven months. Surveyed companies said that high prices of industrial metals and energy commodities were the main reasons behind the rising costs, according to Wang Zhe, a senior economist at Caixin Insight Group. Output prices rose at the lowest rate since February.

Still, the increase in new orders led goods producers to add to their staff in June, as the measure for employment rose from the previous month. The gauge for backlogs of work fell to a four-month low, though it remained in expansionary territory.

Manufacturers maintained a positive outlook for their businesses for the next 12 months, though the indicator for future output expectations remained unchanged from May’s four-month low. Their confidence was driven by expectations that the global economy will pull through the pandemic, according to the survey.

China’s official manufacturing PMI, released by the National Bureau of Statistics on Wednesday, fell slightly to 50.9 (link in Chinese) in June from 51 the previous month. The official PMI polls a larger proportion of big companies and state-owned enterprises than the Caixin PMI, which is compiled by London-based data analytics firm IHS Markit Ltd.

Economists with Nomura International (Hong Kong) Ltd. expect the official manufacturing PMI to bounce back to 51.2 in July, as they anticipate a release of pent-up demand once China gets its latest Covid-19 flare-up under control.

Still, the economists warned that the manufacturing sector would likely come under increased pressure in the second half of this year once that pent-up demand fades. Exports are also expected to weaken as developed markets shift back to services consumption as they reopen. Also, they predicted that surging raw materials prices will suppress demand in the sector.

Wang also warned that inflationary pressure, coupled with the economic slowdown, remains a serious challenge to China. China’s producer price index (PPI), which gauges changes in prices of goods circulated among manufacturers and mining companies, rose at the fastest pace in almost 13 years in May. A banking regulatory official expected the PPI to rise another 10% year-on-year in June.

The Nomura economists said it is unlikely that China will significantly tighten its monetary and credit policies even though Beijing has grown increasingly concerned about rising commodity prices. Instead, policymakers will likely boost supplies and relax some overly ambitious carbon emission reduction measures, they said.

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Read more about Caixin’s economic indexes.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.