BlackRock Gets Ready to Launch in China’s Booming Mutual-Fund Market

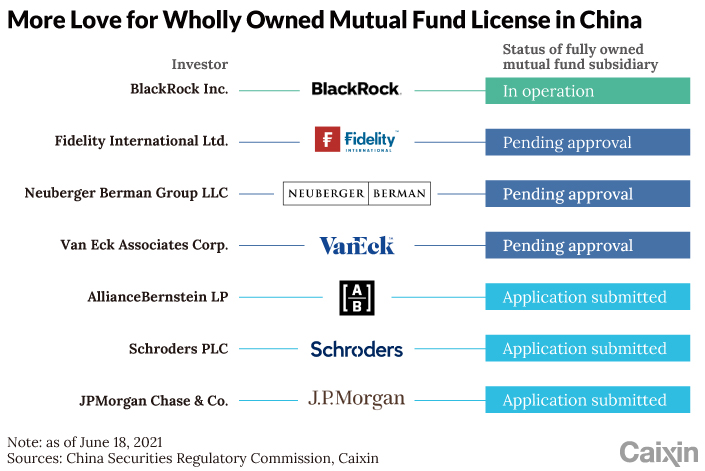

BlackRock Inc. has applied to start selling its first mutual fund product on the Chinese mainland less than a month after becoming the first foreign financial institution to win a license to operate a wholly owned mutual fund business in the country.

BlackRock Fund Management Co. Ltd., a Shanghai-based subsidiary of the U.S. group, submitted paperwork on Thursday to launch the “BlackRock China New Horizon Mixed Securities Investment Fund” (贝莱德中国新视野混合型证券投资基金), according to (link in Chinese) the China Securities Regulatory Commission (CSRC) website.

The world’s biggest asset manager is one of dozens of overseas financial institutions hoping to make money from China’s increasingly affluent households by grabbing a slice of the country’s $3.6 trillion mutual fund market. China’s retail investors, notorious for their speculative trading, have traditionally preferred to invest in the stock market by picking their own shares in the hope of turning a quick profit. But they are increasingly taking a longer-term view and putting their money into exchange-traded funds and mutual funds aided by the growth of smartphone apps and robo-advisory services.

A survey (link in Chinese) of 27,667 retail investors who trade stocks found that 67.1% had bought mutual funds in 2020, a jump of about half from 2019, according to the Shenzhen Stock Exchange which publishes an annual survey of individual investors.

|

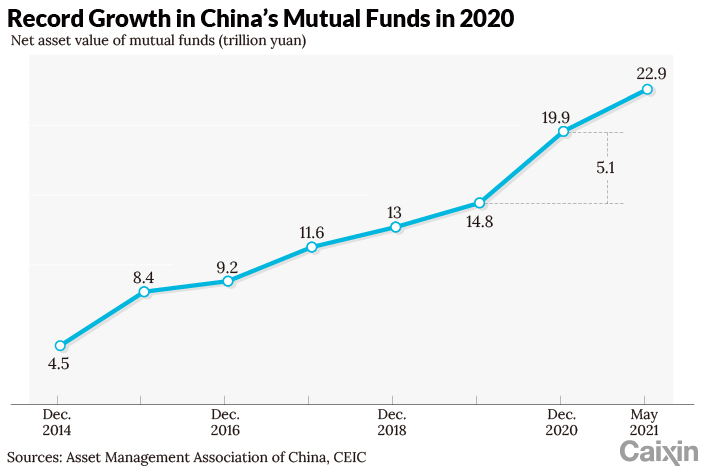

The net asset value (NAV) of mutual funds available in China grew by 5.1 trillion yuan ($788 billion) in 2020, the biggest annual expansion on record, according to data from the Asset Management Association of China, as the stocks entered a bull market and the economy recovered from the Covid-19 epidemic. The NAV of outstanding mutual funds was about 23 trillion yuan at the end of May, almost double the figure three years ago.

|

BlackRock is one of the world’s largest asset managers with more than $9 trillion in assets under management at the end of March 2021, according to Morningstar, a U.S. investment research firm. Its Shanghai mutual fund subsidiary finally got its license to start operations last month after being approved by the CSRC in August 2020, making it the first wholly foreign-owned mutual fund company to officially get the green light. As of Friday, its mutual fund business is staffed by more than 40 employees (link in Chinese), according to the Asset Management Association of China.

|

Fidelity International Ltd. and Neuberger Berman Group LLC are among several rivals with plans to join the club after China scrapped the limit (link in Chinese) on foreign ownership in April 2020. Other foreign institutions are looking to expand through joint ventures with local Chinese partners.

JPMorgan Chase & Co. and Morgan Stanley, which both have a longstanding presence in China’s financial sector through joint ventures, are expected to buy out their Chinese partners. JPMorgan owns a 51% stake in China International Fund Management Co. Ltd. and Morgan Stanley has 49% of Morgan Stanley Huaxin Fund Management Co. Ltd.

A previous version of this story gave the incorrect name of the fund BlackRock applied to launch. It is the BlackRock China New Horizon Mixed Securities Investment Fund.

Contact editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- MOST POPULAR